The Indian stock markets may well be seeing heightened volatility amidst geo-political risks and valuation concerns but most market experts prefer keeping less than 15 percent cash in their portfolio and are not currently looking at increasing the cash levels, revealed a latest market poll by Moneycontrol.

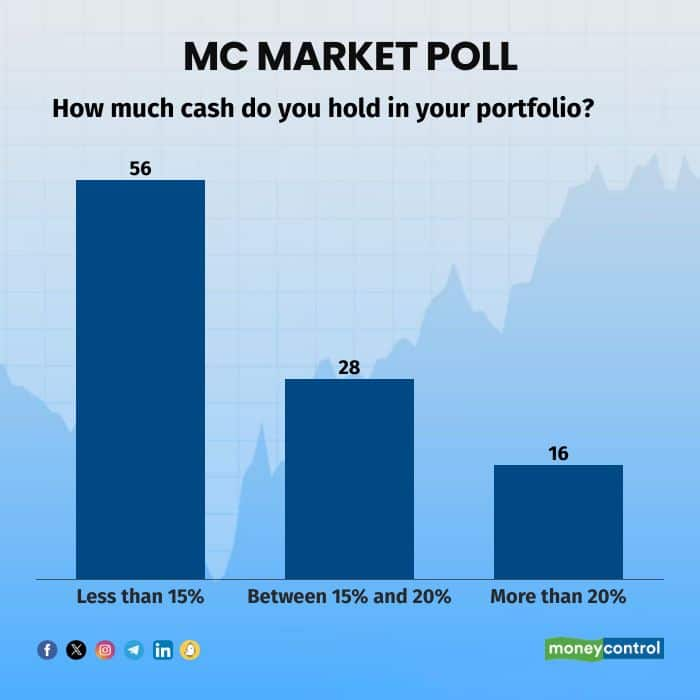

As per the poll findings, 56 percent of the respondents said that they are holding less than 15 percent cash in their portfolio while another 28 percent said that their cash holding is between 15 percent and 20 percent. Only a minor 16 percent said that their cash holding is in excess of 20 percent.

More importantly, a huge 68 percent of the respondents said that they are not looking to increase their cash holding in the near future.

Also read: Equities should outperform cash over the medium to long term: 3P Investment Managers' Prashant Jain

The Moneycontrol poll saw more than two dozen market experts participating with the respondents ranging from analysts to traders and from fund managers to advisors spanning across intermediary categories including broking firms, mutual funds, portfolio management services (PMS), advisory platforms and alternative investment funds (AIFs).

MC Market Poll: Further 10% correction possible; Nifty likely to end CY24 between 25000 and 27000, say experts

This poll findings clearly suggest that despite market corrections and global uncertainties, majority of the market players are confident of their current positions and are not anticipating the need for keeping higher liquidity though 32 percent of respondents indicated they are considering increasing their cash levels.

Kaustubh Belapurkar, Head of Research at Morningstar India, told Moneycontrol that the findings are not surprising as most equity mutual fund managers prefer to stay invested rather than take larger cash positions. “This has been a strategy most have always followed,” he said.

In 3P Investment Manager's latest newsletter, market veteran Prashant Jain also stated that equities -- especially large caps -- should comfortably outperform cash over the medium to long term, largely driven by earnings growth. For this reason, his fund was mostly fully invested.

“The long-term case for equities is further bolstered by the significantly lower taxation of capital gains on equities compared to cash,” said Jain in the newsletter.

MC Market Poll: Experts discount China factor; say high valuations, earnings disappointments biggest risks

In the mutual fund arena, as per the latest available data for August 2024, fund managers had marginally increased their cash positions from Rs 1.29 lakh crore, representing 3.04 percent of the total equity AUM, to Rs 1.46 lakh crore, or 3.38 percent of the total equity AUM, in August 2024.

Divam Sharma of Green Portfolio said that, as of now they were waiting for a further correction to aggressively deploy cash.

“There is no significant change in our cash positions. Our fresh inflows are being deployed in a staggered manner as our new allocations model portfolio has 20-30 percent cash at the moment,” he said.

A similar approach was described by Pankaj Tibrewal in IKIGAI Asset Managers' latest newsletter. He said that the fund is almost 90 percent invested in a staggered manner, allowing them to carefully pace and position their portfolio for long-term growth.

Interestingly, several mutual fund schemes showed considerable shifts in their cash allocations in August.

For instance, Nippon India Mutual Fund saw its total holdings increase from Rs 5,548.82 crore in July to Rs 6,711.08 crore in August. Similarly, Motilal Oswal Mutual Fund experienced a substantial increase in cash, rising by Rs 2,196.40 crore between July and August.

MC Market Poll: Majority prefer deploying cash in large-caps while avoiding small- and mid-caps

On the other hand, Franklin Templeton Mutual Fund significantly reduced its cash positions, with a decline of Rs 1,458.05 crore. The cash position data of mutual funds for the month of September is currently unavailable.

Patterson PMS’ Prasanna Bidkar said that they recently seen cash positions increase to 30 percent as they aim to protect against market downturns due to high valuations. Most of their cash positions are in the range of 10 to 30 percent.

“We have stocks on our radar but haven’t bought them yet; when prices align with our comfort levels, we’ll invest,” he explained adding that during sharp market corrections, they plan to use 2-5 percent of their cash to buy equities at lower valuations.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!