In a truncated trading week, the Indian market surged significantly, with benchmark indices recording the biggest weekly gains since February 2021. Foreign institutional investors' (FII) purchases contributed to this rise, alongside positive outcomes from US-India trade negotiations, leading the Nifty to gain 4.48 per cent for the week.

Both large-cap, mid-cap, and small-cap indices also increased by more than 4 percent. All sectoral indices closed in positive territory, with the Nifty Realty and Private Bank indices surging by 7 percent.

In contrast, US indices closed in the red, as illustrated in the chart below. New restrictions on semiconductor exports to China led to a sharp decline in semiconductor stocks, dragging the market lower. Additionally, Federal Reserve Chair Jerome Powell stated that tariff increases have been significantly larger than anticipated, which could result in higher inflation and slower economic growth, prompting a fresh wave of selling.

Most other markets closed in positive territory on news of new rounds of negotiation with the US. The worst seems to be behind us regarding tariffs, unless Trump decides otherwise.

During the week, gold prices reached a new high in international markets, while oil prices ended three consecutive weeks of losses due to new US sanctions on Iran.

Nifty began the week with a significant gap-up and continued to build on its gains. The market believes that the impact of the Trump tariff trade has already been factored in. Moving forward, any developments will likely be viewed as resolutions or positive news for the market. The strong liquidity from domestic investors is fuelling buying activity, and foreign institutional investors (FIIs) have also started to participate. The weekly momentum indicators remain positive according to the RMI indicator. We are now in a "buy on dips" market.

The 40-day Advance/Decline (A/D) ratio has continued to rise from its most oversold condition since 2022 when Nifty hit 15200. This trend is encouraging for the market, indicating that the upward trajectory remains intact despite potential short-term volatility.

Source: web.strike.money

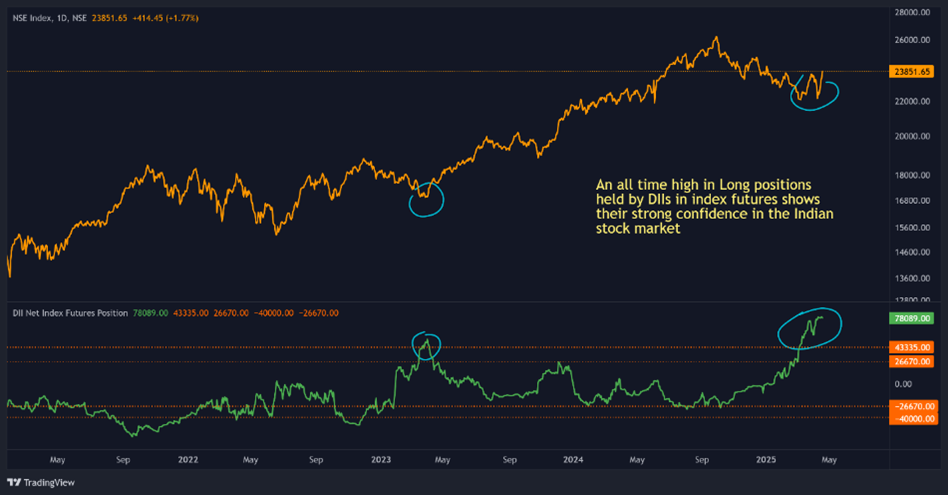

Domestic Institutional Investors (DIIs) have spent the entire period from March to April increasing their long positions in index futures. As of Wednesday, this week, their long positions reached an all-time high. Despite short-term volatility, this ongoing confidence reflects the strong belief shown by Indian institutions. This time, DIIs have your back.

Source: web.strike.money

In the very short term the swing went up to 95 but that did not prevent the market from advancing. This is a sign of a very strong trend in progress. There is no point in calling it overbought. The RSI on daily chart is at 67 and below the overbought zone as well. I have also added the Open Interest PCR on the chart below and that too is not overbought. So the uptrend may just continue barring some one/two day reactions due to news till a combined overbought condition is reached.

Source: web.strike.money

Sector RotationNifty 50 opened with a gap-up in a truncated week and closed at 23851.65, 4.48% above its previous week’s close.

Indices positioning on Weekly Timeframe

Weakening Quadrant: None of the sectoral indices are in this quadrant.

Lagging Quadrant: Nifty IT and Nifty Auto continued to perform poorly. Nifty Media, Realty, Consumer Durables, FMCG, and India Consumption gained some momentum. Nifty Pharma remained a silent underperformer.

Improving Quadrant: Nifty Energy, Nifty Oil & Gas, and Nifty Infrastructure continued to show increased momentum.

Leading Quadrant: Nifty Metal entered this quadrant from Improving last week, but its momentum has reduced. Nifty Bank, Pvt Bank and Nifty Financial Services continued to show strength and momentum.

Indices position on the daily timeframe

Weakening Quadrant: Nifty Infrastructure, Nifty Oil & Gas, and Nifty Energy are losing strength compared to the Benchmark and are headed towards the Lagging quadrant.

Lagging Quadrant: Nifty Pharma and Nifty Realty showed some relative momentum, but Nifty Metal and Nifty IT kept on deteriorating in terms of momentum and relative strength.

Improving Quadrant: None of the Indices in this quadrant.

Leading Quadrant: Nifty Media, Nifty India Consumption, Nifty FMCG, and Nifty PSU Bank are showing signs of fading momentum. Nifty Pvt Bank, Nifty Fin Services, and Nifty Bank continued to show their dominance, and Nifty Consumer Durables joined them by entering from the Improving quadrant.

Stocks to watchAmong the stocks expected to perform better during the week are ICICI Bank, UPL, Indigo, SRF, Marico, Chola Finance, Bajaj Finance, Laurus Labs, Bajaj Finserv and BSE.

Among the stocks that can witness further weakness are Tata Elsi, TI India and Zydus Life.

Cheers, Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!