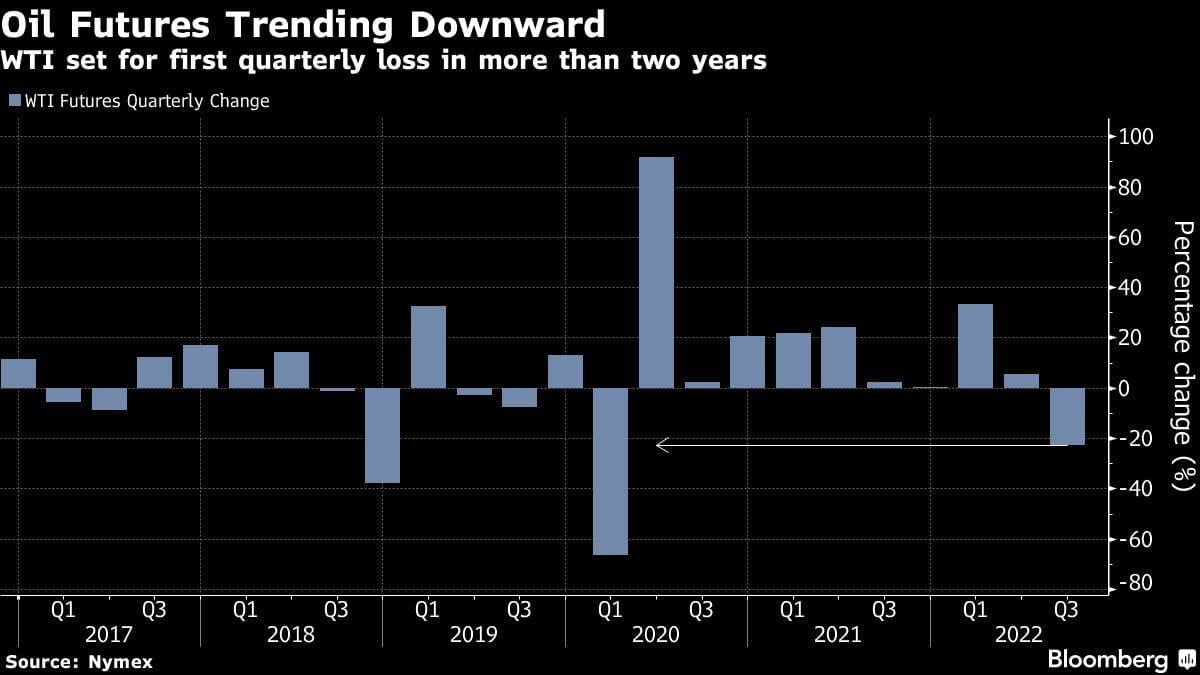

Oil headed for its first quarterly loss in more than two years as escalating fears over a global economic slowdown and a stronger dollar overshadowed the prospect for tightening supply.

West Texas Intermediate futures traded near $81 a barrel and are down 23% this quarter. Federal Reserve officials reiterated Thursday that they will keep hiking interest rates to restrain high inflation, raising concerns about demand. The dollar hit a record this month, adding to bearish headwinds.

The economic recovery in China continues to be challenged by lockdowns in major cities as well as an ongoing property market downturn. Factory activity struggled in September, while services slowed, data released Friday show.

“Oil’s poor quarter is clearly a reflection of an oil market that is losing its tightness as global recession risks surge,” said Ed Moya, senior market analyst at Oanda Corp. “Energy traders clearly expect drastic action by OPEC+.”

The Organization of Petroleum Exporting Countries and its allies have started talks about lowering oil output at their meeting next week, although the size of any supply reduction is still under consideration, according to delegates. All but one of 19 traders and analysts in a Bloomberg survey predicted a cutback.

Oil is poised to eke out its first weekly gain since the end of August, despite the overall bearish sentiment, as escalating tension with Russia and a surprise drop in US crude stockpiles signaled potential tightening of supply.

Widely watched time spreads in US oil futures have been ticking higher. The WTI prompt spread -- the gap between the two nearest contracts -- was 82 cents a barrel in backwardation, compared with 49 cents a week earlier.

Elsewhere, Hurricane Ian threatened to carve a new path of destruction through the Western coast of the US, as quickening wind speeds in the storm means it’s now classified as a Category 1 hurricane again. The potential damage in South Carolina will be severe but likely won’t rival the devastation across Florida.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.