February 13, 2023 / 16:31 IST

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty has formed a bearish engulfing pattern on the daily chart as sellers outnumbered buyers during the session. On the daily chart, the index found resistance around the upper band of the falling channel, resulting in a fall towards 17,700.

The momentum oscillator RSI is about to enter a bearish crossover on the daily chart.

The trend looks sideways to negative for the near term as the headline index failed to provide an upside breakout. On the lower end, crucial support is visible at 17,650, below which Nifty may witness a significant correction.

February 13, 2023 / 16:26 IST

Vinod Nair, Head of Research at Geojit Financial Services

In response to rising bond yields and the dollar index, the domestic market is experiencing a broad-based sell-off, with IT and PSBs at the forefront.

Clampdown in Adani group is adding anxiety to the domestic market. Domestic inflation is expected to rise from its 12-month low of 5.7% in December, nudged up by higher food inflation, while US inflation is expected to fall further from its December low of 6.5%, alleviating concerns about US rate hikes.

However, interest rates are expected to stay high in 2023 and elevated yields will be a discomfort for equity.

February 13, 2023 / 16:21 IST

Ajit Mishra, VP - Technical Research, Religare Broking:

Markets started the week on a feeble note and lost nearly half a percent, tracking weak global cues. After the flat start, the benchmark gradually drifted lower as the day progressed however a marginal rebound in the latter half trimmed some losses.

Meanwhile, a handful of heavyweights were dictating the trend wherein profit taking in the IT majors was largely weighing on sentiment. The pressure was visible on the broader front too wherein both midcap and smallcap lost over a percent each.

The dip in the index has pushed the bulls slightly on the backfoot but they are not out of the game yet. A decisive close below 17,650 in Nifty could turn the bias in the favor of further fall else range bound move would continue. Meanwhile, we reiterate our view to focus on stock-specific opportunities and maintaining positions on both sides.

February 13, 2023 / 16:13 IST

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas

The Nifty opened on a flat note and witnessed selling pressure from the beginning of trade. It closed in the negative down 85 points.

On the daily charts Nifty has faced selling pressure from the zone 17,850 – 17,900 where resistance in the form of the 20-day moving average (17,862) was placed. Since past one week the Nifty has been range bound and until we get a decisive move above the zone of 17,850 – 17,900 the range bound action is likely to continue.

The daily momentum indicator has a positive crossover which is a buy signal and also suggests that this dip should be bought into. Overall, we expect the Nifty to test the upper end (18,100) of the downward sloping channel from short term perspective.

February 13, 2023 / 16:09 IST

Deepak Jasani, Head of Retail Research, HDFC Securities:

Nifty fell for the second consecutive session on February 13 dragged down by weak Asian cues. At close, Nifty was down 0.48% or 85.6 points at 17,770.9. Volumes on the NSE were on the lower side.

Broad market indices fell more than the Nifty even as the advance decline ratio fell to 0.41:1.

Asian stock markets were mostly lower Monday ahead of a US inflation update on Tuesday that traders worry might lead to more interest rate hikes. European markets were slightly higher on Monday as investors assess the economic outlook and the potential for further monetary policy tightening from the US Federal Reserve.

Nifty has formed a bearish Engulfing pattern suggesting more pain in the near term. A break of 17,721 could lead to faster fall towards 17,517-17,545 band. On upmoves, 17,877 could be tough to breach in the near term.

Q3 corporate results season could come to an end in the next two days. Majority of companies that reported numbers in the last few days have disappointed street and that is getting reflected in the poor advance decline ratio today.

February 13, 2023 / 15:48 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Domestic equities succumbed to weakness in global markets as investors’ fret over the Federal Reserve’s stress on the tightening of the monetary policy to tame inflation. Nifty opened lower and traded in negative territory throughout the session to close with loss of 93 points at 17763 levels.

All sectorial indices ended in red with PSU Bank, Realty and IT down 1-2% each. Volatility index, India VIX rose by 8% to 13.7 levels.

We expect market to remain lacklustre as investors await key economic data on global as well as domestic front to provide some clear direction.

Domestic CPI data to be announce today post market, while US would release its monthly CPI data on Tuesday along with Europe’s GDP numbers. Auto and Capital goods stocks likely to do well on back of good quarterly results.

February 13, 2023 / 15:34 IST

S Ranganathan, Head of Research at LKP securities

With the third quarter earnings season coming to a close this week, markets traded weak throughout the day ahead of the inflation print expected today.

PSU Banks & IT stocks dragged indices as traders booked profits on a rather dull day of trade wherein most of the sectoral indices ended in the red.

Equity ownership of retail investors now stands at a record 24.5 percent at the end of third quarter even as they remind themselves of rising fixed income rates on dull days like today.

February 13, 2023 / 15:32 IST

Rupee Close:

Indian rupee closed 22 paise lower at 82.72 per dollar against previous close of 82.50.

February 13, 2023 / 15:30 IST

Market Close:

Benchmark indices ended lower for the second consecutive session on February 13 amid selling across the sectors barring capital goods.

At Close, the Sensex was down 250.86 points or 0.41% at 60,431.84, and the Nifty was down 85.60 points or 0.48% at 17,770.90. About 1235 shares have advanced, 2261 shares declined, and 160 shares are unchanged.

Adani Enterprises, Adani Ports, SBI, Infosys and TCS were among the biggest losers on the Nifty, while gainers were Titan Company, NTPC, Larsen and Toubro, Bajaj Auto and Eicher Motors.

Among sectors, except capital goods, all other sectoral indices ended in the red.

The BSE midcap and smallcap index fell 1 percent each.

February 13, 2023 / 15:23 IST

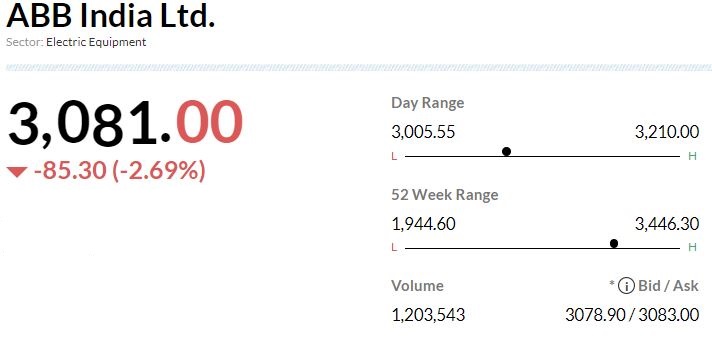

Nomura View On ABB India:

-Neutral call, target Rs 3,121 per share

-Reported unusually strong EBITDA margins despite revenue missing estimates

-Order inflows below estimates

-Management targets Rs 18 billion in strategic acquisitions

-EBITDA margin is significantly above estimates

-Better gross margins & unusually low other expenses led to beat

-PAT beat is almost entirely due to superior operational performance

-Trading at 61x CY24F PE of Rs 52

February 13, 2023 / 15:20 IST

Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas

We remain sceptical of crude oil rally ahead in the absence any real demand from China, and renewed concerns of economic slowdown in and Europe.

Short term prices could fall back to USD 75/bbl while upside capped around USD 82.

For the day, we see crude oil prices moving lower towards the support of USD 77. We advise to short into rallies for the day.

February 13, 2023 / 15:15 IST

Nomura View On Fortis Healthcare

-Buy call, target Rs 319 per share

-Q3 results largely in-line with estimates

-Occupancy rate declined 400 bps QoQ to 66 percent

-Q3 is a seasonally weaker quarter

-EBITDA margin came in at 16.6 percent versus 18.2 percent in Q2 & was lower than estimates by 80 bps

Fortis Healthcare was quoting at Rs 272.00, down Rs 10.90, or 3.85 percent on the BSE.