Capex-focused stocks have been out of favor for some time, as brokerages cut exposure after the government’s spending plans remained uncertain post the 2024 general elections. Power, industrial, and infrastructure stocks, which once delivered fourfold returns in five years, became too expensive for new investors. However, after a significant correction, analysts are beginning to take another look at these stocks.

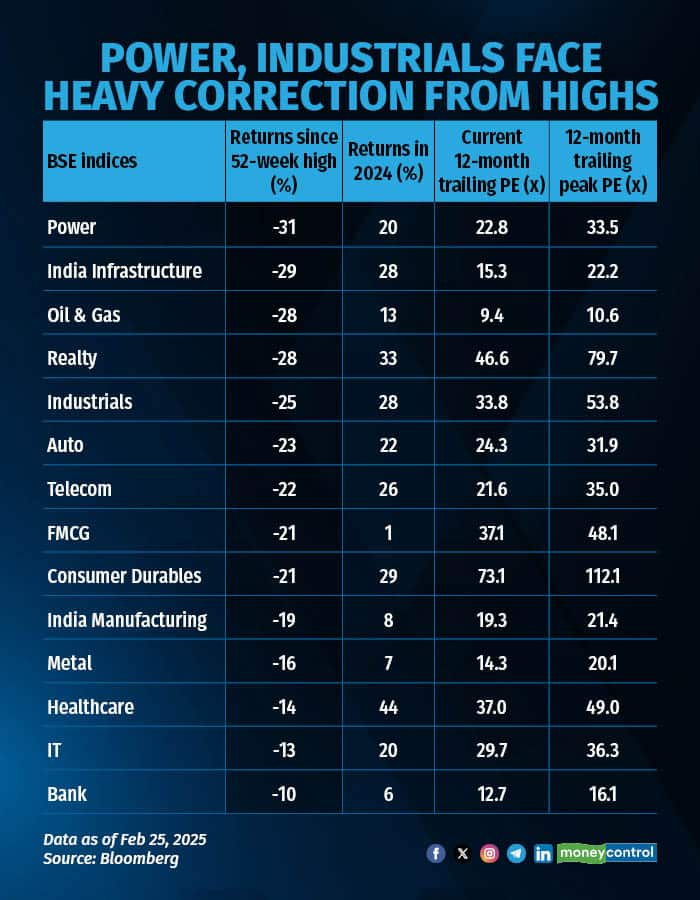

Capex plays have been hit the hardest during the market’s four-month losing streak. According to Bloomberg data, power, industrial, and infra stocks have fallen up to 30 percent from their 52-week highs. A key reason has been the exit of Foreign Institutional Investors (FIIs), who had large stakes in these stocks. Additionally, high valuations and weak quarterly results have also made them less attractive.

Despite this, some believe a turnaround could be on the horizon. The Union Budget for FY25-26 kept capex spending largely unchanged at Rs 11.2 lakh crore. However, with the 2024 general elections and Delhi elections now over, experts expect a revival in large government orders that could kickstart the capex cycle.

Jefferies noted that companies like ABB India, Siemens, Thermax, L&T, and Bharat Heavy Electricals Limited (BHEL) are currently trading at a discount to their FY27 price-to-earnings multiples. Similarly, Rahul Chadha, founder and CIO of Shikhara Investment, told CNBC-TV18 that he sees opportunities in industrial stocks, particularly around March or April, when lower valuations could offer attractive entry points.

While central government capex may not increase much, Chadha expects state governments and Public Sector Undertakings (PSUs) to pick up the slack, along with private sector investment as capacity utilisation improves. “Indian industrial firms are also gaining ground in global supply chains, which strengthens their long-term prospects,” he said.

While central government capex may not increase much, Chadha expects state governments and Public Sector Undertakings (PSUs) to pick up the slack, along with private sector investment as capacity utilisation improves. “Indian industrial firms are also gaining ground in global supply chains, which strengthens their long-term prospects,” he said.

Power stocks, which have been weighed down by project delays and weak demand, are also catching the attention of brokerages. Analysts at InCred Equities expect power demand to rise in the coming months. In the first two weeks of February 2025, weekly energy demand and peak demand rose ~7 percent and ~6 percent, respectively, signaling a potential recovery.

Additionally, new renewable energy targets could support long-term growth for power stocks. “NTPC remains active in the thermal space with 26GW of projects in the pipeline. Capex growth for Power Grid could also boost earnings,” InCred analysts noted.

With valuations resetting and sector-specific tailwinds emerging, capex plays seem well-positioned for a rebound. But whether they regain favor as a long-term investment theme—or just stage a short-lived bounce remains uncertain.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.