The recent tussle with China has derailed the momentum and the market is now awaiting some fresh trigger. We reiterate our cautious view on the index and suggest focusing more on stock selection in the meanwhile.

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,760.06 | 494.74 | +0.58% |

| Nifty 50 | 26,192.10 | 158.35 | +0.61% |

| Nifty Bank | 59,732.10 | 443.40 | +0.75% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 854.05 | 25.90 | +3.13% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,298.00 | -138.50 | -2.55% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8372.75 | 116.05 | +1.41% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty FMCG | 55000.70 | -208.60 | -0.38% |

The recent tussle with China has derailed the momentum and the market is now awaiting some fresh trigger. We reiterate our cautious view on the index and suggest focusing more on stock selection in the meanwhile.

Technically the Nifty’s high-low range is becoming narrower. A breakout of 9720-10046 band could lead to acceleration of movement in that direction.

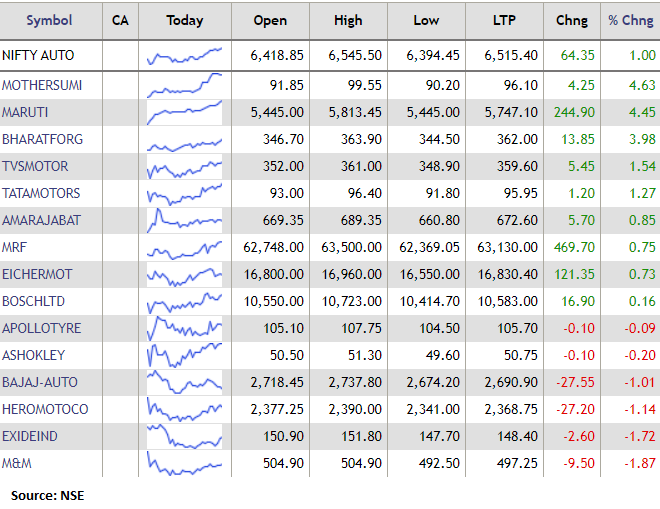

After another day of indecisive trades, brought by the threat of escalation in border dispute with China, Indian benchmark indices ended slightly negative. The losses were mainly due to financial stocks. The major sectoral gainer was the Auto sector, led by gains in Maruti. FIIs have also been net sellers in equity this week which have impacted the markets. Volatility to remain.

The markets are in a clear state of consolidation - we are unable to go past either of the two levels - 10050 or 9700. Until that does not happen, we will be trading in a rangebound pattern.

Today we have noticed that USDINR depreciated by 0.25% and touched the 7 week's low levels of 76.31 levels. Geopolitical Tension between Indian & China is a major cause of depreciation of USDINR. Although uncertainity in global financial market and increase cases of Covid-19 also negative for the currency.

We expect USDINR may depreciate further and it is expected that USDINR may test 76.60 - 76.80 levels soon. Traders can go for buy in USDINR at 76 - 76.10, with the stop loss of 75.60, and for the target of 76.60 - 76.80 levels.

Benchmark indices ended lower in the volatile trade on June 17 with Nifty below 9900 level.

At close, the Sensex was down 97.30 points or 0.29% at 33507.92, and the Nifty was down 32.85 points or 0.33% at 9881.15. About 1409 shares have advanced, 1116 shares declined, and 152 shares are unchanged.

Bharti Infratel, Power Grid, Kotak Mahindra Bank, ITC and Shree Cements were among major losers on the Nifty, while gainers were Maruti Suzuki, Bharti Airtel, Wipro, Axis Bank and IndisInd Bank.

Mixed trend seen on the sectoral front with buying witnessed in the auto, IT and pharma sectors, while bank, FMCG and metal ended lower.

The company's consolidated net profit rose 72.6% at Rs 137.6 crore versus Rs 79.7 crore and revenue was up 75% at Rs 1494 crore versus Rs 854.3 crore, YoY, reported CNBC-TV18.

Oil prices declined on Wednesday as data showed an increase in U.S. crude and fuel inventories, raising the prospect of oversupply as a potential second wave of the coronavirus pandemic threatened to halt any recovery in demand.

Gold prices held steady on Wednesday, supported by concerns stemming from a surge in coronavirus infections in Beijing but with hopes for a potential COVID-19 drug and a stronger U.S. dollar limiting their advance.

Bharti Airtel has acquired a strategic stake in Edtech startup Lattu Media Pvt Ltd (Lattu Kids) as part of the Airtel Startup Accelerator Program.

Shares of India Cements rallied 10.6 percent on June 17 after a media report indicated that the supermarkets chain D-Mart owner Radhakishan Damani may be planning to take a control of company.