Citing the favorable risk-reward ratio available in the large-cap space, Prashant Jain, CIO of 3P Investment Managers decided to slash the 3P India Equity Fund’s exposure to small and mid-caps (SMIDs) from 23 percent to 16 percent.

There was heightened excess seen in the SMIDs universe during the second half of CY23, noted Jain. The consensus opinion believes that small-caps have seen a sustained, long-term outperformance over the years. However, there have been alternating periods of outperformance and underperformance of small-caps relative to the benchmark Nifty 50 index.A

Also Read | Vikas Khemani bullish on FY25, here are his 2 must-haves

Prashant Jain said that avoiding weak businesses lowers the risk of permanent loss of capital and avoiding excessive valuations lowers the risk of poor long-term returns. As a result, Jain decided to reduce exposure to the small and mid-cap stocks.

Nearly 90 percent of the fund comprises companies that enjoy leadership/strong positions in respective businesses and should be able to increase/maintain their market share. The portfolio continues to be well diversified across sectors and key economic variables.

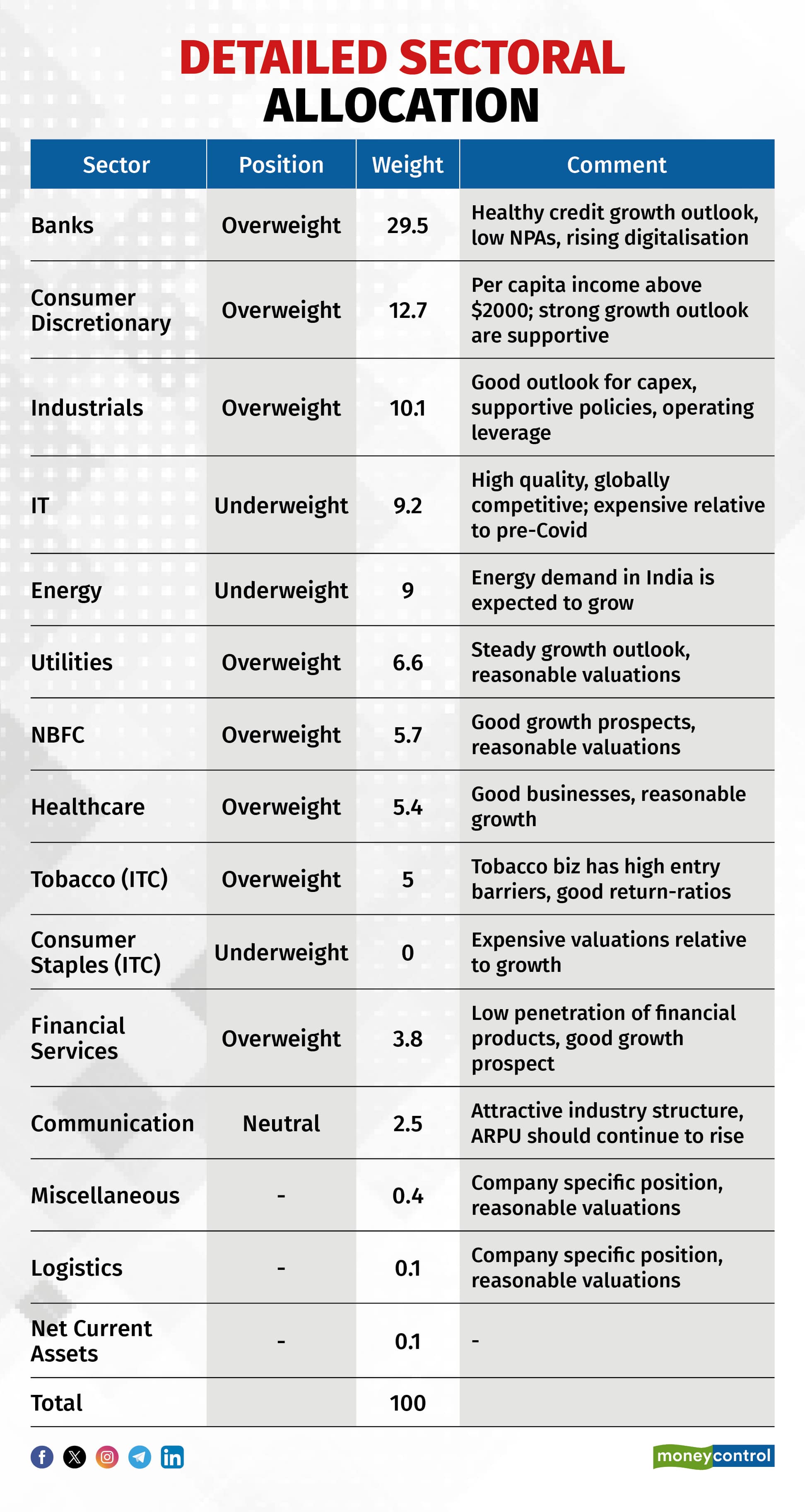

The fund is overweight consumer discretionary, financials, healthcare, industrials & utilities and is underweight consumer staples, IT, materials and oil & gas.

In the portfolio, the top ten companies have more than 50 percent weight in the portfolio. The fund’s top holdings are ICICI Bank, SBI, HDFC Bank and Reliance Industries.

Jain added that the companies part of the fund are following good ESG practices. The companies that are part of the power portfolio are looking to rapidly scale up their renewables portfolio.

Additionally, the fund participates in IPOs on a selective basis. In the last quarter, the 3P India Equity Fund participated in two IPOs. The first was the Medi Assist issue, the firm is the largest and most profitable medical insurance third-party aggregator in India. The second issue that the fund invested in was Popular Vehicles, which is a leader in servicing of Maruti cars by volume.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.