Post elections, we see debates on reforms vs freebies, but have we considered what these terms even mean?

A casual tweet I did on the subject went viral a few days ago. And I thought the subject warranted a deeper analysis.

Reforms vs Freebies

First off, words matter. Framing matters. A reminder that this is the lens through which the privileged see the world

Corporate tax reduction = Reform

Capital gains tax cut = Reform

Near free land to industry = Reform

Near free IIT/IIM/ University education = My birthright

Yes I know IIMs charge more now but most social media warriors (including myself) studied there when that wasn't the case. IITs and government Engineering colleges, as also public universities, are still heavily subsidized.

Free/subsidized food to the poor = Fiscal profligacy

Free healthcare = Revadi

Reservations = Anti-merit

Spanking new expressways are Infrastructure in the minds of the chattering classes.

Schools, libraries, clinics are not.

Simply put: anything that benefits the privileged (example- Corporations, stock market investors etc) is classified under Reform whereas anything benefiting the under-privileged, even if it is in health & education without which the country/economy can't prosper, is 'a waste of taxpayer money', Anti-merit etc.

All the people who got heavily subsidized education in Universities, IITs and IIMs, especially those who went abroad & didn't even pay taxes in India to compensate, have their knickers in a twist because women who travel in buses are getting a subsidy or someone is getting cheap rice!

We forget that one of the objectives of taxation IS some amount of redistribution, at least to ensure basics for the poorer segments.

The Balance between the short-term and the long-term

One way of framing this debate is between the privileged and the deprived but there is also another way of looking at it, which is the balance between the short term and the long term objectives.

Just as in the case of company managements, we investors want to them to achieve this balance, we have to keep the same outlook for the nation's or the government's priorities.

Today we are proud that major global organizations from the World Bank to Microsoft to Google and many more are headed by people of Indian origin; as also that India is now considered a nation of techies.

Think about it: all this came out of the original investments in IITs starting in the 1950s and the IIMs in the 1960s.

We could send the Chandrayan to the moon because we started space research decades before any other developing country had even thought of it.

I still remember when MGR was promoting the mid day meal scheme in Tamil Nadu schools (originally started by Kamaraj), how much breast-beating there was in financial papers that this was undesirable and profligate spending.

And yet that changed the outcome in terms of education and Human development for the state.

From once being one of the poorest states in the country, Tamil Nadu now has the about the lowest incidence of poverty among the major States.

Similarly giving bicycles to school going girls appears like a freebie but it increases mobility for girls and which in turn means that they can study further. The reason? Often basic schooling is available close who the children's home but for high school or college they have to travel further. Having or not having a bicycle determines whether the girl child would actually study further.

Overall, spending on health, nutrition and education improves the quality of the human capital i.e the workforce, in making our young people employable.

This, of course, has a positive impact on businesses as a second order effect. Plus higher employment means higher levels of consumption which in turn boosts both the countrimy’s GDP as well as the top line and bottom line of businesses.

The point is that proper social or for that matter research, funding does have an economic payoff, except that the exact effect may not be determined at the beginning and will certainly not show up on a one or two year basis.

Helping businesses: What is the objective?

That was about social spending.

But what if the government does want to give some benefits to businesses, which is anyway classified as reforms by the business press. What is the framework to use?

It has to be in the context of what objectives these benefits aim to achieve.

Is it more local employment? Is it boosting investments or capital expenditure? Is it transfer of technology over a period of time?

Only when we have a framework will we be able to evaluate whether the subsidies or benefits are being optimally used - meaning what is the best way to structure the benefits and who should be the beneficiaries?

For example, let us take the corporate tax cut about 5 years ago. This obviously benefited the high taxpayers among the companies.

As one goes down the list of the high corporate taxpayers, one would see that most of these fall in one of 3 categories: Banks and financial institutions, Public sector units and MNCs, most of which are in the consumer goods business.

Giving a tax cut to these corporations did leave more money in their hands but none of these categories are high capital expenditure spenders and so the same money did not give a boost to investments in the economy, by and large.

It is arguable that a better strategy of boosting private investments even using a direct tax route may have been to provide specific tax breaks for investments as has been done a number of times in the past. And if the aim was to boost consumption, it was probably better to give this incentive on personal income tax rather than corporate tax. Or give incentive to businesses that are more employment intensive, which tend to be the small and medium enterprises or export oriented businesses.

It does appear that this corporate tax cut did not boost investments or employment or consumption.

Another one is incentives and subsidies to manufacturing companies. This may take the form of below market rate land or schemes like the Production Linked Uncentive (PLI) scheme.

For example, Foxconn has got 75% subsidy on the first 200 Acres of land required for the Semiconductor fab project. Any additional land, required for the core activities of the project, will be available at 50% subsidy.

It appears that a bulk of the PLI scheme incentives have been given to large hardware manufacturers. Once again this must be evaluated against stated objectives, especially whether this is the best use of money if the goal is to boost employment.

How is it funded?

In corporate decisions, it is not just about what you spend your money on but also how are the funds generated to fund the projects. That is the way to look at government decisions too.

For example the government can fund social spending by increasing taxes or other revenue sources.

Of course, unlike companies, governments have access to on-tap debt, which is often used to fund the government's priorities.

For example, when the Mahatma Gandhi National Rural Employment Guarantee Act, 2005 (MNERGA) and some other social schemes were introduced, there was no MNREGA tax or cess that was launched.

Then let us see how government debt moved. This has to be looked at not in absolute terms but as percentage of the GDP.

The debt of the Indian states plus Central Government used to be in the 50-70% of GDP range in the 1980s and 1990s. Then it started to go up and reached 83.2% of GDP in 2003-4.

Thereafter it started to go down reaching a low of 65.5% in 2010-11. In spite of the Global financial crisis and oil remaining over $100 a barrel for a few years, the total government debt to GDP was at 67% in 2013-14.

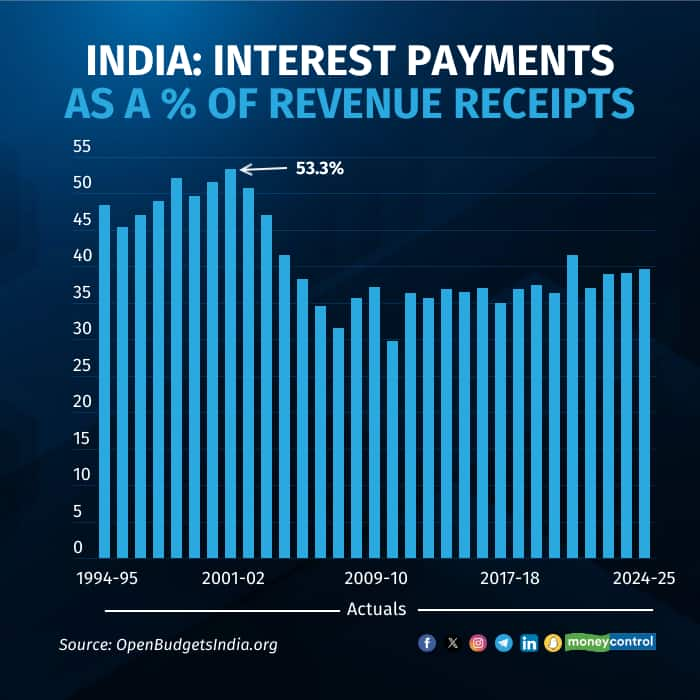

Along with the reduction in that came a dramatic reduction in interest cost as a percentage of revenue receipts in the central government budget. This came down from a peak of 53.3% in 2001-2 to less than 30% in 2010-11.

That means from a time when over 53% of the revenues of the government were just used to pay interest on government debt, this percentage came down to little over 29%.

Savings of roughly 25% of the revenue receipts was what was used to fund MNREGA and other social schemes.

Thereafter, both government debt as a percentage of GDP and interest cost as a percentage of budget revenue receipts have continue to creep up even before, as well as after the pandemic.

This is inspite of a very good environment on global growth prior to the pandemic as well as oil prices remaining relatively low for most of the past decade. This oil price Bonanza was not passed on to the consumers but the government debt instead of being paid down continued to go up. Even 3 years after the pandemic peak the government debt to GDP ratio is close to 82% of GDP roughly 15% higher than where it was a decade ago.

Interest expenses as a percentage of revenue receipts are now over 40% as against 29.5% in 2010-11. This means that far less of the government receipts are available for productive and social spending.

As it turns out, the discussion between what is policy reform and what is fiscal profligacy is a lot more nuanced than the way it is discussed usually. You have to think through who is benefiting, in what time frame, whether something is optimal for the objective stated as also how it is funded.

I hope this gives you a better framework for analysing government policy and the forthcoming budget.

(Devina Mehra is the Founder and Chairperson of First Global, a leading Indian and Global investment Management firm. She is a gold medalist from IIMA and has been in the Investment business for over 30 years. She tweets @devinamehra and can be contacted at info@firstglobalsec.com or www.firstglobalsec.com)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.