April 24, 2023 / 16:05 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

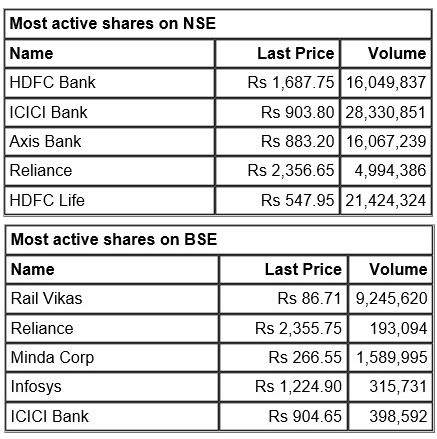

Indian markets outperformed their Asian peers as Sensex closed above the 60,000 mark on strong buying in financial stocks after earnings from ICICI Bank and Reliance Industries matched street expectations. After witnessing a sluggish trend over the past few sessions, fresh buying emerged ahead of the monthly F&O expiry later this week.

While the markets may still be choppy and volatile, we may see select bouts of buying going ahead. Technically, on daily and intraday charts the Nifty has formed a reversal formation and on daily charts it has also formed a reversal candle which is largely positive. For the bulls now, 17,700-17,650 would act as a key support zone. Above this,the index could retest the level of 17,825-17,850. On the flip side, below 17,650, traders may prefer to exit from the trading long positions.

April 24, 2023 / 15:58 IST

Santosh Meena, Head of Research, Swastika Investmart:

Contrary to last week, this week started on a strong footing thanks to broad-based buying in banking names post-ICICI Bank results. HDFC Twins also supported the market after some relief from the RBI on priority sector lending. The headline indices outperformed, while the broader market slightly underperformed after last week's outperformance. This week is an earning-heavy week, and we also have April's F&O expiration; therefore, volatility may increase.

Technically, both Nifty and Bank Nifty witnessed a breakout of the bullish flag formation, where 17,800–17,860 is an immediate resistance zone for the Nifty; above this, we can expect a rally towards the 18,100–18,200 zone. On the downside, the 200-daily moving averagearound 17,600 will act as a strong support level.

Bank Nifty is near the critical supply zone of 42,700–43,000; above this, we can expect a rally towards 43,500 and 44,000 levels. On the downside, 42,000 has become a near-term floor.

April 24, 2023 / 15:56 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The positive market sentiment in the domestic market was boosted by strong earnings reported by heavyweights. This led to a reversal in the cautiousness from the initial below-expectation Q4 results. However, the weak global sentiment did raise some concerns midway. But the banking sector played a key role in this upward trend, with sector majors reporting strong earnings.

April 24, 2023 / 15:55 IST

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas:

The Nifty opened on a flat note and witnessed a consolidation during the first half of the trading session. The action picked up during the second half and Nifty managed to close above 17,700 which indicates that it has started the next leg of upmove. On the daily chart, the Nifty has managed to hold on to the lower end of the rising channel and the 200-day moving average (17,615) which is a bullish sign. The daily momentum indicator has a negative crossover and since prices have resumed their up move, it is likely that the momentum indicator shall provide a positive crossover over the next few trading sessions. Considering the above parameters, we change the short-term outlook to positive and expect the Nifty to target levels of 18y,100. In terms of levels, 17,620 – 17,600 shall act as a crucial support zone while 17,860 – 17,900 is the immediate hurdle zone for the Nifty.

April 24, 2023 / 15:40 IST

Taking stock: Nifty rises 119 point to close just shy 17,750; Sensex jumps 410 points

After a week of weakness, the benchmark indices made a comeback on April 24 following some strong earnings announcements by private lenders over the weekend and today that lifted the overall mood on Dalal Street.

During the last week, most market participants were cautious after the IT sector earnings were way below expectations. Meanwhile, hawkish commentary by some of the US central bank office bearers also did not help the bulls. However, some low level buying eventually came in IT and bank indices on April 24.

The Nifty 50 index rose 0.68 percent or 119.35 points to 17,743.40 and the BSE flagship Sensex also inched higher by 0.67 percent or 410.04 points to 60,056.10.

April 24, 2023 / 15:30 IST

Market at close

Benchmark indices settled the session near the day's high, with Nifty around 17,750.

The Sensex settled 401.04 points or 0.67 percent higher at 60,056.10, and the Nifty gained119.40 points or 0.68 percent at 17,743.40. About 1,847 shares advanced, 1,643 shares declined, and 159 shares were unchanged.

Among sectors, information technology, and financials were major gainers whilepharmafaced selling pressure.

The Nifty Midcap 100 index underperformed the headline Nifty 50, but endedhigher. The Nifty Smallcapindex also ended in the green.

April 24, 2023 / 15:11 IST

BSE 500 Recovery from Day's Low

April 24, 2023 / 15:08 IST

CLSA View on Reliance Industries

The brokerage house maintained the 'buy' rating on the stock with a target of Rs 2,970 per share. The Q4 consolidated PAT was ahead of estimates, helped by a notably lower-than-expected tax rate. Consolidated EBITDA was 1 percent ahead of estimates, with a 7 percent miss in retail EBITDA offset by a beat in O2C, while Jio had an in-line quarter.

It was another quarter of big expansion for retail in Q4, implying a huge 58 percent rise in retail selling space in FY23. However, for FY23, FCF dipped to negative driven by a large capex of $17 billion led by retail and telecom.

The broking firm raises the 24/25 EPS estimates by 3 percent/4 percent.

Reliance Industries was quoting at Rs 2,356.90, up Rs 8.00, or 0.34 percen on the BSE.

April 24, 2023 / 15:06 IST

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

Indian Rupee appreciated on Monday on strong domestic equities and a soft US Dollar. Weak tone in crude oil prices also supported Rupee. However, FII outflows capped sharp gains. US Dollar declined amid recession concerns in US while expectations of a hawkish Fed supported the greenback at lower levels. Upbeat PMI data from US cushioned sharp fall in US Dollar on Friday.

We expect Indian Rupee to trade with a positive tone on easing global crude oil prices and positive domestic equities. Dollar may continue to remain weak as overall economic data continues to remain largely weak, leading to increasing concerns over recession. However, hawkish sentiments from FOMC meeting may weigh on risk assets, which may put downside pressure on Rupee at higher levels.

Selling pressure from FIIs may also weigh on Rupee at higher levels. Important data from US for the week is US consumer confidence and Advanced GDP, which are expected weaker than previous reading. USDINR spot price is expected to trade in a range of Rs 81.50 to Rs 82.30 in the near term.

April 24, 2023 / 15:00 IST

Market at 3 PM

Benchmark indices extended the gains and were trading at the day's high with Nifty above 17,700 and Sensex at 60,000.

The Sensex was up 355.54 points or 0.60 percentat 60,010.60, and the Nifty was up 104.30 points or 0.59percentat 17,728.30. About 1,695 shares advanced, 1,614 shares declined, and 137 shares were unchanged.

April 24, 2023 / 14:52 IST

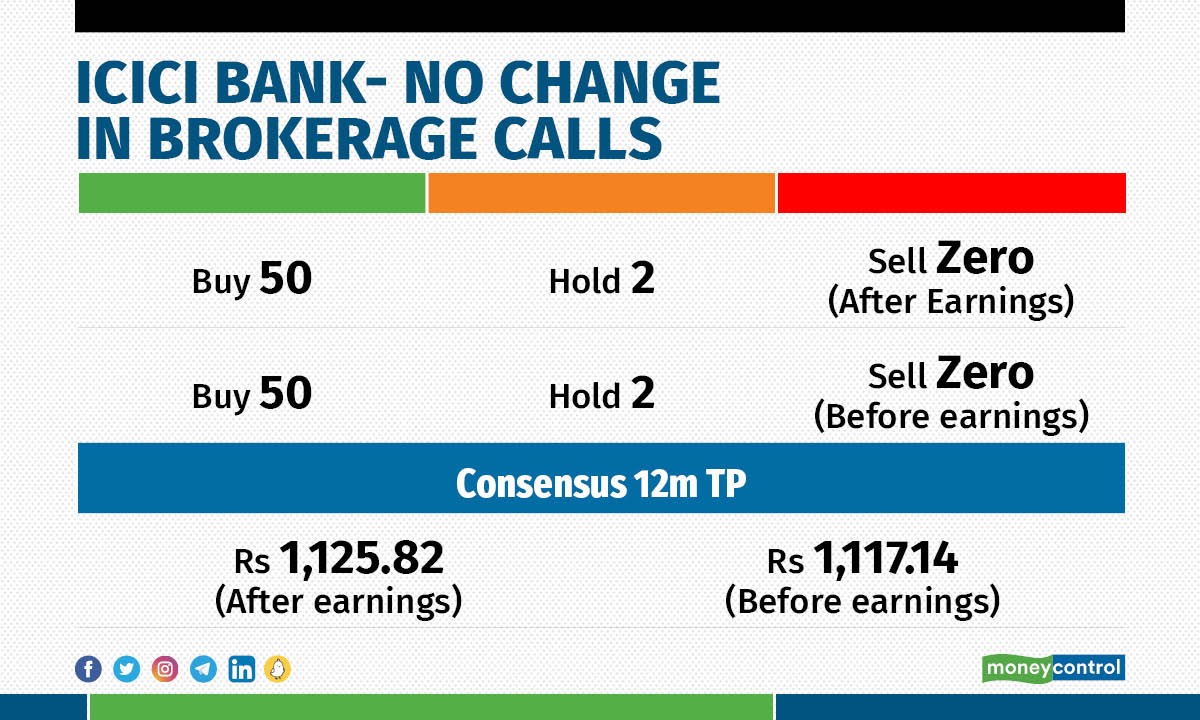

Goldman Sachs View on ICICI Bank

Goldman Sachs has kept the 'buy' rating on the stock with a target of Rs 1,100 per share. The bank's operational performance was in-line, and market share gains are expected to continue with a strong pre-provision operating profit to return on assets (PPOP-ROA).

It believes that the core PPOP growth could likely slowdown in FY24E/FY25E. This was one of the reasons for taking ICICI Bank off its Conviction List recently, even though it remains a buy.

ICICI Bank was quoting at Rs 904, up Rs 19.80, or 2.24 percent on the BSE.

April 24, 2023 / 14:48 IST