Indian market witnessed a euphoric rally in July despite rising COVID-19 cases faltering growth statistics in India as well as across the globe. Bulls pushed benchmark indices higher by over 7 percent each, and about 40 portfolio Management Schemes (PMS schemes) delivered more than 8 percent return in the same period.

As many as 40 schemes tracked by PMSBazaar.com, an online portal for comparing portfolio management services (PMSes) outperformed Nifty, while 178 schemes gave positive returns in July.

PMSes cater to wealthy investors with portfolio sizes exceeding Rs 50 lakh. The professional fee structure is also different from a regular mutual fund (MFs).

The top PMS schemes which have outperformed Nifty50 in July are Wize Market Analytics, MoneyLife, Equirus Securities, Nine Rivers Capital, Right Horizons, Kotak, and AccurCap.

Wize Market Analytics delivered a return of 22 percent in July, outperforming other PMS schemes. The majority of the schemes that outperformed benchmark indices in July were from the mid & smallcap space.

Speaking to Moneycontrol, Anoop Vijaykumar, Fund Manager & Head of Research, Capitalmind who manages Wize Market Analytics’ Momentum Portfolio said that Capitalmind Momentum is a systematic rule-based long-only investment strategy that buys between 15 to 20 stocks showing the strongest positive price momentum relative to the market.

“The portfolio continues holding such stocks until their momentum fades, at which point it replaces those with others. Coming into July, our portfolio had been holding a fair bit of mid-cap pharma and agrochemicals which had already done reasonable well, but then had an exceptional month,” he said.

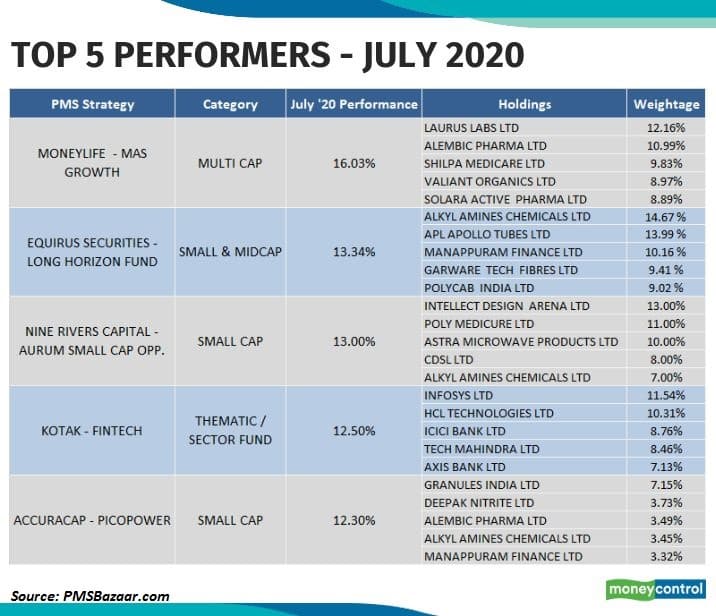

Other schemes that outperformed Nifty50 in July and have disclosed their top holding include names like Monelife Multi Cap fund that delivered 16 percent, followed by Equirus Securities Small & Midcap fund (13.3 percent), Nine Rivers Capital SmallCap Fund (13 percent), Kotak Fintech Thematic fund (12.5 percent), and Accuracap Smallcap fund (12.3 percent), data from PMSBazaar.com showed.

The recent correction in the mid and smallcap space is providing investors with an opportunity to build their portfolio for the long-term.

“Investors rebalancing their portfolio as per their risk appetite can be one of the reasons for the outperformance of mid and smallcaps,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited told Moneycontrol.

Moneylife MAS Growth Multicap fund is a long term high capital growth fund with tactical allocation to sectors and stocks that exhibit strong cash flow and price trends. The top five stocks in the portfolio are Laurus Labs, Alembic Pharma, Shilpa Medicare, Valiant Organics, and Solara Active Pharma.

Equirus Securities Small & Midcap fund’s top holding includes names like Alkyl Amines, APL Apollo, Manappuram Finance, Garware Tech, and Polycab India.

Nine Rivers Capital Smallcap fund’s top holding include Intellect Design, Poly Medicure, Astra Microwave, CDSL, and Alkyl Amines Chemicals.

Kotak Fintech Thematic Fund bets on Infosys, HCL Technologies, ICICI Bank, Tech Mahindra, and Axis Bank.

Accuracap Smallcap fund bets on names like Granules India, Deepak Nitrate, Alembic Pharma, Alkyl Amines, and Manappuram Finance.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.