February 22, 2021 / 16:15 IST

Ajit Mishra, VP - Research, Religare Broking

Markets started the week on a feeble note and lost over 2%, tracking subdued global cues. Among the benchmark indices, the Nifty index slipped below the crucial support zone of 14,800 and finally closed at 14,676 levels. Mostly sectoral indices, except metal, ended with losses wherein realty, auto and IT were the top losers. The broader market indices too witnessed sell-off as both midcap and smallcap ended with losses of more than 1%.

The recent spike in the COVID cases combined with subdued global cues is weighing on the sentiment. After this slide, Nifty has lost momentum and the next major support exists at 14,300. Going ahead, macroeconomic data i.e. GDP data and core sector data and updates on COVID-19 cases would be actively tracked.

February 22, 2021 / 15:49 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Rising economic restrictions from spike in virus cases and weak global cues hit the domestic market sentiment. The rate of market fall was aggravated by a sharp rise in volatility, being a monthly F&O expiry week. FPI inflows which was leading the rally slowed down due to global vulnerabilities from rising bond yield & inflation. However, this is a buy on dip market, a short-term correction will trigger new buying, as economic fundamentals have improved, with more focus on industrial & cyclicals.

February 22, 2021 / 15:37 IST

Market Close:

Benchmark indices ended lower for the fifth straight session on February 22 with Sensex breaching 50,000 mark and Nifty also settle below 14,700 level.

At close, the Sensex was down 1,145.44 points or 2.25% at 49,744.32, and the Nifty was down 306.10 points or 2.04% at 14,675.70. About 1030 shares have advanced, 1942 shares declined, and 151 shares are unchanged.

Tech Mahindra, M&M, Dr Reddy’s Labs, ITC and IndusInd Bank were major losers on the Nifty, while gainers included Adani Ports, JSW Steel, Hindalco Industries, Tata Steel and ONGC.

Except metal (up 1.6 percent), all other sectoral indices ended in the red. Also, both BSE Midcap and Smallcap indices shed over a percent.

February 22, 2021 / 15:27 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market failed to show resilience to stay above level of 14,750. While it is subject to further price action evolution, the technical factors are shifted today to support a further correction in the future. Any corrective wave down should find support around 14,500-14,300.

The traders to refrain from building a new buying position until we witness a correction till 14,300-14,500 level. The volatility is observed to expand in today’s trading session indicating profit booking and stock distribution at a higher market level.

February 22, 2021 / 15:25 IST

ICICI Securities on Torrent Power:

ICICI Securities maintain hold rating on the stock, but increase the target price to Rs 347 (earlier: Rs 334), incorporating the two Gujarat-based solar projects totaling 250MW, but await further clarity on company’s capex plan and target IRR for the aggressively bid UT discom. Increasing gas prices are a medium-term concern. However, improving demand in DF areas and upcoming capex are the positives.

February 22, 2021 / 15:22 IST

Abhishek Bansal, Founder Chairman, Abans Group:

Gold prices rallied from a 7-month low on the support from a weakness into the dollar index. US Stimulus expectation has also provided support to the gold prices.

US COVID-19 stimulus of the $1.9 trillion is expected to pass by the end of the week and is likely to support precious metals.

However, gold may find fresh direction from Federal Reserve Chairman Jerome Powell's testimony on the Semiannual Monetary Report to Congress starting Tuesday.

February 22, 2021 / 15:18 IST

European shares drop:

European shares fell on Monday as concerns over the risk of higher inflation due to a jump in commodity prices tempered optimism around a vaccine-led economic recovery.

February 22, 2021 / 15:15 IST

Dollar pares losses:

The U.S. dollar pared losses in early European trading after hitting multi-year lows against sterling and the Australian and New Zealand currencies as vaccine progress, expectations for faster economic growth and inflation sent bond yields higher.

Yields on 10-year U.S. and German government bonds hit one-year and eight-month highs respectively as traders continued to play reflation trades.

The British pound was holding the $1.40 line after reaching 1.4043, its highest since April 2018, as Prime Minister Boris Johnson charts a path out of lockdowns on the back of rapid vaccinations.

February 22, 2021 / 14:56 IST

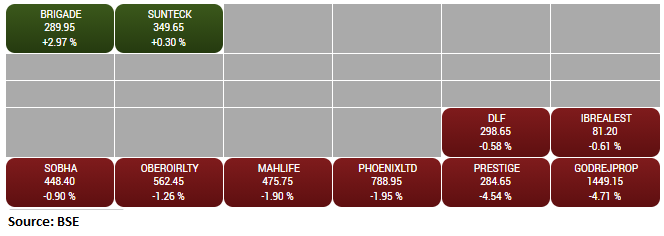

BSE Realty Index slipped 2 percent dragged by the Godrej Properties, Prestige Estate, Phoenix Mills

February 22, 2021 / 14:41 IST

L&T Construction wins orders:

The Power Transmission and Distribution business of Larsen and Toubro has won a slew of orders across its spectrum of offerings, company said in the BSE release.

Larsen & Toubro was quoting at Rs 1,455.40, down Rs 53.40, or 3.54 percent on the BSE.

February 22, 2021 / 14:27 IST

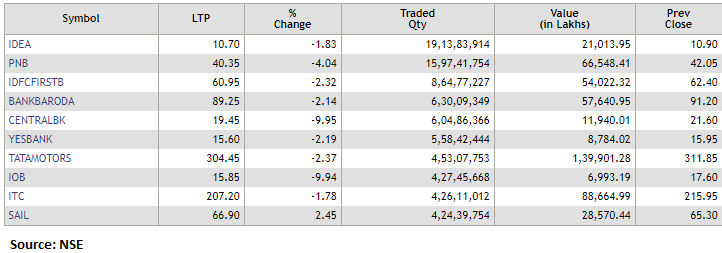

Most active stocks on NSE in terms of volumes