Dear Reader,

Winning three of the four state elections, at a time when exit polls gave a clear majority in only one state, should come as a pleasant surprise for the stock market. Even the most optimistic estimate did not provide the BJP, which is ruling at the centre, with the result that has emerged from these elections.

Market and political analysts are extrapolating the win to the 2024 general elections. With these three states constituting 66 seats, commentators expect a strong performance in the general election.

Over the next few months, expectations on the possibility of the BJP government returning to power and continuity in government policies will increase. The Make in India or Atmanirbhar Bharat policies will attract investor interest in domestic companies, most of which are small and mid-cap. Analysts may be taking a longer-term view of some sectors that have been transformed, like the railways, defence, and other PSU companies.

Given the market's strong performance ahead of the election results, some may think the market had some inkling of the results. But this may not be entirely true. As is always the case, traders like to lighten their position ahead of an important event. This is what happened in the truncated week ending December 1, 2023.

A large part of the rally during the week was on account of short covering in derivatives. Short positions by FPIs were reduced from 130,000 contracts to 47,000 contracts during the week.

In the truncated week, the benchmark posted solid gains, with the BSE Sensex rising by 2.29 percent and Nifty50 by 2.39 percent. Besides short covering, a strong economic data print with GDP and manufacturing numbers helped improve market sentiment. Further, a buoyant primary market with the listing of two much-awaited IPOs during the week and a strong global market helped Indian markets close on a strong note.

The market stands on a strong foundation

The Nifty closed higher for a 5th consecutive week. As mentioned earlier, among the reasons behind the rally, the strongest one was the short covering by FIIs. To our surprise, they were not cutting shorts significantly for most of November, so we were wondering if this would end badly. The only time that happened was before the lockdown in 2020.

We are not in the same scenario. News of the Twin Wars no longer makes the headlines. This week, after expiry, we finally saw a big reduction in shorts, clearly indicating that the process of covering is underway, which may not end in a day. Wait for the positions to return to the long side or near some previous peak levels before considering a top again. In other words, the rally is not over.

We expect this rally to continue for more time, and the Nifty may touch 20700 in the coming days. We also do not rule out the market overshooting this target, irrespective of the blip the election result may cause.

Source: web.strike.money

The 40-day advance-decline (A/D) ratio peaked in June, even as the market made a new high in September. However, after that, the market fell below the June levels. The ratio is rising again along with the market. Wait for it to enter the overbought zone near the red lines before considering another top.

Source: web.strike.money

The overbought reading in the Daily Swing indicator has led to a consolidation. In the last two months, it was followed by a sell-off to the downside. The behaviour change gives bulls an upper hand. Do not be quick in calling the next top on this indicator now that it does not result in a meaningful reaction. Multiple divergences can occur and fail to follow through, and one should wait for a confirmation from price action. Bears need to be patient because overbought readings fail in a trending market.

Source: web.strike.money

Options data

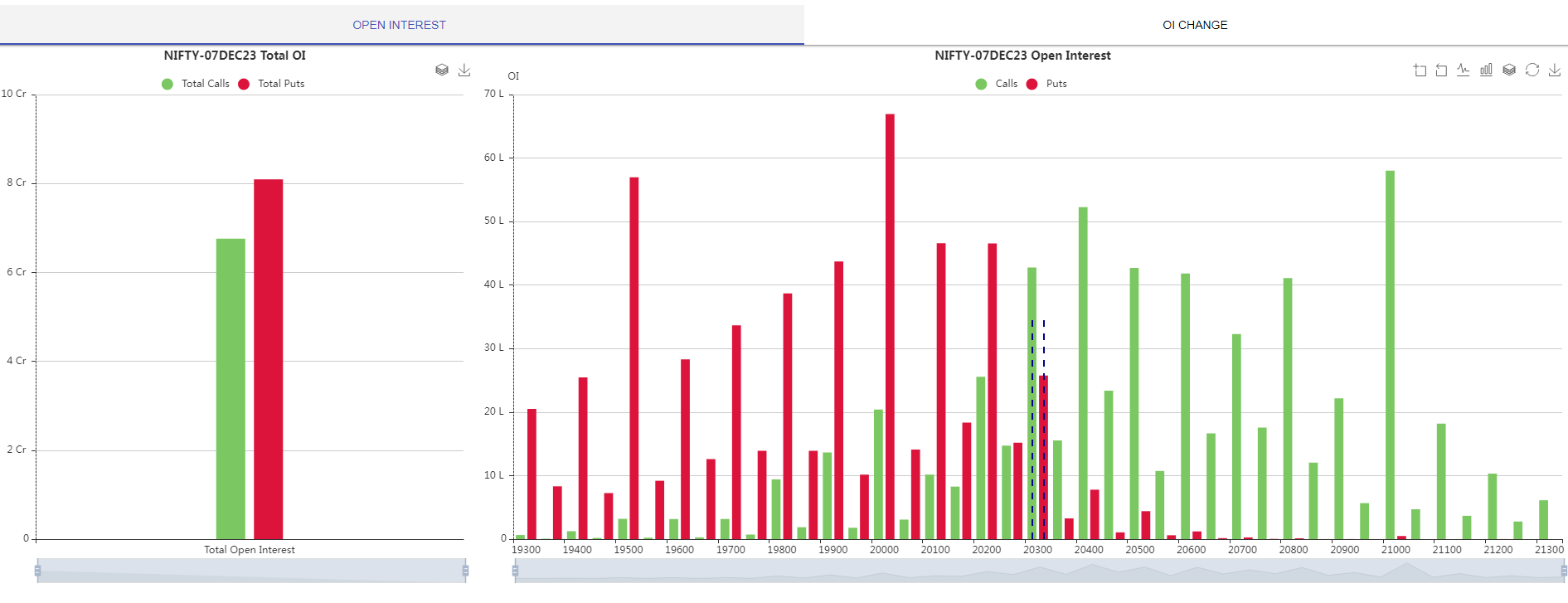

Options data also points to a bullish market. Despite an event (elections) overhang, traders have taken a position on the long side. More put writers are in the market than call writers, as seen from the open interest data below.

Source: icharts.in

Indices and Market Breadth

As has been the nature of markets, the broader one outperformed the benchmark indices. During the week, all sectoral indices ended in the green, with the BSE Oil & Gas and Power indices gaining 5.7 percent each, the BSE Capital Goods index up 3.6 percent, and the BSE Metal index rising by 3 percent.

Another highlight of the week was foreign investors buying in the cash market with purchases of Rs 10,593.19 crore.

Among the week's top gainers were Navkar Corporation, up 32.74 percent; Datamatics Global Services, up 23.27 percent; and Tanfac Industries, which gained 21.56 percent. The losers during the week were Aether Industries, which fell 10.47 percent; TVS Shrichakra, which fell by 8.82 percent; and RattanIndia Power, which dropped by 8.74 percent.

Global Markets

The US market continued to trade higher during the week, with the Dow Jones closing 2.42 percent, S&P 500 gaining 0.77 percent, and Nasdaq closing 0.38 percent higher. The S&P 500 and Nasdaq closed the month with the highest monthly gain of 5.42 percent and 6.13 percent, respectively, since July 2020.

The US markets got a boost from falling treasury yields, inflation, and a dovish statement from the Fed. Fed Chair Jerome Powell's speech in Atlanta helped push the 10-year Treasury yield to its three-month low at 4.2 percent, which also helped equity markets. Powell said that interest rates were now well into the restrictive territory but, at the same time, cautioned that investors against expectations of aggressive interest rate cuts ahead.

European markets also had a good run, with the DAX registering a 2.30 percent gain, CAC rose by 0.73 percent, FTSE by 0.55 percent, and the Pan-European Stoxx 600 posting a 1.03 percent gain. Better than expected retail sales without affecting the inflation rate were drivers for the market.

Asian markets, however, did not participate in the overall global bullish party. Hang Seng dropped by 4.06 percent, Shanghai was down by 0.31 percent and Nikkei fell by 0.58 percent. Hang Seng index touched a new 13-month low, falling for five of the six trading days and four consecutive months since July 2023. The index has lost 15 percent in value in 2023, with foreign investors pulling out a record $18 billion during this period.

Stocks to watch

Among the derivative stocks showing strong momentum are Aarti Industries, Axis Bank, Bajaj Auto, BPCL, HAL, Hero Moto, Indigo, PFC, SBI Life and Trent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!