The market clocked a record-high closing, and sustained its pre-Budget and Santa Claus rally for the second consecutive week, which ended on December 20.

The momentum was driven by easing US-China trade worries, a likely Brexit deal, no Goods and Services Tax (GST) rate hikes, and hope of more measures in the forthcoming Budget 2020.

The inflow of foreign money also lifted sentiment due to an increase in the risk-on strategy, whereas DIIs preferred to book profits as they were net sellers in all sessions during the week gone by, which indicated that the market mounted all wall of worries.

The BSE Sensex and Nifty50 climbed over 1.5 percent last week (driven by IT, metals and private banks), but the same trend was not seen in broader markets as the BSE Midcap index ended flat and Smallcap index gained 0.44 percent.

After a two-week rally, the valuations turned richer. Hence, there could be some consolidation in the coming week that could decide a further market trend, but the overall momentum remains positive considering the global and domestic cues, experts feel.

"Given the sharp run up, we remain cautious on the markets and expect some consolidation in the near term. A prudent approach is to be selective in stock picking and buy fundamentally sound companies with strong growth prospects," Ajit Mishra, VP - Research at Religare Broking told Moneycontrol.

Meanwhile investors would continue to track global markets, he said.

Vinod Nair, Head of Research at Geojit Financial Services said considering strong liquidity, the momentum is likely to shift from pricy stocks to value stocks going ahead, but a short-term consolidation cannot be ruled out as investors may slide to a holiday mood given that the last two weeks, we had a solid Santa clause rally.

Here are 10 key factors that will keep traders busy next week:

RBI's open market operation

PSU banks will be in action on December 23 as the Reserve Bank of India (RBI) said it would simultaneously purchase and sell government securities worth Rs 10,000 crore under a special Open Market Operation (OMO). The Nifty PSU Bank index on last Friday gained 2.28 percent ahead ofthe OMO.

Such exercises are done by the central bank when the proceeds from sale of short-term securities are used to buy long-term government securities or bonds in a bid to bring down interest rates on long-term securities.

"This move is taken specifically to lower longer-term yields as they have consistently been on an upmove since the RBI kept repo rate unchanged and slashed its forecast of economic growth rate to a decade low. All the bond market enthusiasts and PSU banks will cheer this move as the yield curve has steepened sharply despite RBI's constant efforts to lower rates since the start of the year," Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote said.

Addition and deletion in BSE Sensex and Nifty indices

Titan Company, UltraTech Cement, Nestle India will be included in BSE Sensex with effect from December 23. On the other side, Tata Motors, Tata Motors DVR, Vedanta and Yes Bank will be removed from the index.

Along with Sensex, there would also be addition and deletion in BSE Sensex 50, BSE Sensex Next 50, BSE 500, BSE 100, BSE 200, BSE 150 Midcap index, BSE 250 Smallcap index, BSE 250 LargeMidcap index, BSE 400 MidSmallcap index, BSE 100 Largecap TMC, BSE Sensex 50 TMC, BSE Sensex Next 50 TMC, BSE Carbonex and BSE 100 ESG indices on same day.

In BSE Sensex 50 index, UPL and Dabur India will replace Indiabulls Housing Finance and Yes Bank while in the BSE 100 index, InterGlobe Aviation, Info Edge and SBI Life Insurance will replace Glenmark Pharma, Cadila Healthcare and Edelweiss Financial Services.

Meanwhile, Affle India, Mishra Dhatu Nigam and Responsive Industries will make a entry into Nifty 500, Nifty Smallcap 250 and Nifty MidSmallcap 400 indices with effect from December 26 (Thursday).

However, CG Power, Coffee Day Enterprises and Cox & Kings will be removed from the same indices.

Kennametal India and Tasty Bite Eatables will replace Den Networks and Hathway Cable & Datacom in Nifty 500, Nifty Smallcap 250 and Nifty MidSmallcap 400 indices on December 27 (Friday).

On the same day, Jump Networks will be added in the Nifty Media index, whereas Hathway Cable & Datacom and Music Broadcast will be removed.

US-China trade

Indian markets are expected to continue to take note of consistent improvement in global sentiment due to positive developments in the US-China trade dispute and an increase in US consumer spending. The US stocks on last Friday registered record closing highs.

President Donald Trump claimed progress on issues from trade to North Korea and Hong Kong after speaking with Chinese President Xi Jinping, which ultimately indicated there could be no another escalation in the two countries' trade war.

Reports suggested that the phase one US-China trade deal is expected to be signed in January. Once that gets signed, recently President Trump had said both countries would commence negotiations for a phase two deal, though he has not mentioned about the timeline for the same. It means the trade episode will be continued in 2020 as well.

"Phase 2 negotiations are expected to cover issues such as Chinese government subsidies to state-owned enterprises, digital trade, data localization, cross border data flows and cyber intrusions. The extent of hardball president Trump plays in phase 2 would depend on the state of the economy and markets heading into the elections, his approval ratings and on who the Democrat challenger is," Abhishek Goenka of IFA Global said.

Brexit

The market momentum may also get supported by the Brexit deal as it cleared the first step as it got approved by UK Prime Minister Boris Johnson in parliament on December 20. It clearly indicated that Britain's departure from the European Union will take place as per the deadline of January 31, 2020 set by Johnson.

If the deal happens as per the plan, then the prime minister will face talks to secure a trade deal with the European Union.

"After January 31, there shall be a short window of 11 months until December 31, 2020 by when the UK and EU would have to hammer out a trade deal that would establish the future trading relationship between them. This could be a tall order especially if UK wants to differ significantly from current EU standards and tariffs. The more closely aligned the UK is with European standards, the smoother the transition would be," Abhishek Goenka said.

Rupee and oil price

The movement in Indian currency against the US dollar and rising oil prices after easing US-China trade tensions will also be closely watched in the coming week.

"Currency and crude prices failed to garner investors' attention and this could hit the bullish sentiment. Further weakness in the rupee and a jump in crude prices could play spoilsport for the markets going ahead," Shrikant Chouhan, Senior Vice-President, Equity Technical Research, Kotak Securities said.

The Indian rupee depreciated to 71.12 against the US dollar, from 70.81 a dollar on week-on-week basis while international benchmark Brent crude futures jumped to $66.14 a barrel from $65.22 week-on-week and it was at $60.82 a barrel on December 3.

F&O expiry

The current month futures and options contracts will expire on December 26, and traders will roll over their positions to next month.

After consistent buying interest that pushed the Nifty to record closing highs last week, there has been a change in trading range to 12,100-12,350 in the coming sessions, and as the index is well above their sizeable call base of 12,200, it could act an immediate support, experts feel.

On the monthly options front, maximum Put open interest was seen at 12,200 followed by 12,000 strike, while maximum Call open interest was at 12,300 followed by 12,400 strike. Meaningful Put writing was seen in 12,250 and 12,200 strike, while Call writing was seen at 12,350 followed by 12,400 strike.

"Rollovers are likely to pick up pace, which will trigger some volatility, going forward. However, looking at the additions in 12,200 Put, we feel the Nifty has limited downsides. ITM Put strike of 12,300 also saw huge additions last Friday with muted implied volatility," Amit Gupta of ICICI Direct said.

He felt that in the absence of any major events, traders have written ITM Put with higher Delta to capitalise on decay in time value as there is one holiday this week. This will keep the bias positive, he said.

India VIX fell to 12.32 from 13.30 on a week-on-week basis, which could continue to provide the support to the index to attract fresh buying interest.

FII Flow

Foreign institutional investors turned net buyers for December, particularly seeing consistent buying during the week gone by following favourable global cues. They net bought Rs 4,892 crore worth of shares during the week, taking the total net monthly inflow to Rs 1,163.60 crore. As a result they were net buyers for third consecutive month.

Experts feel the FII inflow could reduce or could be muted in coming two weeks as most of FIIs will be on vacation for Christmas and new year celebration, but the flow could be robust in 2020, backed by stimulus from major global central banks.

On the other side, domestic institutional investors were net sellers for the week, selling Rs 3,751 crore worth of shares which could be due to profit booking as indices traded at record high levels. Hence, whether they could continue selling or start buying again will be closely watched in coming weeks.

Technical View

The Nifty50 ended at record closing high, but witnessed a Doji kind of indecisive formation on daily charts on December 20, which indicates there could be consolidation in coming sessions before firm directional move on either side.

But as it formed bullish candle on weekly scale, the overall sentiment may remain positive and may help the index to move around 12,350-12,400 levels, experts feel.

"The underlying trend of Nifty continues to be positive with rangebound action. The presence of crucial overhead resistance around 12,350 is likely to weigh on the market at the higher levels, but the lack of strength in the broad market indices and market breadth is not a good sign for the bulls at the new highs. Hence there is a possibility of a downward correction in the short term," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Shrikant Chouhan advised traders to be cautious while adding long positions at higher levels. For Nifty, support exists at 12,200/12,150 levels, he said.

Corporate action

Global cues

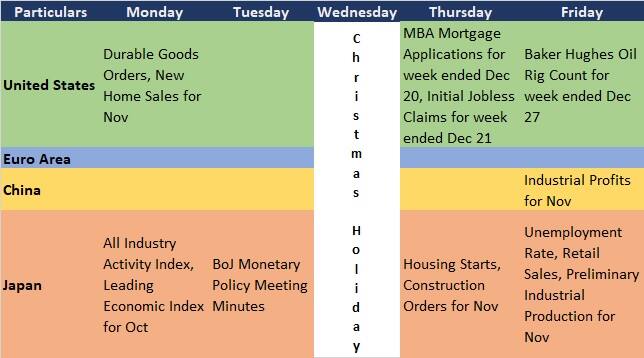

Watch out these key global data points in coming week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.