Taking Stock | Bulls back on Street as Sensex rallies over 250 points, but closes below 40K

Top Nifty gainers include names like Hindalco, BPCL, Tata Steel, and JSW Steel.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,265.32 | 158.51 | +0.19% |

| Nifty 50 | 26,033.75 | 47.75 | +0.18% |

| Nifty Bank | 59,288.70 | -59.55 | -0.10% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| TCS | 3,229.20 | 49.20 | +1.55% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,436.50 | -159.00 | -2.84% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 38360.30 | 535.00 | +1.41% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Energy | 34986.10 | -118.90 | -0.34% |

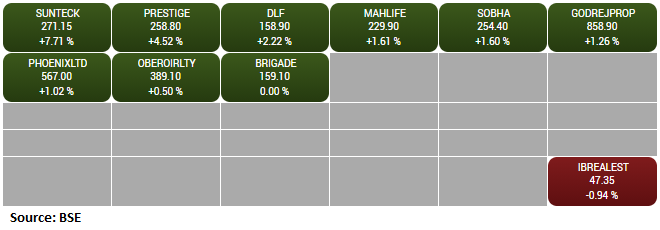

Against the backdrop of positive sentiment in the global market, the Indian market saw an improvement. The Nifty Index, led by HDFC Bank, rose 0.75 percent, while the Bank Nifty rose 1.99 percent. Cement, metals and pharmaceutical stocks performed well in the broader market. We witnessed the volume-based activity in reality and housing finance companies.

Technically, it is clear that the market has taken a break after a sharp decline on Thursday. If the market breaks 11660 levels on Monday then today's formation could turn into a bearish continuation formation and then the Nifty would fall to 11550 or 11500 levels. On the upside, 11850 and 11900 would be the main obstacles. The Bank Nifty has established a bullish harami pattern and in next few days it looks like the broader market would move towards the trend of financial stocks.

Markets took a breather after yesterday’s fall and managed to close half a percent higher. Despite mixed global cues, the benchmark witnessed a positive start, followed by the range-bound move till the end. Amid all, movement on the stock-specific front kept the participants busy wherein the metal and select banking stocks witnessed a strong rebound. The Nifty index finally settled near day’s high at 11,763 levels, up by 0.7%. The broader market indices too showed some resilience and posted decent gains.

Indications are in the favour of consolidation in Nifty thus we suggest continuing with the stock-specific trading approach and maintaining positions on both sides. However, it’s easier said than done due to prevailing choppiness. Meanwhile, global cues will be on the radar as US elections are just around the corner as well as the second wave of Covid-19 infection has led to more lockdown and restriction. Any further rise in restrictions could severely impact investors’ sentiments.

The market has lifted marginally after yesterday’s deep fall, but the overall trend is still fragile. The market trend has turned weak due to high stock prices in spite of lack of required fiscal support and rising spread of covid impacting economic recovery. The quick bounce of the market to above last high and near the pre-covid level, has brought volatility, which can stay for some time.

For Nifty 50 a strong support is at 11,500 limiting the downside, in the near-term. The market will look forward, with high hopes on Q2 results and update on stimulus plans. IT, Telecom, Pharma and Banks will be the sectors under focus with a positive bias.

At 40k Sensex today the market mood was far from cheerful despite Metals & Pharma stocks posting gains. Selective buying in Midcaps by savvy investors not withstanding the general mood in the broader markets was that of caution as profit booking was seen across several sectors.

We did not have much happening in the markets today. The support of 11550-11600 is still intact and therefore we continue to be in a bullish environment. Next week could prove crucial as we need to see if the Nifty is able to get past the 11950-12000 level or the bears take over and break the levels of 11500.

The BSE-30 Index declined 1.3% in the current week. The market witnessed a slight correction as sentiments turned cautious on rising number of Covid-19 cases globally, despite domestic cases coming under control, and fading hopes of US fiscal stimulus.

Axis Bank, Infosys and HCL Technologies gained the most while Sun Pharmaceuticals, Bharti Airtel and Tech Mahindra lost the most in the BSE-30 Index in the past week. Infosys and TCS came out with good set of numbers while that of Mindtree disappointed the investors.

FPIs bought equities worth USD649 mn over the past five trading sessions while DIIs sold USD 523 mn worth of equities in the same period. Going into the next few weeks, the key events are the US elections, progress on the US fiscal stimulus and earnings announcements from Indian corporates. Valuations are not attractive. Hence, investors should trade with a cautious bias as after the swift rise in markets, there could be sharp corrections. Risk could be resurgence of Covid-19 in India.

After breaking 10-day winning streak in the previous session, the benchmark indices bounced back on October 16 supported by the bank, metal and pharma names.

At close, the Sensex was up 254.57 points or 0.64% at 39982.98, and the Nifty was up 82.10 points or 0.70% at 11762.50. About 1459 shares have advanced, 1135 shares declined, and 171 shares are unchanged.

JSW Steel, Tata Steel, BPCL, Divis Labs and Hindalco Industries were among major gainers on the Nifty, while losers were UPL, HCL Tech, M&M, Asian Paints and Reliance Industries.

Except IT other sectoral indices ended higher led by the metal, bank and pharma. BSE Midcap and Smallcap indices rose 1 percent each.

A rally in the Dollar Index to a 1-week high on Thursday, was bearish for silver prices, along with reduced hopes for a pre-election U.S. pandemic stimulus bill. Silver prices also fell, on the back of concerns that industrial metals demand in Europe will take a hit, after some cities imposed fresh lockdown measures, to curtail the spread of Covid infections.

Silver prices are likely to find support near the 100-days EMA at USD 23.68, and the 200-days EMA at USD 21.73, while critical resistance is seen near USD 25.98-26.83 levels.

Privately-held Liberty Steel has made a non-binding offer for the steel unit of German conglomerate Thyssenkrupp TKAG.DE, the group said on Friday, reported Reuters.

“Liberty Steel is convinced that a combination with Thyssenkrupp Steel Europe can be the right answer from an economic, social, and environmental perspective,” the group said in a statement.

Company's September production fell 40.5% MoM at 6,246 million tons versus 10,508 million tons (MoM).