Anup Chandak

The Nifty, much like in the November series, also started on a flattish note for December expiry, and was in a consolidation phase throughout the month.

In December expiry, the Nifty series closed with a minuscule gain of around 0.08 percent, while the Bank Nifty also closed on an absolute flattish note on the other side with a gain of just 0.05 percent.

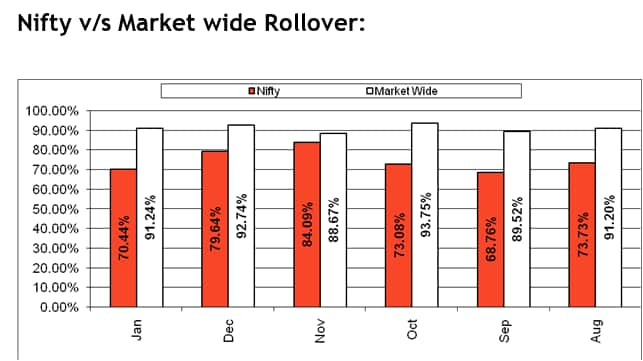

The rollover in the Nifty was a bit on the lower side at 71 percent as compared to last three-month-average of 78 percent, and is now starting the new expiry at a multi year low Open Interest with just 1.23 crore shares. While the rollover in the Bank Nifty was on the higher side at 78 percent versus a three-month average of 64 percent.

The Nifty and the Bank Nifty has seen a decent amount of long addition throughout the December series, and we feel most of them have got carried forward to the next series.

On the FII front, the data continues to be positive throughout the November and December series. Currently in Derivatives, they are net long in Index Futures with around 23,000 contracts and they have rolled over more longs than short positions in the next series.

In the cash market, after the close of Aramco IPO, they once again turned net buyers in December, and have so far bought Rs 2500 crore of equity on net basis.

On the options front in the December monthly expiry, the 12,000 PE is highest in terms of open interest with around 26.80 lakh shares, followed by 11,500 PE, which has 21.03 lakh shares. While on the Call side 12,200 CE is highest in Open Interest with 16.59 lakh shares followed by 12,500 CE, which has 15.09 lakh shares in Open Interest.

The put-call Ratio (PCR) have also started on the lower side at 1.31 level, which is a positive sign for the market. The volatility index continuously inched lower and is currently at sub-11 levels, indicating there is not much of volatility market is expecting in the January month.

On the other hand, the Nifty is starting the new series with a multi-year low Open Interest of 1.23 crore shares, and with such a low Open Interest, we have seen in the past it is difficult for the market to go down. Hence, keeping in mind the data above, we feel that after consolidation the market is now ready to inch higher and make new lifetime high at around 12,500-12,600 before the February Budget.

Thus one should at current level and also at every dip targeting 12,500-12,600 keeping strict stoploss of around 11,950 level.

Highlights

Nifty Future began the January series with multi year low open interest at 1.23 crore versus 1.47 crore shares in open interest.

January series started with Rs 1,19,017 crore versus Rs 1,20,458 crore in stock futures, Rs 14,954 crore versus Rs 17,909 crore in Nifty futures and Rs 100,894 versus Rs 110,640 crore in Index Option and Rs 13,565 crore versus Rs 15,447 crore in stock options.

Nifty January month rollover was at 70.44 percent versus 79.64 percent.

Market wide rollover was at 91.24 percent versus 92.74 percent.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.