July 09, 2020 / 09:59 IST

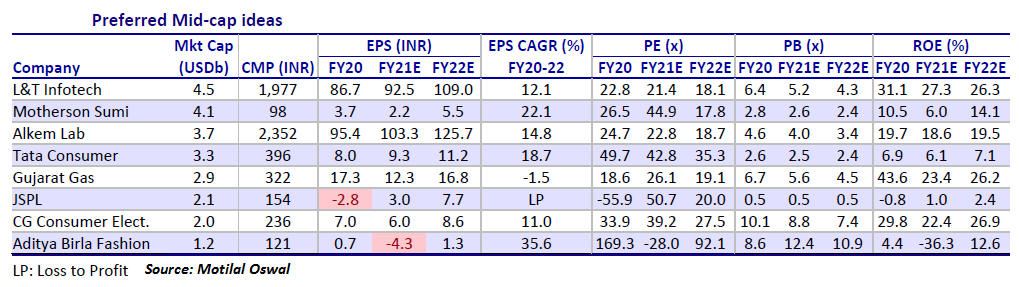

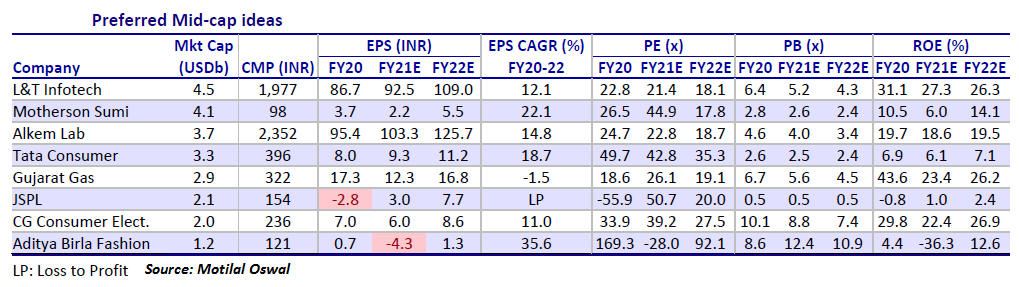

The broader market, which has been in a perpetual bear hug, is seeing signs of revival but most experts who Moneycontrol spoke to advise retail investors to remain cautious, especially in the remaining six months of 2020. The S&P BSE Sensex and the Nifty50 have fallen more than 11 percent each while the S&P BSE Midcap index was down 10 percent and the S&P BSE Smallcap index fell 6.8 percent during the same period, outperforming the benchmark indices. Experts say that the recovery in the small and midcaps is a welcome sign but it is unlikely to sustain over a longer period of time and retail investors should remain cautious. We are seeing a catch up in the broader market space as Nifty50 scales past the 10,000-mark. Without a proper earnings recovery, any rally in the broader market space is a hope rally and one should not get carried away. The discount between the midcap and the Nifty50 has also disappeared, which makes the risk-to-reward unfavourable for investors, experts say. “Both mid and small-caps had missed participating in the last two years when the Nifty50 recovered sharply. In the very near future, as the Nifty50 could attempt to go closer to the 11,000-mark, we can expect sharp up moves in select mid & smallcap stocks,” Rusmik Oza, executive vice president, Head of Fundamental Research at Kotak Securities told Moneycontrol. “However, one needs to be very careful while buying mid & smallcaps stocks and they should know what they are buying. One should clearly stay away from penny stocks.” Oza added since Nifty50 was trading close to ~22x on one-year forward basis, valuations were stretched and he didn’t expect the index to go or sustain above the 11,000-mark. There is hardly any valuation gap between the Nifty50 and Nifty Midcap 100 Index, he said, suggesting caution. Small and midcaps have outperformed benchmark indices by a small margin but many of these stocks have seen a double-digit move in the last six months. Experts say that broader market stocks have rallied ahead of fundamentals and a sharp or a one-way rally is unlikely. “The steep value distortion in many of the small and midcaps during COVID-19 paved the way for outperformance as there was a sizable valuation gap between midcaps and largecaps in the first six months of 2020,” Aasif Hirani – Director, Tradebulls Securities, said. “The partial opening of the economy has given confidence to investors resulting in small and midcaps catching up with largecaps. We may see outperformance but at tepid pace, as we have already seen the bulk of the rally in small and mid-caps,” he added. Action is likely to remain stock-specific in the broader market space. We have collated a list of 15 stocks from various brokerage houses for the next 6-12 months:

Disclaimer

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.