October 12, 2021 / 16:35 IST

Anindya Banerjee, DVP, Currency Derivatives & Interest Rate Derivatives at Kotak Securities

:

The USDINR spot closed 16 paise higher at 75.51, the highest level since July 2020, in a volatile session of trading. There may have been intervention from RBI at higher levels, coupled with lumpy corporate flows which pushed prices lower but rising oil prices and firming US bond yields kept bids alive. Over the near term, bias remains upward. The range can be between 75.10 and 75.90 on spot.

October 12, 2021 / 16:33 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

It was a volatile session for the markets but bulls gained strength in late trades as Nifty once again breached the 18,000 mark before ending a tad lower below the psychological mark. On daily and intraday charts, Nifty has formed a promising higher bottom formation.

The intraday structure suggests 17850 could be the trend decider level for the bulls. Above the same, the uptrend formation is likely to continue up to 18050-18125 levels. On the flip side, below 17850/59850 the uptrend would be vulnerable.

October 12, 2021 / 15:57 IST

S Ranganathan, Head of Research at LKP securities:

The day witnessed hectic activity in PSU banking space with stocks from 2-wheelers and consumer durables seeing good demand in line with the festive mood.

While we did see a continuation of profit booking in IT names, the small & midcap space was buzzing with accumulation across sectors. A late surge in the metal index led by aluminium stocks lent support to the rally.

October 12, 2021 / 15:48 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some volatile movements and an attempt to hold the 17900 level. The market shows that it is going to be crucial in the short-term scenario to sustain above the 18000 level.

If the market is able to sustain the level of 18000, we can witness higher levels of 18250. The momentum indicators like RSI and MACD indicating positive momentum is likely to continue.

October 12, 2021 / 15:38 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Following selling in IT stocks as a result of a weak start to the earnings season and weakness in global markets, the domestic market traded in the negative zone. However, with strong support from PSU Banks on revamped hopes of privatisation and continued buying interest in consumer goods, metals and auto, indices managed to end on a positive note.

While global markets traded with cuts in fears of rising inflation due to soaring commodity prices and energy crunch.

October 12, 2021 / 15:35 IST

Market Close:

Benchmark indices ended higher on the fourth consecutive session amid volatility on October 12.

At close, the Sensex was up 148.53 points or 0.25% at 60,284.31, and the Nifty was up 46.00 points or 0.26% at 17,992.00. About 1664 shares have advanced, 1483 shares declined, and 115 shares are unchanged.

Titan Company, Bajaj Auto, Bajaj Finserv, SBI and Hindalco were among the major gainers on the Nifty. HCL Technologies, HDFC Life, Coal India, Tech Mahindra and Shree Cement were among the big losers.

On the sectoral front, auto, FMCG, metal and PSU Bank indices rose 1-3 percent, while IT index lost nearly 1 percent. BSE Smallcap and Midcap indices ended in the green.

October 12, 2021 / 15:21 IST

Emkay on Ramkrishna Forgings

Research house Emkay has retained buy on Ramkrishna Forgings with a DCF-based Dec'22 target price of Rs 1,530, implying a forward EV/EBITDA of 9x.

Operating leverage, B/S deleveraging, diversification and continued order wins/flows are likely to put company on a sustainable path of profitability.

ROE is likely to rise from a low of 3% in FY21 to 23% in FY24E, driven by better margins and asset turnover. The key risks are delay in auto sector/macro recovery, client concentration risk and adverse currency.

October 12, 2021 / 15:18 IST

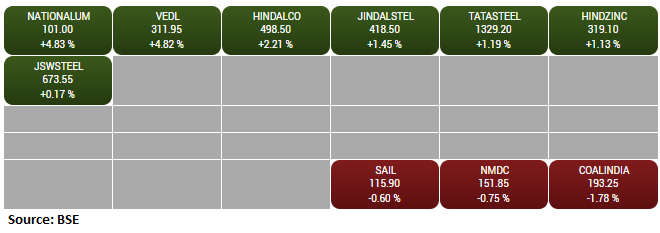

BSE Metal index rose 1 percent led by the NALCO, Vedanta, Hindalco Industries

October 12, 2021 / 15:14 IST

Yash Gupta, Equity Research Analyst, Angel One:

The Subject Expert Committee (SEC) of the drug regulator has granted an emergency use of Covaxin for kids age between 2-18 years.

Bharat Biotech Covaxin has completed phase 2 and phase 3 trials on children below 18 years of age in September 2021 and then submitted the trails data to DCGI (Drug and Controller general of India) after that Covaxin got approval for emergency usage for kids age between 2-18 years.

Overall this is positive news, as now children will also get the vaccine. Children will also require to get two dosages, with a gap of 20 days which is 84 days in the case of adults.

October 12, 2021 / 15:09 IST

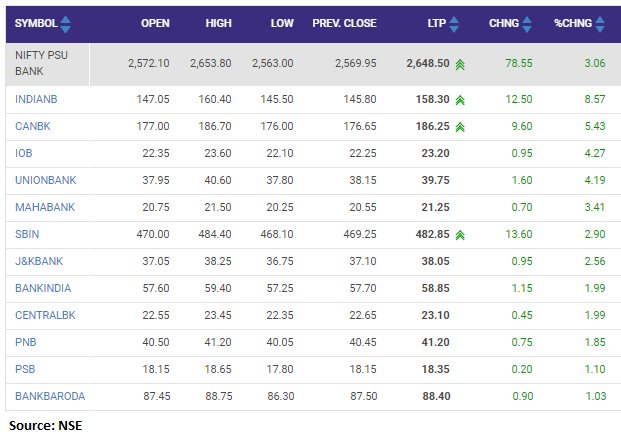

Nifty PSU Bank index added 3 percent supported by the Indian Bank, Canara Bank, IOB

October 12, 2021 / 15:01 IST

Market at 3 PM

Benchmark indices kept gyrating between gain and losses with Sensex holding above 60000 level.

The Sensex is up 79.34 points or 0.13% at 60215.12, and the Nifty was up 26.90 points or 0.15% at 17972.90. About 1593 shares have advanced, 1490 shares declined, and 127 shares are unchanged.

October 12, 2021 / 14:56 IST

Q2FY22 Power Generation at 7.3% YoY

"India’s overall power generation has improved to 7.3% YoY at 345 billionunits in Q2FY22, due to better power demand post lockdown relaxations. September generation was hit due to coal shortage, which showed volume contraction of 2% YoY. Coal-based thermal generation significantly improved 9.4% in Q2FY22 while hydro generation was saw slight growth at 1.8% YoY to 56.6 billion units and gas generation was negatively affected by higher gas prices. Renewables power generation rose 9% YoY on higher capacity addition," said Elara Securities.