Considering overall chart structure and the derivatives data, we believe that the ‘Santa Rally’ has been over and now we may see a corrective move in index towards 10,500-mark in coming days, Jay Purohit, Technical & Derivatives Analyst, Centrum Broking said in an interview with Moneycontrol’s Kshitij Anand.

Q) It looks like the market is witnessing resistance around 10,950-11,000 levels? A strong fall on Friday suggests that traders booked profits. But, can we call this as Santa rally from the lows?A) Despite the continuous fall in global bourses, Nifty50 index showed tremendous strength in the last few days. But, the decoupling with global markets did not sustain for long and we saw a sell-off on Friday.

The 11000 call writers of Nifty defended their territory well and as a result, we witnessed a sharp selling pressure from its resistance zone of 10950 – 11000 last week.

On Friday, the Nifty has given a breakdown from the ‘Rising Channel’ on the intraday chart and nosedived on the chin to form a big red body candle on the daily chart.

The index failed to sustain above its previous swing high on the daily time scale and trimmed off all the intra-week gains in just a few hours on Friday.

The ‘RSI’ oscillator has turned southwards from its resistance of 60-62 level and is showing negative divergence on the daily chart, which is a negative sign for the index.

The fall of Friday’s session was supported by the good amount of short build-up in Nifty, suggesting further weakness in the index.

On the index options front, 10800 – 11000 put writers were running for the shelter on Friday; followed by huge writing in 10800 – 11000 call options, which doesn’t bode well for the bulls.

Considering overall chart structure and the derivatives data, we believe that the ‘Santa Rally’ has been over and now we may see a corrective move in index towards 10500 marks in coming days.

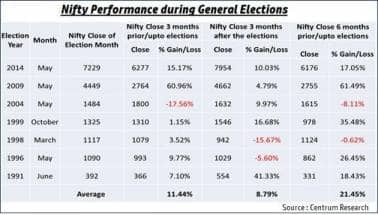

Q) What is your call on high-beta stocks? Do you think they will do well in the run-up to general elections 2019?A) Historically, we have seen a decent rally in the market prior to general elections in most of the occurrences (see exhibit). History may repeat itself and we may see a good rally in the coming few months.

But, this time, it won’t be a cake-walk for the bulls as most of the global indices are witnessing serious carnage from the last few days. The Dow Jones has broken down from its 11-month consolidation and is expected to witness further sell-off in the near term.

In our domestic market too, Friday’s fall seems to be a game changer for the coming few weeks. Though we may see a rally in equities before elections, bears may dominate the market in the coming few weeks.

In that scenario, high beta stocks shall also witness selling pressure in the short term. Thus, one should wait for the market to form the new base before building a portfolio for the general elections.

A) Last week, we witnessed a range breakout in both Nifty Midcap 100 and Nifty Smallcap 100 indices. But, both the indices have started correcting from the ‘Potential Reversal Zone’ of the Bearish Harmonic Pattern called ‘Bearish AB=CD’ on daily time scale.

However, till the time Nifty Midcap 100 and Nifty Smallcap 100 indices sustains above their breakout level of 17630 and 6340 respectively; we may see some outperformance in the mid and small cap counters in coming days.

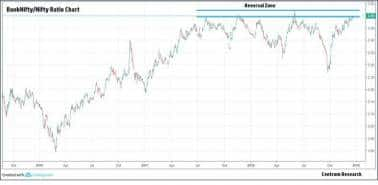

Q) What are charts of Bank Nifty suggesting?A) The BankNifty outperformed the benchmark indices in the last few weeks and has rallied sharply from there. But, the banking index failed to insulate itself from Friday’s fall and made a ‘Gravestone Doji’ candle on the weekly chart.

Thus, we may see further fall in the BankNifty towards 26000 mark in coming weeks. Also, the ratio chart of BankNifty/Nifty indicates a possibility of underperformance in the BankNifty in coming days.

In the last four occurrences, we witnessed underperformance in the banking index against the Nifty once the mentioned ratio reaches to 2.49 – 2.52 level (see exhibit). At the current juncture, this ratio is around 2.50 level, which is providing us with a pair trade opportunity for the short term.

On Friday, we recommended our clients to initiate a pair trade of – Buy Nifty (2 Lots) and Sell BankNifty (3 Lots) as we are expecting the ratio to come down to its mean (2.38 - 2.40).

A) Here is a list of top 3 stocks which could give 7-11% return in the next 1 month:

Adani Ports: Sell| LTP: Rs 359.20| Target: Rs 335-330| Stop Loss: Rs 383| Downside 8%

After a decent rally in November, the stock has started moving in a sideways direction. On Friday, the stock price gave a breakout from the consolidation phase of the last three weeks.

But, it failed to sustain above the breakout level and corrected sharply with heavy volumes, which is a negative sign for the stock.

Also, we are observing the formation of a Bearish Harmonic Pattern called ‘Bearish Bat’ on the daily time scale and the ‘Potential Reversal Zone (PRZ)’ is placed at 377.50 – 379.90.

Since the stock has started correcting from PRZ along with the negative divergence of ‘RSI’ oscillator, we may see 335 – 330 level in the coming days. Thus, any bounce towards 370 shall be used as a shorting opportunity with a stop-loss of 383.

Pidilite Industries Ltd: Sell around 1165| LTP: Rs 1140| Stop Loss: Rs 1213| Target: Rs 1060 – 1040| Downside 7%

The stock witnessed a decent rally in the last few weeks and made a new all-time high last week. But, the stock failed to hold at a higher level and gave a failed breakout on the daily chart.

Also, we are witnessing the formation of a ‘Triple Top’ pattern on the weekly time scale which is a reversal chart pattern. The momentum oscillator ‘RSI’ is showing negative divergence on both daily and the weekly time scale, indicating a reversal on the cards.

Looking at this technical evidence, we are expecting a correction in the stock towards 1060 – 1040 level in a coming month. Thus, one can initiate a short position in the counter in the zone of 1165 – 1170 with a stop-loss of 1213.

Tata Global Beverages Ltd: Buy| LTP: Rs 215.60| Stop Loss: Rs 205| Target: Rs 235 – 240| Upside 11%

After a sharp rally from 111.60 – 325.75, the stock has started correcting from the start of the calendar year 2018. In this phase, the stock price has corrected by around 40 percent from its 52 week’s high.

But, taking support around the 61.80% retracement level of the mentioned rally, which also coincides with ’50 EMA’ on the monthly chart. The stock has started rebounding from the last few days and is now showing some strength on the daily chart.

The momentum oscillator such as ‘RSI’ is also showing positive divergence from the oversold territory on both daily and weekly time scale.

Considering the current chart structure, we are expecting a bounce in the stock towards 235 – 240 level. This bullish view will negate if the stock closes below 205 level.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.