A majority of markets experts is of the view that the benchmark Nifty 50 index would end the current calendar year (CY25) between 25,000 and 27,000. Taking the upper end of the expectations into consideration, this hints at a 17 percent gain from the current levels.

Meanwhile, the current valuation of the Indian stock market is being viewed as “reasonable” by a majority of market experts.

These are some of the key findings of the latest Moneycontrol Market Poll, which saw participation of nearly 45 respondents across categories including broking firms, mutual funds, AIFs, PMS and independent experts.

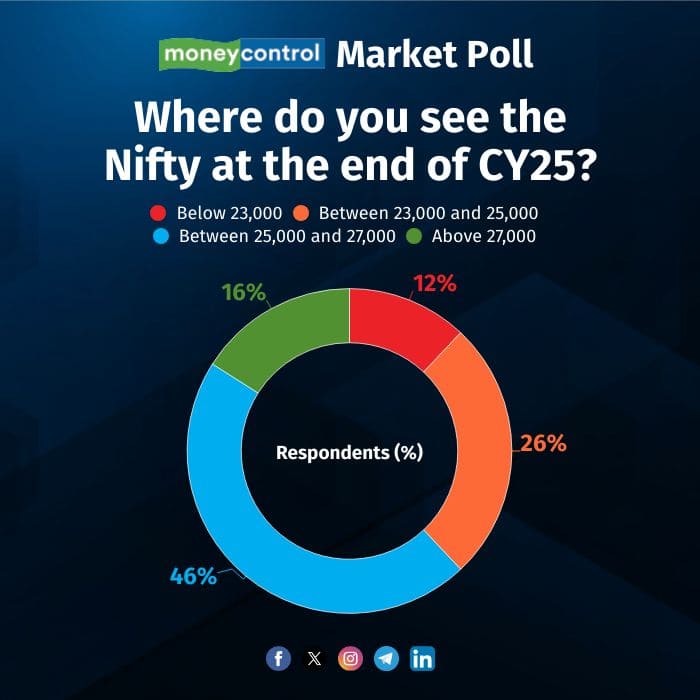

While 46 percent of the respondents said they expect the Nifty 50 to end CY25 between 25,000 and 27,000, another 26 percent of the respondents expect it to end the year between 23,000 to 25,000.

While 16 percent see it closing above 27,000, only 11 percent see the Nifty ending CY25 below 23,000.

India's benchmark indices, Sensex and Nifty, closed 2024 with gains of 8.17 percent and 8.8 percent, respectively, marking the ninth straight year of positive returns. Since January 1, the Nifty has fallen around 3 percent and is currently hovering around 23,000 levels.

In a recent report, analysts at PL Capital revised its 12-month target for the Nifty 50 to 27,172, forecasting a 16% upside from current levels. "We value Nifty at a 2.5 percent discount to the 15-year average (19.0x) PE at 18.5x with Dec 26 EPS of 1467 to arrive at the 12-month target," the brokerage stated.

In a bull case, they noted that the index is expected to reach 29,263 at a P/E of 20.1x (a 25% upside), while the bear case projects a target of 25,082 (a 10% downside).

Fisdom's Nirav Karkera adds that there could be a best case scenario where indices remain above 24,000, with a potential bull case target between 24,700 and 25,000, contingent on a turnaround in the latter half of the year.

"While the first quarter may present challenges, recovery is expected to begin in the third quarter, driven by improving earnings and a reversal of foreign capital flows into India. The market is likely to record at least one all-time high during the calendar year, supported by favourable macroeconomic factors and sectoral performance," he said.

Global brokerage firm CLSA has a more cautious outlook and has predicted muted returns for the benchmark index this year on the back of challenging global macroeconomic environment, near-term economic growth slowdown in India, and elevated absolute and relative valuations.

According to the report, some of the challenges could include uncertainty surrounding trade policies under Trump’s administration, with the severity of restrictions likely influencing the performance of export-focused emerging markets (EMs) such as China.

Additionally, the report noted that moderate restrictions may attract inflows to EMs, potentially causing India to underperform in a broader EM rally, while stricter policies could have the opposite effect.

On a slightly more positive note, global brokerage firm Citi, in their recent report, estimated a year-end target of 26,000 on Nifty, on the back of possible easing in inflation to 4.2% in FY2026, creating room for rate cut by the central bank.

Omniscience Capital’s Vikas Gupta is of the view that while nobody can call the bottom, their analysis shows that there are no fundamental factors, which should drive further major downside.

“However, we are optimistic about a capex heavy, infra oriented budget targeted towards development rather than targeted to providing freebies for individuals. This will drive revenue and earnings growth for next few years. With RBI likely to cut rates, Nifty should likely be up around 15~20% for the year,” said Gupta.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.