August 16, 2022 / 16:09 IST

Ajit Mishra, VP - Research, Religare Broking:

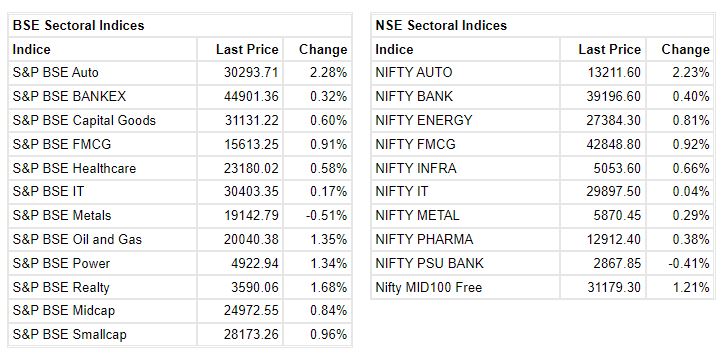

Market started the truncated week on an optimistic note amid supportive global cues. The benchmark witnessed a gap up opening and thereafter it continued to hover in the positive range throughout the session. Healthy buying in sectors such as auto, FMCG and realty drove the rally. Consequently, the Nifty ended higher by 0.72% at 17,825 levels. Amongst the broader markets, mid-cap and small-cap outperformed and ended in the positive range of 1-1.5%. Almost all the sectoral indices ended in the green except for PSU bank and media.

Markets will continue mirroring global peers for cues. Meanwhile, we suggest investor’s to continue maintaining a stock specific approach. Also, investor’s will keep a close watch on fluctuating crude prices and currency movement.

August 16, 2022 / 16:02 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets maintained their upward bias through the trading session aided by positive global cues and few domestic factors that triggered a rally in realty, automobile and banking stocks.

Moderating domestic inflation level has raised expectations that interest rate hike by the central bank may slow down going ahead. While strong FII fund infusion has certainly bolstered the sentiment of investors.

Technically, the Nifty has held the higher bottom formation on intraday charts and 17750 would be the trend decider level. Above which, the index could hit the level of 17900-17925. On the flip side, a quick intraday correction is possible if the index trades below 17750 and below it could retest 17700-17650.

August 16, 2022 / 15:53 IST

Vinod Nair, Head of Research at Geojit Financial Services.

The easing of inflationary pressures has encouraged domestic investors to remain optimistic about the pace of economic recovery.

Better-than-expected CPI numbers, aided by slower increase in food and fuel prices, may limit the pace of rate hikes by the RBI.

In the Asian market, the Chinese central bank surprised the market by cutting its interest rates after a weak set of economic data. Following that, oil prices slumped on demand worries.

August 16, 2022 / 15:51 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nifty index formed a Doji candle on the daily chart which indicates indecisiveness at the current level. The index after a stupendous rally is showing signs of exhaustion however a profit booking scenario will be confirmed only on a close below 38,700 level.

If the index surpasses the level of 39,500 on a closing basis will see extension of the rally towards 40,000-41,000 levels.

August 16, 2022 / 15:34 IST

Market Close:

Indian benchmark indices ended on positive note on August 16 with Nifty finishing above 17,800.

At Close, the Sensex was up 379.43 points or 0.64% at 59,842.21, and the Nifty was up 127.10 points or 0.72% at 17,825.30. About 1926 shares have advanced, 1527 shares declined, and 153 shares are unchanged.

HDFC Life, Adani Ports, Eicher Motors, BPCL and Maruti Suzuki were among the major Nifty gainers. The losers included Grasim Industries, Hindalco Industries, SBI, Bharti Airtel and JSW Steel.

Except metal and PSU Bank, all other sectoral indices ended in the green with auto and realty indices rising 2 percent each.

BSE midcap and smallcap indices rose 1 percent each.

August 16, 2022 / 15:23 IST

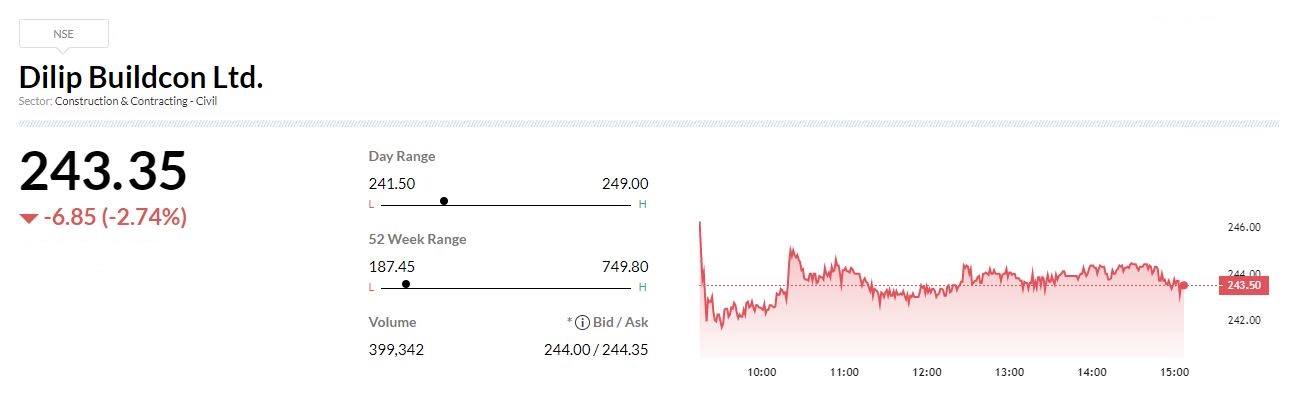

Buzzing

Dilip Buildcon has posted consolidated loss of Rs 55.1 crore for the quarter ended June FY23, against profit of Rs 32.86 crore in year-ago period, but sequentially the loss widened from Rs 41.09 crore in previous quarter on weak operating performance.

Revenue grew by 18.3% to Rs 2,884.4 crore compared to corresponding period last fiscal. The net order book as on June 2022 stood at Rs 25,160.2 crore.

August 16, 2022 / 15:21 IST

CLSA View On Sobha

Foreign research firm CLSA has maintained buy call on Sobha and raised the target price to Rs 850 from Rs 805 per share.

It was a strong quarter with record presales & continued FCF generation. The presales of Rs 1,150 crore were ahead of our estimate, driven by new launches, said CLSA.

The company has raised its FY23 presales growth guidance to 15-20%, while we increase our presales estimates by 6% over FY23-25, reported CNBC-TV18.

Sobha was quoting at Rs 709.60, up Rs 21.00, or 3.05 percent.

August 16, 2022 / 15:17 IST

Rajani Sinha, Chief Economist at CARE Ratings:

The fall in WPI inflation for the second consecutive month comes as a big relief. The easing of WPI inflation in July is primarily led by lower food, metals and chemical prices. If not for a sharp sequential rise in mineral oil prices and hike in electricity tariff, the fall in WPI inflation would have been sharper.

Going ahead, the signs of global supply chain normalisation coupled with recession fears in major economies should support the downtrend in commodities prices. Consequently, wholesale price inflation is expected to ease further in coming months. However, lower sowing of paddy and tight supply of wheat could limit the fall in primary inflation. Further, a weaker rupee would to some extend mitigate the benefit of decline in commodity prices.

August 16, 2022 / 15:10 IST

Concord Biotech files draft papers to float IPO

Rakesh Jhunjhunwala-backed Concord Biotech Ltd has filed draft papers with the Securities Exchange Board of India to raise funds through an initial public offering.

The IPO consists of a pure offer-for-sale of up to 20.93 million shares or the entire 20 percent stake by its promoter Helix Investment Holdings Pte Ltd, which is backed by Quadria Capital Fund LP, a healthcare-focused private equity fund in Asia. According to the draft papers, Quadria Capital had invested Rs 475.30 crore in 2016 for a 20 percent stake in Concord.

Legendary stock investor Rakesh Jhunjhunwalal, who passed away on Sunday, held over 24 percent stake in the active pharmaceutical ingredients (API) maker through his investment arm Rare Enterprises.

August 16, 2022 / 15:05 IST

Morgan Stanley View On Metropolis Healthcare

Morgan Stanley has downgraded Metropolis Healthcare to equal-weight from overweight and also cut target prcie to Rs 1,547 from Rs 2,211 per share.

The downgrade reflects competitive intensity, growth outlook, balance sheeet & valuation. The focus on specialised tests & customer experience will provide a moat to its business model.

Morgan Stanley has cut FY23, FY24 & FY25 EPS estimates by 15%, 11% & 11% respectively, while EPS estimate cuts reflect expectations of slower growth and higher costs, reported CNBC-TV18.

Metropolis Healthcare was quoting at Rs 1,447.90, down Rs 40.75, or 2.74 percent on the BSE.

August 16, 2022 / 15:01 IST

Market at 3 PM

Benchmark indices were trading higher with Nifty around 17800.

The Sensex was up 315.20 points or 0.53% at 59777.98, and the Nifty was up 109.90 points or 0.62% at 17808.10. About 1839 shares have advanced, 1467 shares declined, and 130 shares are unchanged.

August 16, 2022 / 14:55 IST

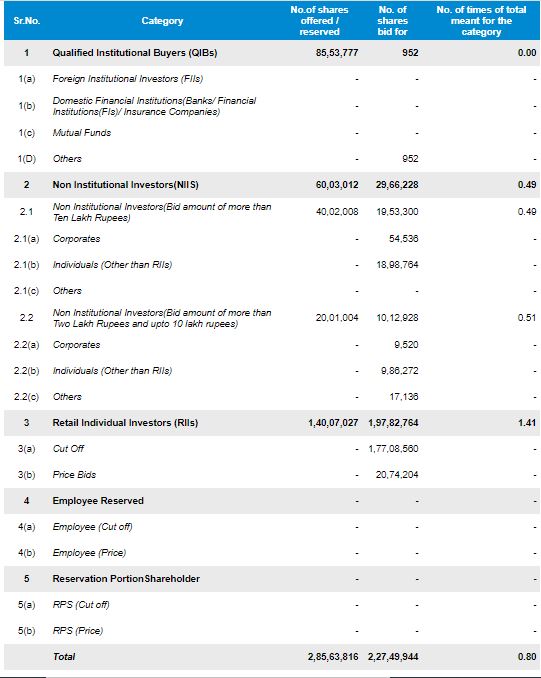

Syrma SGS Technology IPO subscription Updates:

August 16, 2022 / 14:51 IST

Balaji Solutions files draft papers with SEBI:

Balaji Solutions Ltd has filed a draft papers with the Securities Exchange Board of India to raise funds through an initial public offering.

The IPO will consist of a fresh issue of Rs 120 crore and an offer-for-sale of up to 7.5 million shares by its existing shareholders and promoters. The OFS will comprise up to 1.5 million shares by Rajendra Seksaria and up to 6 million by Rajendra Seksaria HUF.

The proceeds from the fresh issue will be used for funding its working capital requirement. As of June 2022, the outstanding amount under the fund-based working capital facilities stood at Rs 11.22 crore.