Abhishek Bansal

The US Department of Treasury publishes a semi-annual report in which they review international economic and exchange rate policies. The US Treasury has set three conditions as follows to identify a currency manipulator and put it under watch:

- A trade surplus of over $20 billion with the US

- A Current Account Deficit surplus of 3 percent of the GDP (recently revised to 2 percent in May 2019)

- Persistent foreign exchange purchases of over 2 percent of the GDP over a 12 months period

In May 2018, India was for the first time placed under the US currency monitoring list after continuous Reserve Bank of India (RBI) interventions in foreign exchange along with five other countries -- China, Germany, Japan, South Korea and Switzerland.

The Indian rupee was down about 14 percent in the year 2017, and India had a significant trade surplus with the US to the tune of $24.2 billion while its Current Account Deficit (CAD) was at 1.9 percent of GDP in June 2018; as a result, India was under the scanner for currency manipulation.

In October 2018, the US hinted at India’s removal from its currency monitoring list as it saw noticeable steps taken by the Indian government. There was a notable decline in 2018 in the scale and frequency of foreign exchange purchases.

Later in May 2019, India was removed from the US currency watch list as it met only one of the three criteria for two consecutive reports.

According to the US Treasury Report on foreign exchange policies of major trading partners, India sold reserves for the most of 2018, with net sales of foreign exchange reaching 1.7 percent of GDP over the complete year. According to the IMF metrics for reserve adequacy, India maintains sufficient reserves.

Figure 1: Source- US Government Trade Representative website, RBI and ABans Research

Figure 1: Source- US Government Trade Representative website, RBI and ABans Research

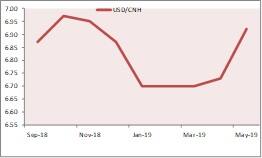

The US decision to remove India from its currency watch list should give an advantage against China and help in increasing bilateral trade with the US. Despite being on the currency manipulation list, the Chinese Yuan has steadily depreciated through 2019 and lost 2.5 percent of its value against the dollar in May 2019 alone, which is the biggest monthly drop since July 2018.

Figure 2: ABans Research

Figure 2: ABans Research

US and China are in the middle of a trade war and are continuing to impose duties on each other since the last year. After the 11th round of talks between the two major trade partners, they failed to reach an agreement over many sticky points. As a further escalation to the trade war, China moved one step ahead and threatened to cut off sales of rare earth minerals.

This is in addition to the 25 percent tariffs already imposed. China dominates rare-earth minerals supply, which is used in automobiles, electronics, oil refining and major weapons systems inherent to US national security.

The US recently announced anti-dumping duties on Chinese Aluminium which could benefit other Aluminium producers, including India. In 2018, Indian Aluminium exports to the US rose by 58 percent to $221 million after US and China entered into a trade war.

Although India met one of the three criteria required by the US Treasury, India is likely to hold an edge over other leading exporters to the US, namely China, Japan, South Korea, Germany, Italy, Ireland, Singapore, Malaysia and Vietnam.

(The author is Chairman at ABans Group of Companies.)Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.