December 07, 2022 / 16:17 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Markets traded lackluster for yet another session and lost over half a percent. After the initial uptick, the Nifty index inched lower and oscillated in a narrow band till the end and finally settled at 18,560.50 levels.

A mixed trend across sectors kept the traders busy wherein buying in the FMCG majors capped the downside. The broader indices traded in sync with the benchmark and lost nearly half a percent each.

Markets have been gradually drifting lower however rotational buying in index majors across sectors is capping the damage. Feeble global cues might continue to put pressure but we expect Nifty to hold the 18,300-18,400 zone. In the current scenario, traders should focus on trade management and prefer sectors that are showing resilience for fresh buying.

December 07, 2022 / 16:05 IST

Mohit Nigam, Head - PMS, Hem Securities:

In the late afternoon session, the erratic trading on the local equity markets persisted. Following a 35 basis point increase in the repo rate to 6.25% by the Reserve Bank of India.

The Reserve Bank predicted that inflation would fall below the upper threshold level of 6% by the March quarter of the current fiscal. Shaktikanta Das, governor of the RBI, stated that the institution will maintain "Arjuna's eye" on the changing dynamics of inflation and will continue to be "nimble and flexible" in dealing with the price situation.

Sectorally, the agriculture industry remained in the spotlight after Reserve Bank Governor Shaktikanta Das stated that the industry is robust and that the rabi planting has started off well. Due to the irregular rains, India is anticipating a moderating of kharif production.

As Beijing stated it was dramatically reducing its "zero-COVID" regulations and moving away from isolating every single case, all Asian markets were trading lower on the global front. The majority of trade on European markets was positive thanks to a surge in healthcare stocks.

On the technical front, immediate support and resistance in Nifty 50 are 18,450 and 18,670 respectively. For Bank Nifty immediate support and resistance are 42,900 and 43,400 respectively.

December 07, 2022 / 15:54 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty witnessed volatile action on December 07 & ultimately broke 18,600 on a closing basis. This is a breach of first line of defense for the index. Going ahead 18,500 will be the key level that will decide further course of action for the index.

If that is breached on a closing basis then the index will get into a short term consolidation. Till then the bulls have a potential to fight back. On the higher side, the immediate resistance zone shifts downward to 18,650-18,670.

The Bank Nifty, on the other hand, is still holding on to its short term support zone of 43,000-42,900.

December 07, 2022 / 15:51 IST

Vinod Nair, Head of Research at Geojit Financial

As the economy deals with the global headwinds, the RBI has become more realistic, lowering FY23 GDP growth forecast from 7% to 6.8%.

The focus remains on fighting inflation which will lead to increase in interest rates in future. Along with a global slowdown, corporate earnings forecast for H2FY23 & FY24 can downgrade. The market is currently trading at premium valuations, a slowing earnings growth will impact market sentiment.

December 07, 2022 / 15:50 IST

Shrikant chouhan, Head of Equity Research (Retail), Kotak Securities

Markets extended losses for the 4th straight session as investors dumped realty and automobile stocks on worries that higher EMI outgo post the RBI's repo rate hike could dent demand going ahead.

Although the rate hike came on expected lines, the RBI showing no signs of letting off in its fight against inflation raised concerns that more hikes could be in the offing going ahead which would hurt growth.

Technically, on intraday charts the Nifty is still holding a lower top formation and also formed a small bearish candle on daily charts which is broadly negative.

For traders, as long as the index is trading below 18,650 the correction wave is likely to continue. Below the same, the index could slip till 18,500-18,425. On the other hand, above 18,650 the index could move up to 18,750-18,800.

December 07, 2022 / 15:35 IST

Rupee Close:

Indian rupee closed 13 paise higher at 82.48 per dollar against previous close of 82.61.

December 07, 2022 / 15:32 IST

Nitin Bavisi, Group CFO at Ajmera Realty & Infra India

The RBI's decision to hike the repo rate by 35 bps is on the much-expected lines with the primary goal of keeping inflation in check. Although this will lead to a marginal rise in lending rates, it may not be of much deterrence for the real estate industry backed by the positive sentiments of homebuyers and strong demand influenced due to the price rise of Indian real estate in the days to come.

The current stance on the repo rate will have lower impact on the mortgage rate, as the pace of hike has been moderated and hence perceived positively by the home buyer.

Inflation has been moderating as RBI has been keenly focused on the evolving changes and taking real-time corrective action in the best interest of economic growth as it continues to float above 4 per cent in the next 12 months.

With the growth forecast positioned at 6.8% and manufacturing services PMI for India in November amongst the highest in the world, we are hopeful of a positive turnout.

December 07, 2022 / 15:30 IST

Market Close

: Benchmark indices ended lower in the volatile session on December 7 with Nifty around 18550.

At Close, the Sensex was down 215.68 points or 0.34% at 62,410.68, and the Nifty was down 82.30 points or 0.44% at 18,560.50.About 1464 shares have advanced, 1928 shares declined, and 140 shares are unchanged.

NTPC, Bajaj Finserv, Tata Motors, SBI Life Insurance and IndusInd Bank were among the top Nifty losers. The gainers included Asian Paints, BPCL, HUL, Larsen and Toubro and Axis Bank.

Power, metal and realty indices down 1 percent each.

BSE midcap and smallcap indices fell 0.4 percent each.

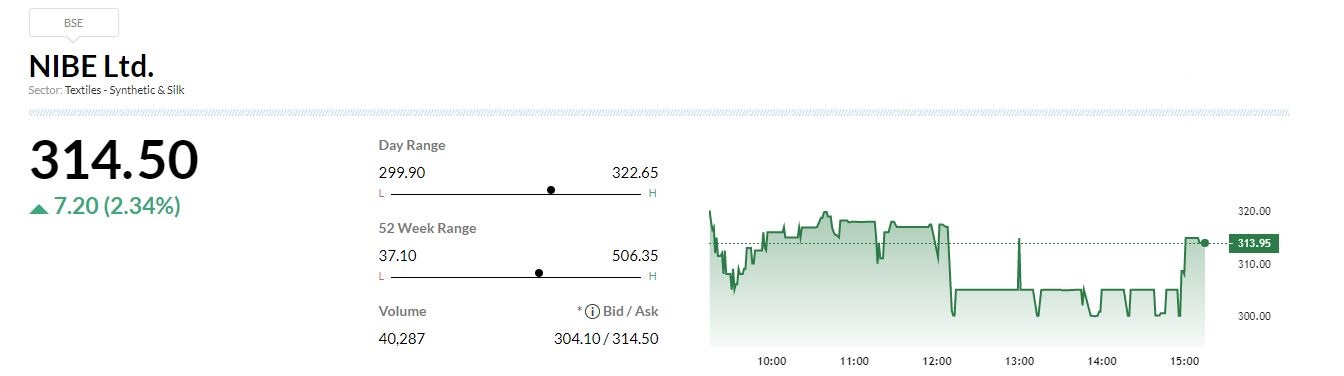

December 07, 2022 / 15:23 IST

NIBE has received Letter of Award from Goa Shipyard Limited for supply of Mild Steel and High Tensile Steel Plates with shot blasting and priming for Main Hull and Superstructure of Floating Dock for a total consideration of Rs 25.18 crore.

December 07, 2022 / 15:22 IST

Dollar flat as growth outlook darkens, yuan firms as China eases curbs

The dollar was little changed on Wednesday after some of the biggest USbanks warned of an impending recession, while China's yuan firmed as authorities loosened some of the country's zero-COVID rules.

Top bankers from JPMorgan Chase & Co, Bank of America and Goldman Sachs said overnight that the banks are bracing for a worsening economy next year as inflation and high interest rates cut into consumer demand.

The greenback was up 0.32% against the Japanese yen following a 0.16% gain on Tuesday. Yet the euro was flat against the dollar at $1.048, after falling 0.2% in the previous session.

December 07, 2022 / 15:19 IST

BSE Power index shed 1 percent dragged by NTPC, Adani Green, JSW Energy

December 07, 2022 / 15:18 IST

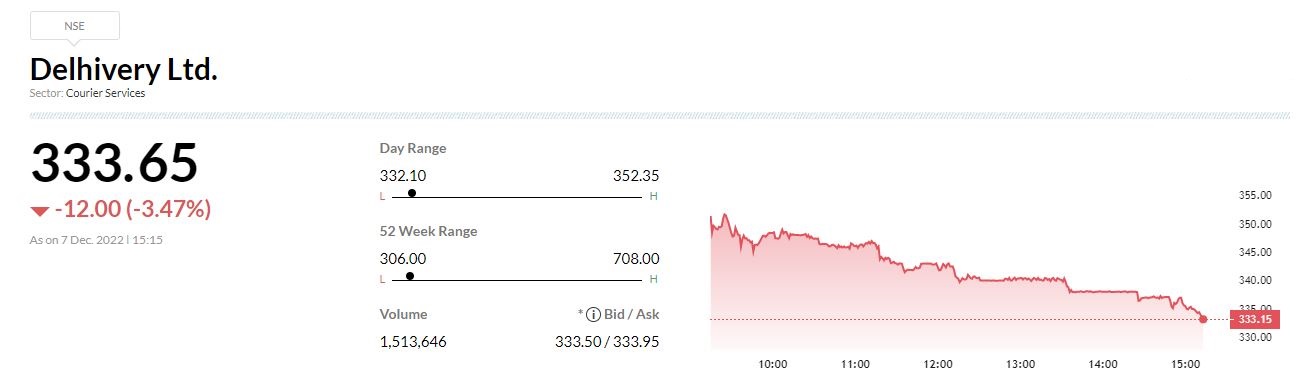

CLSA maintains 'Buy' rating on Delhivery, target Rs 532

-Buy call, target at Rs 532 per share

-Management confident of overall growth going forward

December 07, 2022 / 15:15 IST

Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life Insurance

Overall, the policy seemed slightly hawkish on the margin and indicated that there may be space for further tightening, although it will depend on the inflation trajectory and the terminal rate for the US Federal Reserve.

RBI governor also mentioned that market participants must wean themselves away from the overhang of liquidity surpluses which means market should be prepared for further tighter liquidity condition. Post the policy announcement bond yields hardened a bit. With corporate bonds spreads still being very tight, we may witness some increase going forward. We prefer the short-medium term part of the yield curve.