The Indian market which was hitting record highs just last week saw fierce selling pressure in the last five trading sessions which pushed the Nifty lower by 300 points while the S&P BSE Sensex lost nearly 1,000 points in the same period.

A mix of local as well as global cues led to a steep selloff in equities in just five trading sessions. A week back we were talking about 40,000 on the Sensex and 12,000 on the Nifty, but the recent selloff has put bulls on the back seat as markets are in a bear grip right now.

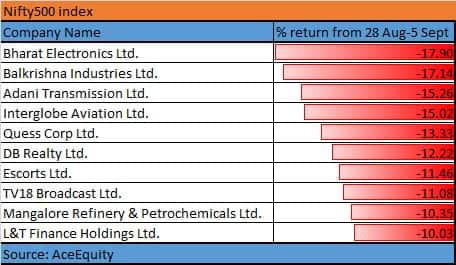

The Nifty might have slipped over 2 percent in five sessions but there are 10 stocks which slipped in double digits include names like Bharat Electronics which slipped 18 percent, followed by Balkrishna Industries, Adani Transmission, InterGlobe Aviation, DB Realty, Escorts etc. among others in the Nifty500 index.

In the mid-cap space, TV Broadcast slipped 11 percent while Mangalore Refinery saw a cut of 10 percent in five trading sessions.

Fall in rupee which came within a kissing distance of Rs 72/$ on Wednesday, rising crude oil prices, lingering worries over trade war between two biggest economies i.e. US and China, as well as concerns over US Fed rate hike which could lead to even string dollar.

Most experts feel that at current valuations there is a higher probability that equity markets will consolidate and the only way investors can make money now is by moving into specific stocks.

"Despite GDP showing good strength, the perils like rupee trading at record low against the dollar and high crude prices can have a huge bearing on the Fiscal Deficit which can eventually dent market sentiments," Akash Jain, Vice President - Equity Research, Ajcon Global told Moneycontrol.

"We believe markets may come under pressure due to sliding rupee and burgeoning fiscal deficit. We recommend a cautious approach. Going ahead, we believe, the progress of ongoing monsoons, rupee movement against the dollar, volatility in oil prices, trade war tensions, US Fed meeting on rate hike will keep domestic bourses volatile," he added.

Jain believes that with GDP going beyond 8 percent, the pressure on rupee should come down. We do not see rupee going down below Rs 73 soon. In terms of markets, investors can now have a stock specific approach.

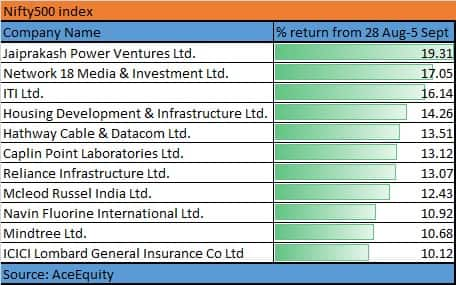

More than 50 percent of the stocks in the Nifty500 index gave negative returns while the rest gave positive returns of up to 20 percent in the same period.

As many as 11 stocks managed to buck the trend and gave double-digit returns in the Nifty500 index including Jaiprakash Power Ventures which rose 19 percent, followed by Network 18 which gained 17 percent, and ITI rallied 16 percent in the same period.

Other stocks which gave double-digit returns include names like Hathway Cable, Caplin Point, Mcleod Russel, MindTree, ICICI Lombard, Navin Fluorine, and Reliance Infrastructure etc. among others.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.