October 28, 2022 / 15:58 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty has been trading near the 78.6 percentretracement of the entire September decline throughout the last week. The key Fibonacci level is near 17800. On October 28, the index attempted to stretch beyond this level on an intraday basis however couldn’t sustain in the higher territory. The hourly chart shows that the index is in process of forming a distribution near this key hurdle. The hourly momentum indicator has developed a negative divergence, which is a sign of exhaustion. The overall structure shows that the next move down could be around the corner. The immediate support zone is at 17,720-17,700. Once that is breached then the index can tumble towards 17,500 in the short term.

October 28, 2022 / 15:51 IST

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

We expect Rupee to trade with a negative bias amid weak global markets and strong Dollar. Expectations of a 75 bps rate hike by Federal Reserve in its November FOMC meeting may also weigh on Rupee. However, FII inflows may support Rupee at lower levels. Investors may remain cautious ahead of core PCE price index which is expected to increase but at a slower pace than the previous month. We expect USDINR spot price to trade in the range of 81.80 and 83.30 in next couple of sessions.

October 28, 2022 / 15:49 IST

Vinod Nair, Head of Research, Geojit Financial Services

Gains in index heavyweights helped the domestic market to withstand its gains despite negative trends in its global peers. US tech stocks had a significant sell-off following disappointing quarterly results and a bleak forecast. The ECB raised its interest rate by 75 basis points, also signalling that it is making progress in combating record inflation, though the plausibility for a recession grew. However, the strengthening rupee along with a softening treasury yield and decent Q2 earnings results are supporting the domestic market in the near term.

October 28, 2022 / 15:40 IST

Rupee Close: Rupee ends at 82.47/$ against Thursday’s close of 82.49/$

October 28, 2022 / 15:37 IST

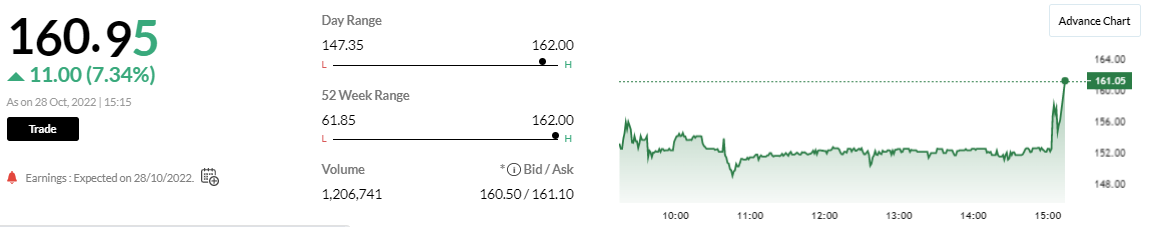

Bandhan Bank Q2FY23

- Net profit at Rs 209.3 crore vs loss of Rs 3,008.6 crore YoY

- Net interest income up 13.3 percentat Rs 2,193 crore vs Rs 1,935.4 crore YoY

-Gross NPAat 7.19 percent vs 7.25 percentQoQ

-Net NPAat 1.86 percentvs 1.92 percentQoQ

-Net interest margin at 7 percent vs 8 percentQoQ

October 28, 2022 / 15:34 IST

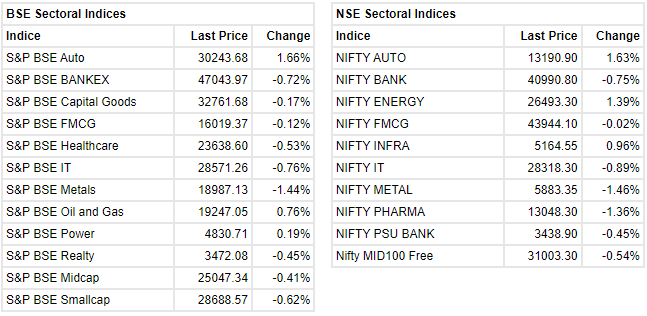

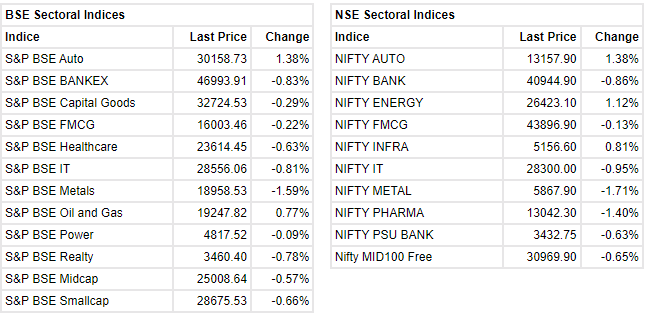

Markets at close

Sensex ended higher by203.01 points or 0.34 percentat 59,959.85. Nifty ended higher by 49.80 points or 0.28 percentat 17,786.80. About 1470 shares have advanced, 1868 shares declined, and 114 shares are unchanged.