While the market still seems to be divided over the outlook for the realty sector after the government announced changes in the tax regime for the segment, mutual funds continue to remain positive on real estate stocks. MFs believe that the lower long-term capital gains tax rate -- without indexation benefit -- is a positive for real estate companies.

In the Union Budget 2024, the government reduced the long term capital gains tax on real estate transactions from 20 percent to 12.5 percent while doing away with indexation benefits.

“If you bought property 10 or 15 years ago, and it appreciated at a 10 percent compound annual growth rate (CAGR), you could save significantly with the new 12.5 percent tax rate,” says Motilal Oswal Mutual Fund's Niket Shah.

He further said that the market comprises of two main types of buyers: those who sell and buy new properties that make up about 60 percent of the market, and investors who primarily engage in buying and selling for investment purposes, accounting for the remaining 40 percent.

For the latter, Shah explained that the lower tax rate is a welcome change. “For that 40 percent, this is like a dream come true. Instead of paying 20 percent, they now only pay 12.5 percent, which could increase demand," he says.

He, however, acknowledged the fact that there is confusion among consumers due to the removal of indexation, especially in areas where property prices have not risen significantly.

He clarified that the new tax rules still allow setting off gains against the purchase of a new house, as per the latest Budget regulations. “If you sell a house that cost you Rs 2 crore for Rs 12 crore, you can set off the Rs 10 crore gain against a new house, avoiding any tax,” he explains, while adding that the fundamentals of real estate investing remain strong and he is not expecting to change his views on the sector.

In a similar context, DSP MF's Anil Ghelani says that they are not looking at a significant change in their universe of listed companies or those that they are considering for exposure.

The main reason, according to Ghelani, is that structural changes, including removal of indexation, are not very disruptive. This new tax regime, Ghelani adds, actually simplifies things across all asset classes, aligning them at a 12.5 percent tax rate with a consistent holding period.

“This could potentially increase demand for real estate, as people may now see it as a viable investment alongside other assets like stocks and gold," he says.

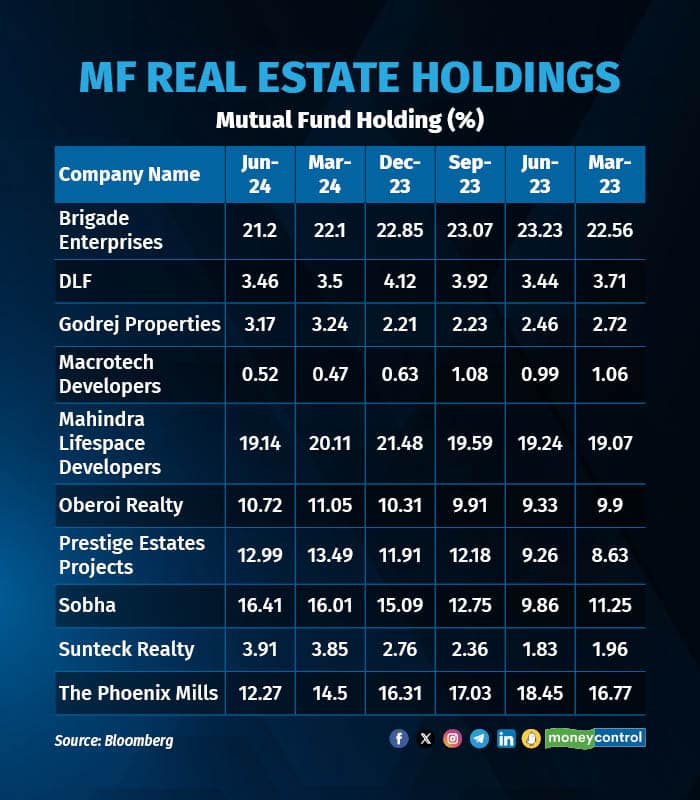

Mutual fund holdings in various real estate companies have varied over time and across companies. The highest holdings are currently in Brigade Enterprises. As of June 2024, mutual funds held around 21.2 percent in the stock, although this is lower than March 2024 and December 2023 at 22.1 percent and 22.85 percent, respectively.

The second largest holding is in Mahindra Lifespace Developers, which experienced a slight decline in holdings to 19.14 percent in June 2024, from 20.11 percent in March 2024 and 21.48 percent in December 2023.

Chetan Shah, Head of Real Estate, Axis AMC, says that while listed real estate companies may face a short-term impact due to reduced investor base, particularly those who invested in pre-launch projects, the long-term outlook for the sector seems unaffected by these changes.

“The initial concern is that the measures appear retrospective rather than prospective, but as the situation normalises, the market should stabilise," he says.

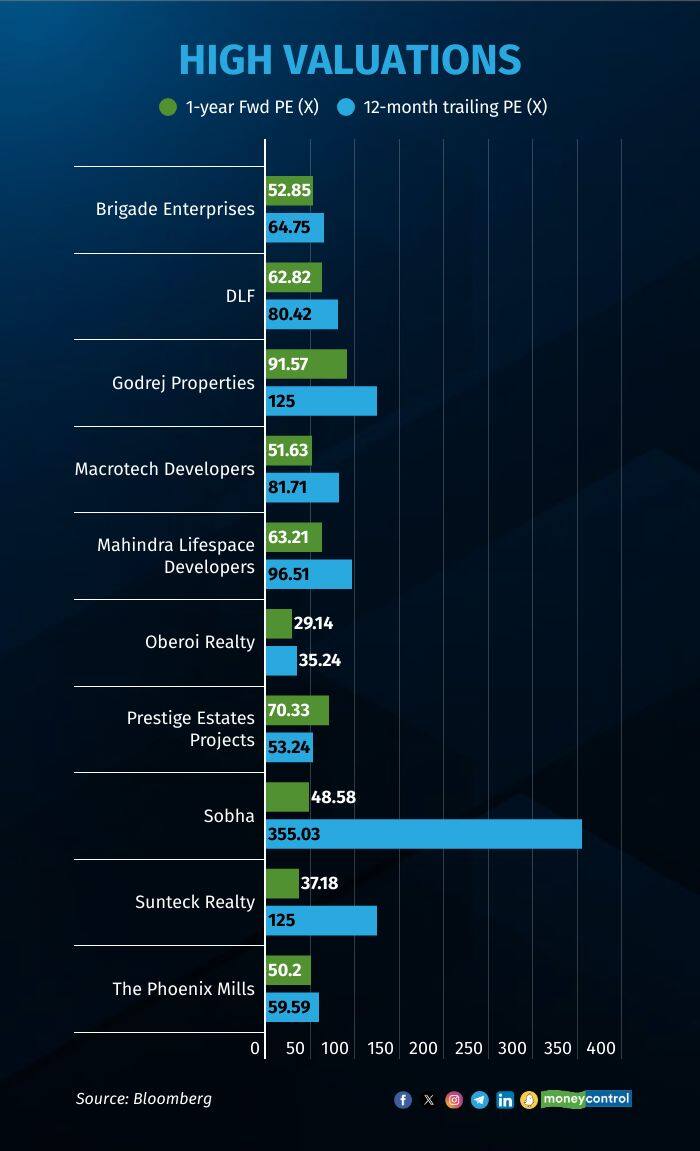

Meanwhile, in terms of valuations, most fund managers agree that valuations within the segment are currently high.

V Srivatsa, Executive Vice President & Fund Manager – Equity, UTI AMC points out that the sector is deeply cyclical, so one needs to question how long this upcycle will last.

He adds that that when it comes to looking at valuations, one must understand that the sector has two kinds of companies - those with a sufficient land bank to meet demand for the next seven to eight years, and those without enough land, looking to acquire more aggressively, either through joint development agreements (JDAs) or outright purchases.

“The former are probably valued more highly due to the recent increase in land values. However, the challenge is that some lands, particularly in regions like the NCR, may not be monetised for years, making it a long-term investment. The second type of companies faces higher risks because they may overpay for land or JDAs due to the sector's current hot state. If these companies buy expensive land now, it could be problematic if the market downturns by the time they are ready to develop and sell, leading to poor returns on capital,” he explains.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.