It was a bad start to the March series, with the US bond yields, which are at their highest in a year, and tensions between the US and Iran sinking the Indian market on February 26 in line with a global rout.

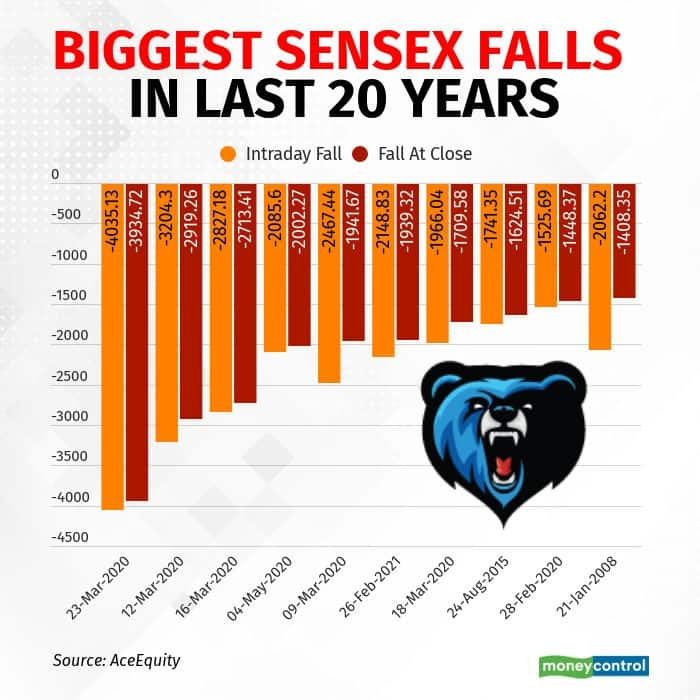

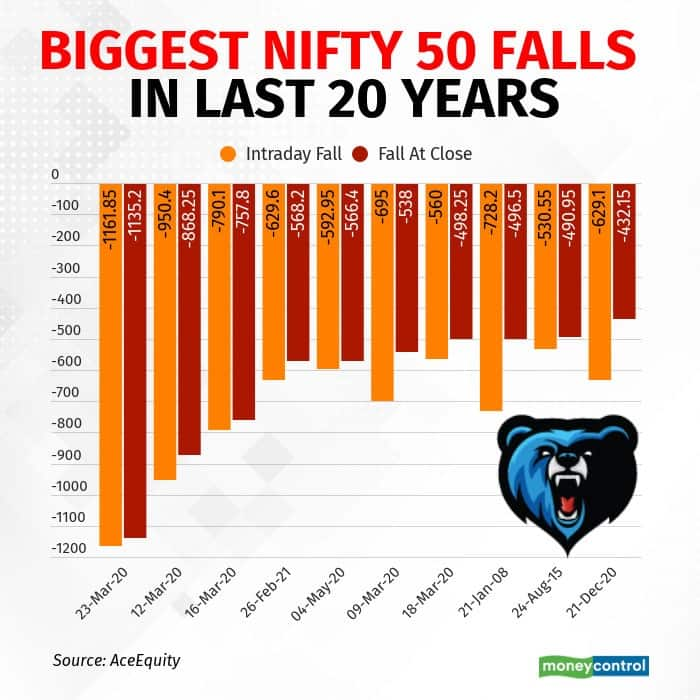

Selling across sectors saw the BSE Sensex clock its sixth-biggest single-day fall and the Nifty50 its fourth-worst performance on February 26. It was also the biggest fall for the Nifty since March 23, 2020, and for the Sensex after May 4, 2020.

The Sensex tumbled 1,939.32 points, or 3.8 percent, to 49,099.99, while the Nifty crashed 568.20 points, or 3.76 percent, to 14,529.20. The indices fell 3 percent each for the week.

"The domestic markets gave in to a riot of sell-off which resulted in the frontline indexes falling by more than 3.75 percent, a very rare thing in an otherwise booming market recovering fast from the pangs of the pandemic-induced economic sluggishness. The rising inflationary expectations in the US and the consequent rise in bond yields have been a subject of intense discussion of late," Joseph Thomas, Head of Research at Emkay Wealth Management said.

"US inflation is expected to rise in the coming months, and therefore, the US yields too. The 10-year US treasury benchmark has already moved up swiftly to 1.50 percent, a steep rise from its lowest point of close to 0.50 percent," he added.

Fed Chair Jerome Powell indicated that the recovery had a long way to go and inflation remained "soft".

"Rising inflationary expectations and the rising yields have a potential to adversely affect the equity sentiment and the equity markets," Thomas said.

The market capitalisation of BSE-listed firms dropped to Rs 206.18 lakh crore on February 26 from Rs 200.81 lakh crore in the previous session, wiping Rs 5.4 lakh crore of the investor wealth in a single day.

The broader markets also corrected but the fall was lower compared to the benchmarks. The BSE midcap index was down 1.75 percent and smallcap 0.74 percent.

The correction was warranted after the sharp upside seen in the market for several months, said experts. "The ingredients of a structural bull market remain intact for India. Such ebbs and corrections will provide opportunities for long-term investors to take advantage of volatility and accumulate quality businesses at reasonable valuations and price points," Devang Mehta, Head Equity Advisory at Centrum Broking said.

All sectoral indices ended in the red on the NSE. The Nifty Bank and financial services indices corrected nearly 5 percent each, followed by auto, IT, FMCG, metal and pharma that were down 1.6-3 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!