Madhuchanda Dey

Moneycontrol Research

• Past one-year rally driven by a handful of names

• Last one month has seen participation from mid and small caps as well

• Breadth of the mid and small cap rally not broad-based

• For rally to be supported by earnings, broad macro revival critical

• Investment revival key missing link

• Get out of weak positions and stick to stocks with earnings visibility

Equity indices are at their life-time highs and investors would be wondering if it is time to be cautious or join the party.

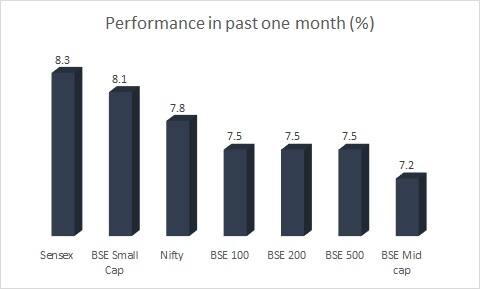

While predicting market movements is a mug's game, investors should remember that the Indian stock market’s mantra in the past one year has been "narrower the better". A handful of stocks have been stealing the show. It's no wonder then that the Sensex, the narrowest index, was the top performer followed by the Nifty, whereas mid and small caps struggled.

Less than a dozen stocks stole the thunder in the markets. These include defensives from the export-oriented IT services sector, evergreen large consumer companies, one large refinery to retail conglomerate, consumer-driven financial services and a handful of corporate banks whose performance has turned around. The export-oriented companies were back on track with an agile response to technological disruption and the rest did well to navigate the slowdown.

However, in equity markets, every sentiment driven rally will ultimately be tested against fundamentals and earnings. The focus on a few quality names wasn’t devoid of reasons.

Back in FY11, Nifty companies accounted for 49 percent of profits of all listed companies. This share has kept on rising with more efficient companies working their way into the index.

The March rally – is this time different?

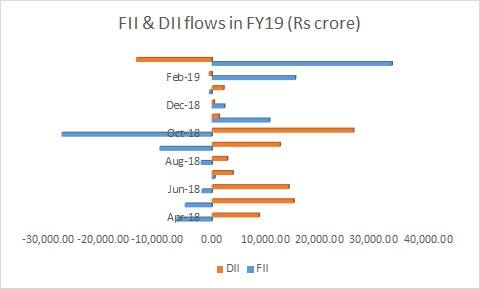

The past one month saw markets perk up after remaining lacklustre for a long period, thanks to strong inflows from foreign institutional investors, who had gone missing.

Flows may have been helped by global central banks shifting to a more dovish and accommodative stance, due to a weakening growth outlook. They may also have been influenced by expectations of India getting a stable political mandate, in contrast to the possibility of a fractured political mandate.

What to read in the recent rally?

The rally had one key difference from the past one year’s performance. While a narrow index such as the Sensex continued to dominate, on the back of smarter moves predominantly from the financial pack, the rally was a bit more broad-based. Most indices moved up and even mid and small-cap indices made a strong comeback.

That gives the impression of a return to euphoria, akin to 2014.

Looks at the small-cap index closely, and it is evident that only 44 percent of stocks had outperformed the benchmark small cap index in the past one year. That number remains more or less the same in March 19 too. So the breadth has not improved significantly. For the mid-cap index, while 45 percent of stocks had outperformed the benchmark in the past year, the number has improved a tad to 51 percent in the past month.

The index that has witnessed a significant improvement in participation of its constituents is the Nifty Junior index. Here, 64 percent of its constituents have outperformed the benchmark in the past month, thereby showing that beyond the top quality names, investors are flocking to high quality mid-sized companies.

Can the election-led euphoria sustain?

Should the election results lead to another stable government, a short-lived euphoria cannot be ruled out. However, investors should remember that markets are ultimately governed by earnings and for the equity rally to sustain, the broad market's earnings growth must improve.

A correlation analysis with nominal as well as real GDP data suggests that while all indices have a positive correlation with the overall growth rate of the economy, the correlation is progressively stronger for mid and the small cap stocks.

In recent years, the overall economic slowdown had disproportionately impacted smaller companies. That isn’t a surprise since the disruption caused by demonetisation and the adjustment to the Goods and Services Tax was much tougher for smaller companies.

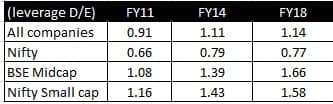

It is also pertinent to take a closer look at the leverage picture of India Inc. As the exhibit suggests, while most large companies managed to run a tight ship, the same was not the case with smaller companies, where the picture has worsened considerably over the years.

Whether a broad-based rally can follow post-election is contingent on growth and earnings. While global macro may turn out to be conducive, as was the case in March 19, it is pertinent to note that in the last few years, consumption has been the primary engine of growth and that too appears to be losing steam. The investment rate in the economy which was a high 34 percent at the end of FY12 has fallen and has been hovering in the range of 28-29 percent. This is the missing link in the India growth story that holds the key to the next leg of growth.

A decisive shift in the government's focus towards consumption, election-driven uncertainty, tighter funding conditions, damaged balance sheets of companies and underutilised capacity have emerged as major challenges for India's capex recovery. Even if the incumbent government gets re-elected, the path towards fiscal consolidation is not an easy one.

Therefore, for euphoria to translate to recovery, an all-round growth revival is necessary. The jury is out on whether such growth can materialise. Hence, prudent long-term investors could capitalise on the rally to get out of weaker positions in their portfolio. The mantra is to stick to well-researched stocks with high earnings visibility irrespective of the outcome of the upcoming elections.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.