Dear Readers,

It is a tough time to be a contrarian in the market, especially if you are a technical analyst. Almost all indicators show the market is overbought, while none of the popular indicators have given a sell signal despite the strong move. That is the nature of the market when it is in the grip of a strong bull or bear market. Indicators can remain overbought or oversold for days if not weeks.

For the first time in three years, Indian markets have seen seven consecutive week of positive closing.

The week started on a cautious note as various data points were indicating a consolidation. FIIs had covered their short trades and were net long in the market, and options data indicated that call and put option writers were head-to-head in terms of their positioning. However, the Fed changed the market sentiment on Wednesday night (Indian time) by announcing they may lower interest rates thrice in 2024.

The last two days of the week saw a sharp rally in reaction to the unexpected development.

A Tenacious Market

Most market indices are trading near their all-time highs, highlighting the strength and width of the current rally.

Normally, market reaction to new developments is short-lived. The market has taken two days to digest the Fed's announcement. The rally's strength will be determined in the coming week, especially since there will be a headwind as traders will unwind positions ahead of the final week before stock options attract delivery margins.

Combined with RSI readings of 85-90 in many indices, especially the Nifty Midcap 100, it is a setup for a near-term correction. A larger pullback, however, can be delayed into the seasonal period of January. With that in mind we have room for Nifty to stretch toward 21800 in the coming weeks.

Despite the rally FII's have added a small amount to their long positions. As seen in the chart below the first red line of overbought position is not touched, indicating we are not yet in extreme territory. In a bull run, the long positions touch the second red line, well above 90,000 contracts. We are presently at 50211, which gives us the comfort of more headroom. Any dip may still be a buying opportunity.

Source: web.strike.money

Source: web.strike.money

Foreign institutional investors (FIIs) bought equities worth Rs 18,858.34 crore in the cash market during the week. For December, FIIs have made cumulative purchases of Rs 29,733.06 crore in the cash market.

DIIs or domestic institutions are often bearish ahead of a meaningful top in the market, but this time round, they added longs in October-November and remain long in index futures. They are not taking a contrary stance on the market, indicating their confidence in this rally.

Source: web.strike.money

Source: web.strike.money

The swing indicator fell to 27, from where the market rebounded. The market can bottom at similar swing readings in the same cycle. The swing makes a double bottom near 28, and the market takes off from there. Now, we will watch for where the swing stops. On the upside, in a rising market, we often witness negative divergences as breadth wanes.

Source: web.strike.money

Source: web.strike.money

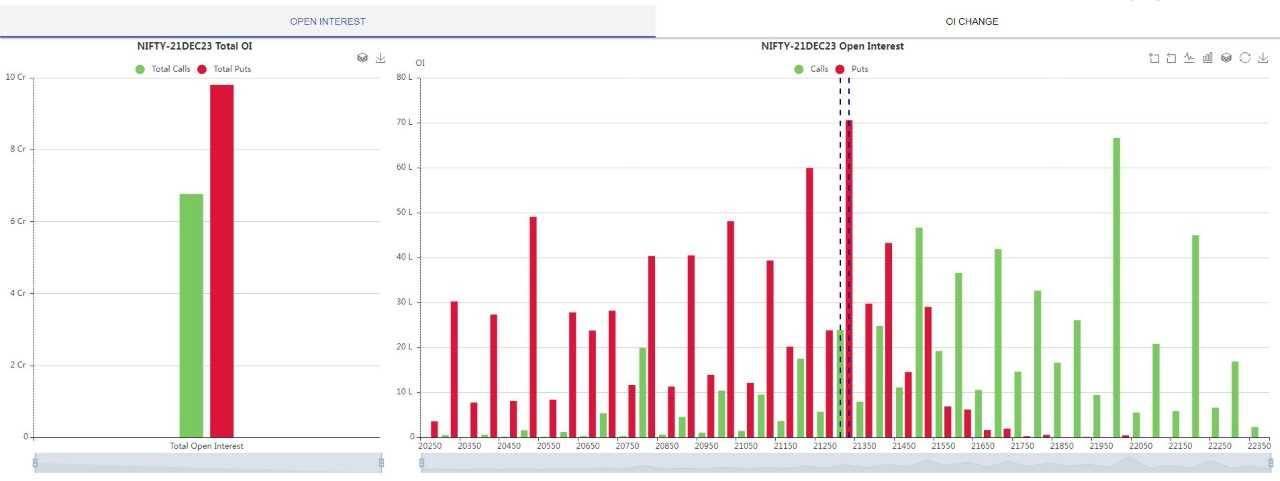

Options Data

Options data shows that the put writers have added to their position, indicating that more bets are for the market to move higher. Based on the open interest position, the nearest resistance level for the market is 21,500. Immediate support stands at 21,200, followed by 21,000.

Source: Icharts.in

Source: Icharts.in

Indices and Market Breadth

Most indices touched new highs during the week. Besides the Fed commentary, Indian markets also received some boost from the Reserve Bank when the central banker revised the country’s growth rate higher. Falling bond yields and crude prices added to the bullish sentiment.

During the week, Sensex gained 2.37 percent while Nifty was up 2.32 percent.

All sectoral indices were in the green during the week, with Nifty IT being the best performing, gaining 7 percent, Nifty PSU Bank and Metal indices were up 5 percent each, and the Nifty Realty index rose nearly 4 percent.

Among the top-performing stocks were GTL Infrastructure, shooting up 31.86 percent, Coffee Day Enterprises, gaining 27.68 percent, while PTC India Financial Services rose by 27.35 percent. The top losers during the week were 63 Moons, down 22.16 percent followed by Axita Cotton at 18.65 percent, and Jain Irrigation losing 9.32 percent.

Global Markets

Global markets, led by the US, continued to rise, with the US indices closing the week at new highs. Like Indian markets, the US also has had seven straight weeks of positive closes, gaining around 2.8 percent higher. Fed commentary, lower oil prices, and the falling inflation rate helped boost market sentiment.

European markets were also taking baby steps, rising for the fifth consecutive week as their central banks maintained interest rates and lowered inflation forecasts. While Dax closed flat, FTSE rose 0.29 percent, and CAC was 0.93 percent higher. The pan-European Euro Stoxx 50 was up 0.58 percent.

Besides the Chinese market, all important Asian markets closed higher. A surprise 0.5 percent fall in inflation, its steepest since November 2020, indicating rising deflationary pressure put pressure on the Shanghai index to slip 0.91 percent during the week.

Nikkei was up 2.05 percent, while Hang Seng gained 2.79 percent. Taiwan gained 1.37 percent, and Kospi gained 1.87 percent.

Stocks to watch

Stocks where we can expect momentum to continue are IT stocks like TCS, Infosys, HCL Tech, LTIM, Tech Mahindra, among others. Besides, banking counters like SBI, ICICI Bank, Bandhan Bank, and RBL Bank can also continue to see buying interest.

Cheers,Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!