Shares of Housing Development and Finance Corporation (HDFC) stopped trading on July 12, marking the end of an over four-decade-long journey for India’s oldest and biggest mortgage lender.

HDFC now lives on as part of HDFC Bank, but many market veterans view the company as a role model for corporate India and synonymous with the country’s socio-economic progress.

Here are some key highlights of HDFC’s market journey –

Founded by H T Parekh, uncle of Deepak Parekh. Incorporated on October 17, 1977

Deepak Parekh joined the company in 1978, leaving his Chase Manhattan Bank job where he was earning twice the salary offered by HDFC.

Deepak Parekh approached UTI seeking investment in HDFC’s IPO. UTI -- the only mutual fund in India that time -- refused, saying retail lending for home loans was too risky.

HDFC IPO launched in 1978. Issue size – Rs 10 crore (10 lakh shares of Rs 100 each). Shares issued to public at par (no premium).

126 equity shares of Rs 100 taken up by the subscribers to the Memorandum of Association, including 100 shares held by H T Parekh.

50,000 Equity shares of Rs 100 each subscribed by ICICI, the IFC (W) and HH the Aga Khan IV respectively.

4,50,000 equity shares of Rs 100 issued for private subscription.

3,99,874 equity shares of Rs 100 offered to the public. The Corporation received 10,697 applications for 4,73,976 equity shares. The Corporation allotted the shares to 10,543 applicants.

The stock has posted a stellar CAGR of around 19 percent over the last three decades. However, the CAGR for HDFC Bank is higher at 24 percent.

Rs 1,00,000 invested in HDFC in May 1995 would have grown to Rs 1,26,39,000 today (without dividends). However, Rs 1,00,000 invested in HDFC Bank would have increased to Rs 4,14,00,000 (without dividends).

HDFC received approval for setting up HDFC Bank in 1994. The bank was inaugurated in February 1995 by the then Finance Minister Dr Manmohan Singh.

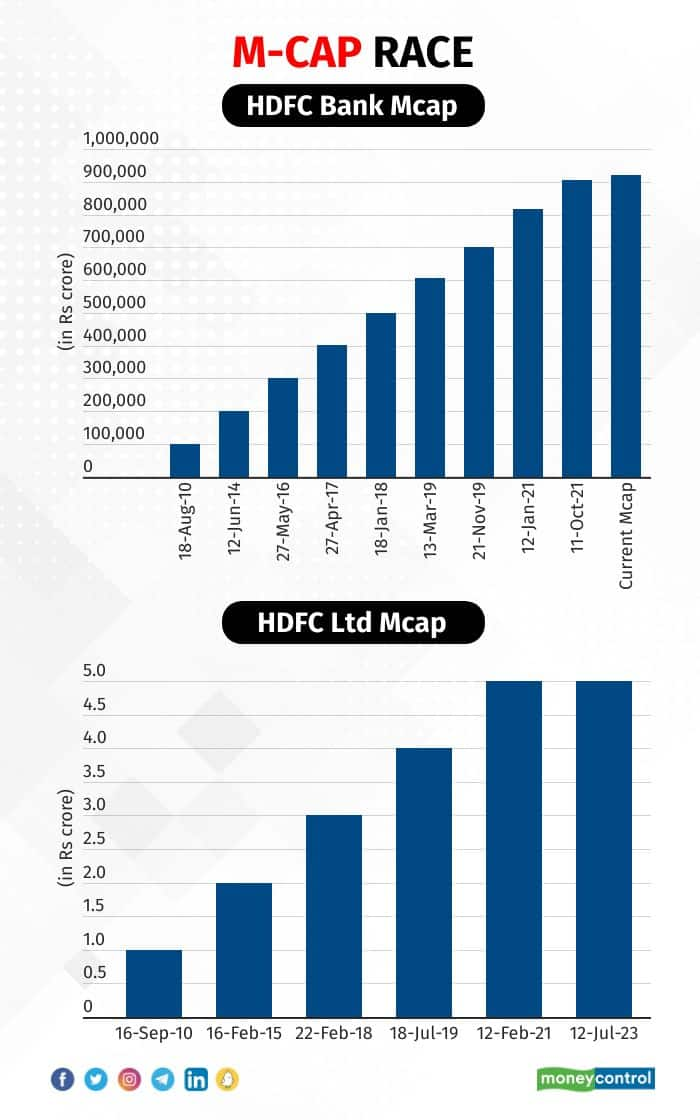

HDFC took 33 years to hit the Rs 1-lakh crore m-cap mark. HDFC Bank reached the milestone in 15 years.

HDFC's market capitalisation reached Rs 2 lakh crore in February 2015, Rs 3 lakh crore in February 2018, Rs 4 lakh crore in July 2019, and Rs 5 lakh crore in February 2021.

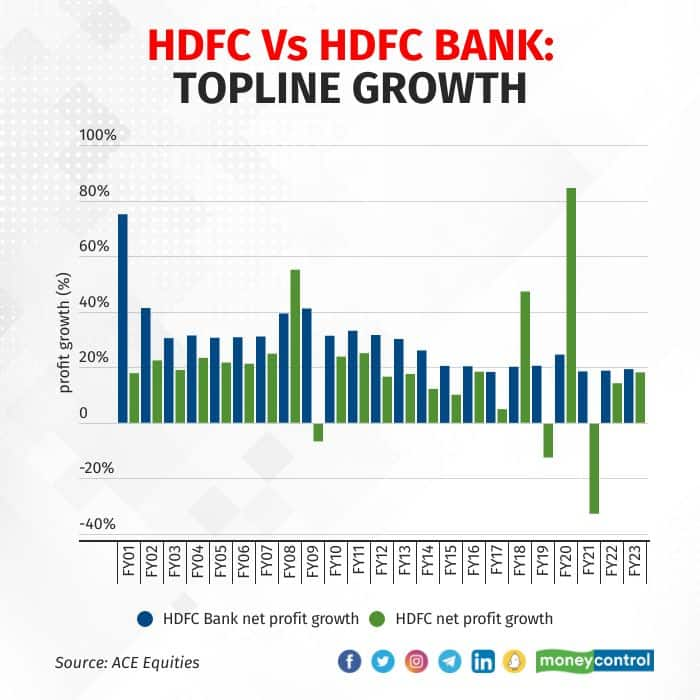

In FY2000, HDFC’s net profit at Rs 400 crore was almost four times that of HDFC Bank at Rs 120 crore.

HDFC maintained its lead for the next decade. In FY2010, HDFC Bank overtook its parent in terms of net profit at Rs 2,949 crore vs Rs 2,826 crore for HDFC. The lead only widened over time.

For the financial year ended March 2023, HDFC reported a net profit of Rs 16,239 crore, compared to Rs 44,109 crore for HDFC Bank.

Even in terms of topline growth, HDFC Bank has usually outperformed its parent.

The HDFC IPO was a tepid affair, with shares listing below the issue price. Even at its last trading session on July 12, 2023, the share closed in the red, down nearly 1 percent at Rs 2,724.30 on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.