Taking Stock: Investor wealth rises by Rs 3 lakh crore, Sensex rallies 593 points

The broader markets performed even better. The BSE midcap index was up 2.6 percent and the smallcap index closed with gains of 2.5 percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,391.27 | -275.01 | -0.32% |

| Nifty 50 | 25,758.00 | 0.00 | +0.00% |

| Nifty Bank | 58,960.40 | 0.00 | +0.00% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Eicher Motors | 7,228.50 | 105.50 | +1.48% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 4,805.50 | -162.00 | -3.26% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10159.00 | 46.35 | +0.46% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Midcap 100 | 59007.80 | -668.40 | -1.12% |

The economy is facing a serious challenge and the RBI has been leading from the front with quick responses through rate cuts, injecting liquidity through OMOs, LTROs and a variety of innovative tools to manage and ensure financial stability. In this hour of economic emergency the MPC has to be in place to formulate policy. This delay could have been avoided.

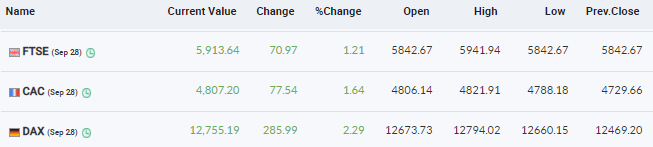

Indian benchmark indices gained strength throughout the day, helped by gains in Banking and financial stocks. Global cues were also positive following positive industrial profits data from China, setting aside concerns about the increasing virus infections and related impact.

Indian markets were also banking on further stimulus and other measures by the government to boost the economy. Traders limit overnight positions and keep booking profits while investors follow an accumulation strategy.

Key Indices ended high as Bulls led the charge backed by Financials and well supported by Auto & Pharma. Expectations of a Stimulus coupled with Capital Support to state run banks fuelled the rally in late afternoon trade. The postponement of the SC verdict by a couple of days provided a breather to the Bulls as Large Caps led the charge.

The markets kept the upward momentum on for the entire day. However, the level to watch out for is 11300-11350. We need to get past and close above that price zone. That would signal that an intermediate bottom has been made and we have entered into an uptrend. Until then, there is always a possibility of a U-turn from the current levels and the Nifty might attempt to go and test the 10750 level.

Benchmark indices ended higher for the second day in a row on September 28 on the back of buying seen across the sectors.

At close, the Sensex was up 592.97 points or 1.59% at 37981.63, and the Nifty was up 177.20 points or 1.60% at 11227.50. About 1888 shares have advanced, 763 shares declined, and 158 shares are unchanged.

IndusInd Bank, Bajaj Finance, Axis Bank, Tata Motors and Power Grid were among major gainers on the Nifty, while losers were Wipro, HUL, Nestle and Infosys.

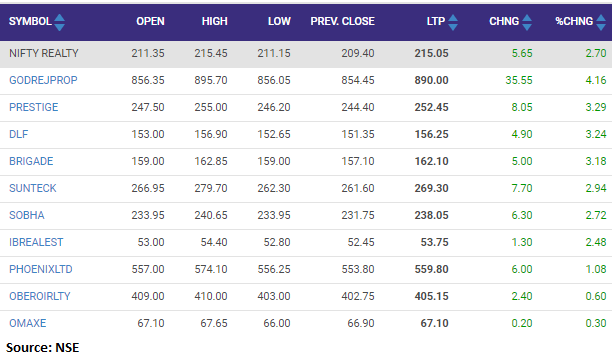

All the sectoral indices ended in the green with bank, metal and auto indices rose 3 percent each. BSE Midcap and Smallcap indices rose over 2 percent each.

Jubilant Foodworks share price touched 52-week high of Rs 2,457.50, rising over 6 percent on September 28 as foreign research house Jefferies has initiated coverage on the stock with a buy rating and kept a target at Rs 2,650 per share.

According to research house, the COVID-19 crisis will have a lasting impact on food services market, however the increased customer focus on hygiene & quality augurs well for the company.

The initiatives are underway to drive growth, gain share and optimise cost and this should reflect in a 25%+ EPS CAGR over FY20-23.The company is a strong recovery play, it added.

Mazagon Dock Shipbuilders being the only shipbuilder to have built destroyers and conventional submarines could have an edge in future orders. Considering the strong order book, superior infrastructure facilities, debt free status, one can expect better growth outlook for the company in the long run.

At the higher end of the price band of Rs 145, the stock is available at a P/E of ~6.1x (on post issue basis). We recommend subscribe on the issue with a view of listing gains.

Lupin announced the launch of Fosaprepitant for Injection, 150 mg Single-Dose Vial, having received an approval from the United States Food and Drug Administration (U.S. FDA) earlier.

At the upper end of the IPO price band, it is offered at 25.4x its FY20 earnings and 5.25% of Q1FY21 QAAUM, demanding `7,024cr market cap, which we believe is reasonable; listed peers like HDFC AMC trades at 35x FY20 earnings and Nippon AMC trades at 37x FY20 earnings. Additionally, HDFC and Nippon AMC trade at 12.56% and 8.55% of Q1FY21 QAAUM, respectively.

Considering attractive valuation, huge growth potential of MF industry, asset-light business and higher dividend payout ratio, we are positive on this IPO and rate it as subscribe.

In the volatile session, Indian rupee ended lower by 17 paise at 73.78 per dollar, amid buying seen in the domestic equity market.

It opened lower at 73.67 per dollar against Friday's close of 73.61 and traded in the range of 73.53-73.85.