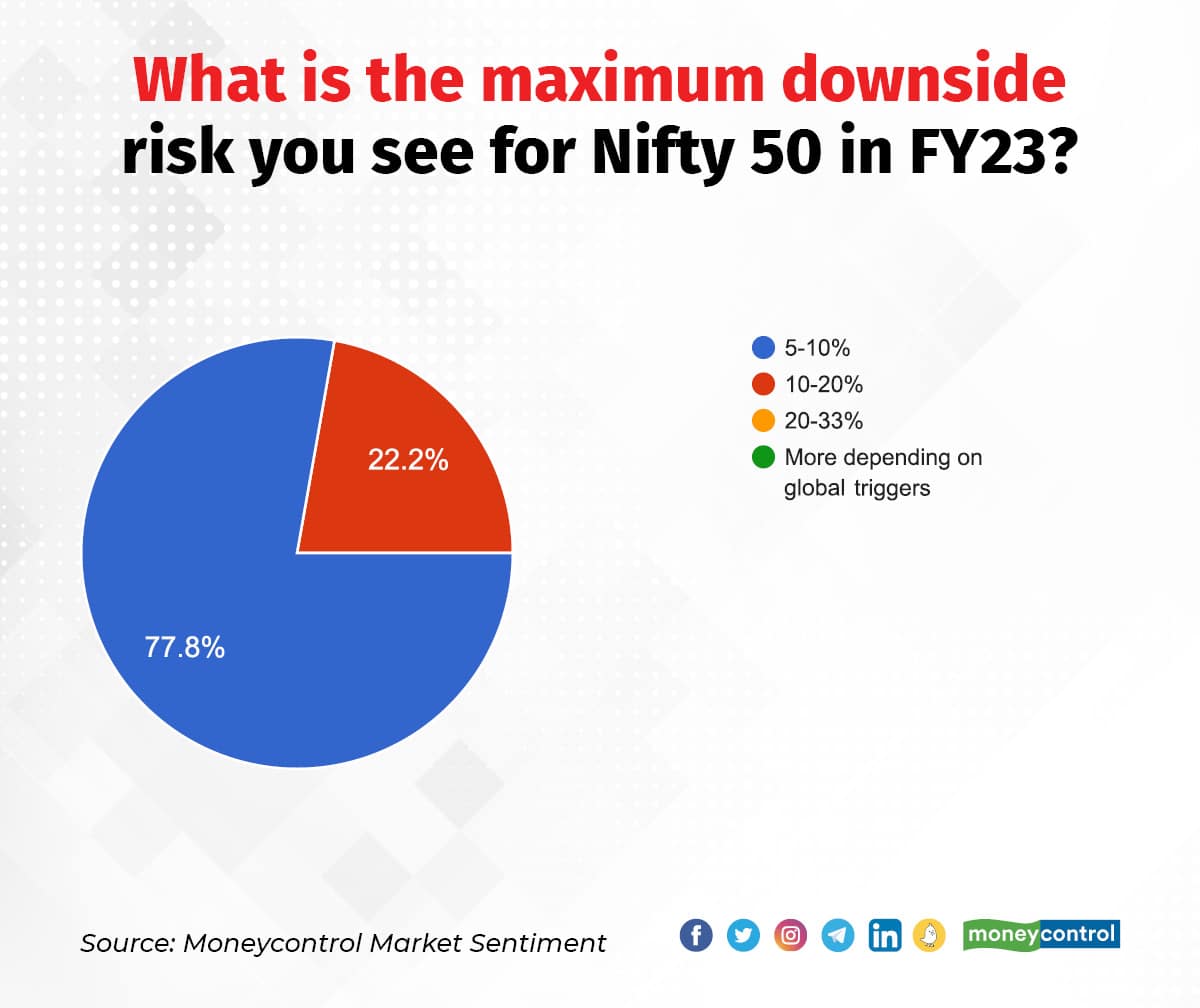

Fund managers do not expect more than a 5-10 percent downside in the benchmark indices in the remainder of the current financial year despite rising concerns of a global recession, the latest edition of Moneycontrol’s Market Sentiment Survey found.

Of the seven fund managers surveyed, six expected only a 5-10 percent correction in the market while one expected an up to 20 percent decline.

Benchmark indices, Nifty 50 and BSE-Sensex, have already fallen close to 5 percent from their recent highs hit earlier this month but remain more than 10 percent lower from their record highs hit in October 2021.

Fund managers also expect the domestic market to consolidate the gains seen since hitting their 52-week lows back in June and suggested that ‘buying the dip’ will likely remain the best strategy going ahead.

Curiously, five out of the seven fund managers were of the belief that Indian markets have already partially factored in the prospects of a recession in the global economy later this year or in 2023 suggesting that downside risk for Indian markets remains lower.

Global markets have tumbled recently on the heightened fears of a global recession caused by the US Federal Reserve’s aggressive interest rate hikes and surging costs for energy. US Fed Chairman Jerome Powell’s recent comments that the central bank’s policy may need to be restrictive to bring down multi-decade high inflation have shattered the market’s illusion of a more calibrated approach from the Fed.

Much of the perceived resilience for the Indian stock market comes from the fund manager’s belief of Indian corporate earnings growing at 10-15 percent in 2022-23 despite inflationary pressure.

Fund managers believe that a recovering domestic consumer economy, normal monsoons and green shoots of a capital expenditure cycle should aid earnings growth going ahead.

The revival in India’s private sector capital expenditure cycle is the most exciting theme for the majority of the fund managers surveyed by Moneycontrol. The recent pick-up in credit growth and the improvement in capacity utilisation above the long-term average has further added to optimism on this front for investors.

However, when talking of a three-to-five-year horizon, the indigenisation of the Indian defence industry is what interested fund managers the most. The current government’s efforts to improve domestic defence production capabilities have enthused investors in defence-related stocks in 2022.

That said, fund managers were largely divided between banks, capital goods and automobile companies with respect to deploying any incremental capital in the market. All three sectors have largely outperformed the benchmark indices in 2022 on the back of optimism for earnings growth in all three.

As regards the currency markets, fund managers are optimistic that the rupee will end the calendar year between 78 and 80 to the US dollar. The domestic currency plummeted to a record low of 81.62 against the greenback on September 26.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.