While there are some concerns about valuations, the overall sentiment remains positive, driven by strong fundamentals, healthy order books, and improving performance metrics.

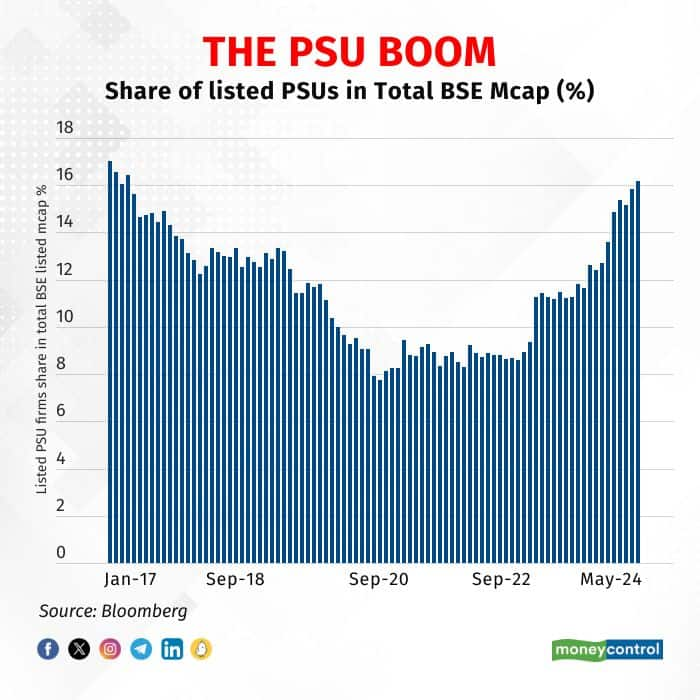

The share of public sector companies in India's total stock market capitalization has soared to a seven-year high of over 16 percent in May, driven by a strong rally in state-owned companies. This surge is a significant rise from the low of 7.8 percent in October 2020, doubling since then, and stands in contrast to the peak of 29 percent in February 2009.

Neeraj Chadawar, Head of Fundamental and Quantitative Research at Axis Securities, highlighted that with more PSU firms listed, including major players like LIC, there's optimism for further growth with stable political and policy continuity. He noted, "Healthy fundamentals and reduced government intervention have boosted confidence in PSU stocks, leading to positive sentiment and rerating."

This year, listed PSU firms have collectively added almost Rs 18 lakh crore, reaching a total market capitalization of Rs 67.4 lakh crore. The recent addition of newly listed PSUs has also contributed to this increase. In contrast, the BSE PSU Index has seen a significant gain of 35 percent, while the benchmark Sensex and Nifty have only risen by 3 percent.

Analysts believe that the rally has been fuelled by strong fundamentals. However, concerns about valuation are being overlooked by investors, as the pendulum swings on the side of exuberance.

That’s not without reason. Market expert Ambareesh Baliga pointed out that some stocks and sectors were overlooked for a long time until recently. "Four years ago, PSU stocks, including PSU banks and defense companies, were not getting much attention. But now, many of them have become multibaggers, meaning their value has skyrocketed. Because of this, the weightage of PSU stocks in the market has increased. While the Indian markets overall have done well, PSU stocks have led the rally."

Besides reduced government interference, analysts attribute the rally in PSU stocks to burgeoning order books for these companies over the past four to five years as most belong to the core sector, which is seeing a turn in the cycle. Banks, which constitute a bulk of the PSU pack, have managed to clear their books after a prolonged period of bad loans. They're now clocking good ROEs, with SBI achieving double-digit ROEs, bettering several private sector banks. This transformation has prompted a rerating of PSU stocks and a reduction in the gap between multiples of PSUs and private firms.

Chadawar emphasized the importance of being selective in investing in PSUs with clear earnings visibility and consistent order books. He stated, "It's crucial to have assurance in execution efficiencies, particularly in defense orders, which span multiple years. While there are substantial orders in the defense sector, uncertainties about execution efficiencies remain for the next three to four years."

He suggested that if execution efficiency aligns with market expectations, continued momentum in those stocks can be expected. Additionally, Chadawar mentioned that earnings for PSU stocks in the March quarter met expectations without any negative surprises.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.