Brent oil will likely hit $150 a barrel this year as the supply shock from the war in Europe coincides with resilient demand from people keen to travel after the virus, according to veteran commodities trader Doug King.

The world has few options to pump more crude, and there’s little sign that consumption is under threat, said King, who runs the $425 million Merchant Commodity Fund, which returned 28% in the first two months of this year.

“Jet fuel demand is going to come back, travel is going to come back,” he said in an interview on Friday. “I think people have money. They’re going to go spend it, so I don’t see the demand destruction at these prices.”

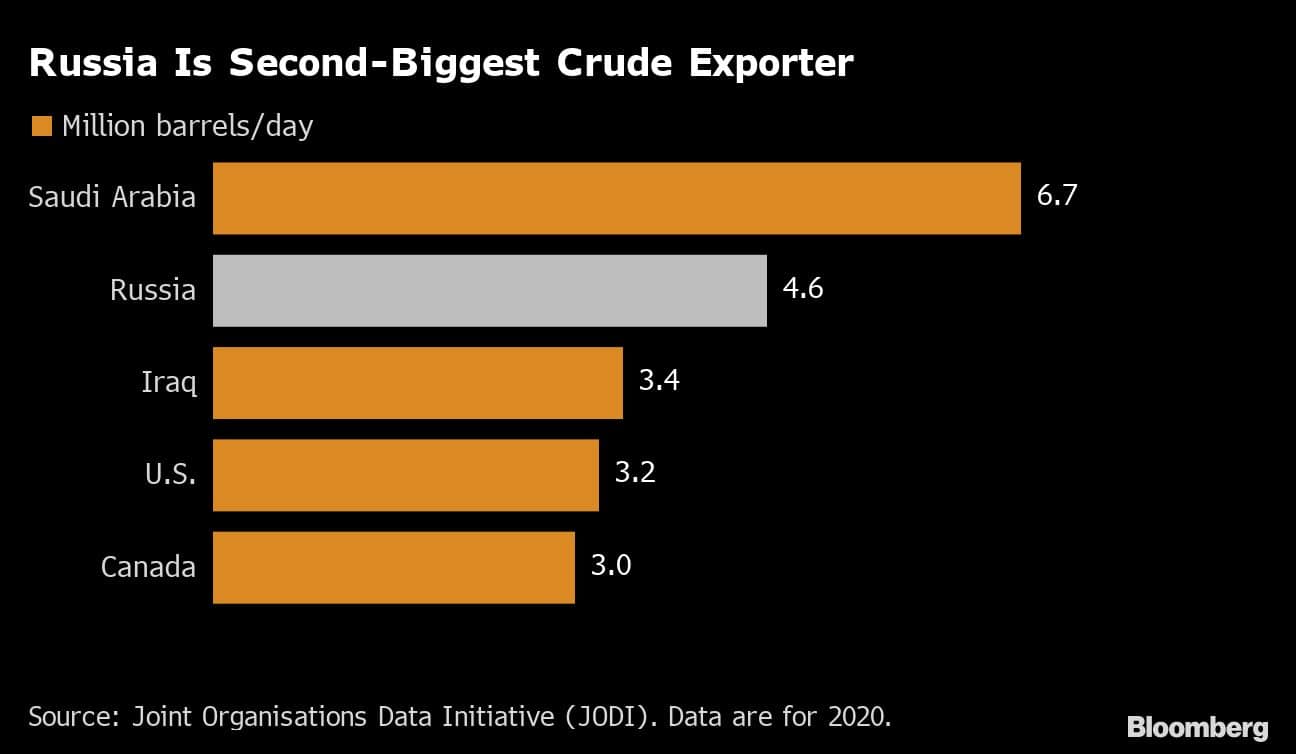

Oil was already elevated before Russia invaded Ukraine as supply struggled to keep up with the demand rebound from the pandemic. The ensuing financial penalties on the country, one of the biggest crude producers, and self-sanctioning by much of the industry saw Brent -- the global benchmark -- flirt with $140 a barrel in early March, although it’s now eased back to near $115.

Supply losses due to the war in Europe are likely to dwarf any demand destruction, as people want to start traveling more as soon as they get the opportunity, according to King. The floor for Brent is now about $100, he said.

The Merchant fund returned 74% in 2021, placing King among a group of hedge fund managers, including Pierre Andurand, who made large profits from the boom in raw materials last year.

The Bloomberg Commodity Spot Index is already up 26% this year, with King seeing a lot more opportunity in raw materials, which he says are skewed hard to the upside as supply chains in general are still “absolutely stressed.”

The huge ramifications from last year’s global gas crunch on other fuel sources and industries such as fertilizer and manufacturing are only likely to filter down over the next six to 12 months, with the war making the situation “far more explosive,” he said. Exploration for new oil resources is also constrained.

“It isn’t like in 2007-08, where you saw explorers everywhere, you saw the multinationals going for fields and developing this and developing that,” he said, adding that ESG mandates had changed things. “Commodity markets that don’t react to price signals mean it’s pretty precarious.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.