September 06, 2022 / 15:51 IST

Vinod Nair, Head of Research, Geojit Financial Services

Domestic indices wiped out early gains to close flat, tracking mixed global cues. Meanwhile, energy crisis and upcoming ECB interest rate decision pressurized European markets. Chinese policymakers’ renewed efforts to strengthen economy boded well for the Chinese bourses. In an effort to stabilize declining oil prices, OPEC+ opted to cut back on the output given the faltering global growth outlook.

September 06, 2022 / 15:48 IST

Rupak De, Senior Technical Analyst, LKP Securities

Nifty failed to capitalize on early gains as profit-taking took place around 17,750. On the lower end, 17,600 acted as support for the index. The trend remains sideways as Nifty failed to provide any directional breakout. Resistance seen at 17,770; whereas, support is visible at 17,580/17,468.

September 06, 2022 / 15:46 IST

Demat accounts cross 100-million mark for first time in India

According to data released by depository firms National Securities Depository Limited (NDSL) and Central Depository Services (CDSL), over 2.2 million new accounts were opened last month, bringing the cumulative figure to 100.5 million.

“This shows that the culture in equity investing is slowly but steadily picking up in India, especially in tier 2 and tier 3 cities, which were underserved till now. Higher participation of investors bodes well for the depth and development of equity markets in India, along with the availability of equity capital to companies through primary issuances,” said B Gopkumar, MD & CEO, Axis Securities.

September 06, 2022 / 15:37 IST

Market at close

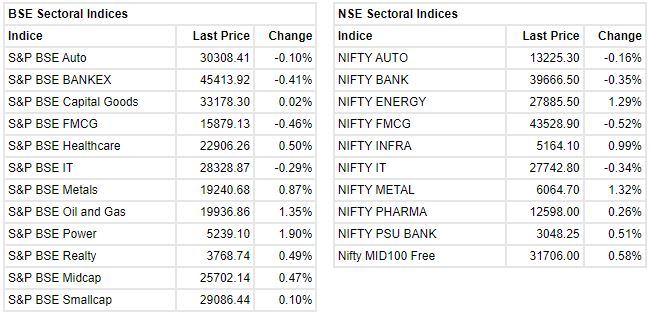

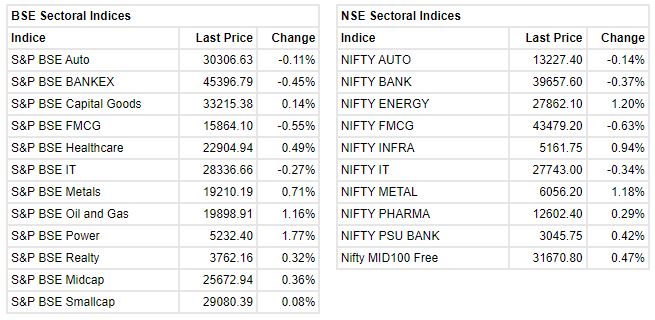

: Benchmark indices ended the session on September 6 on a flat note amid volatility. Sensex was down 48.99 points or 0.08% at 59196.99, and the Nifty shed 10.20 points or 0.06% at 17655.60. About 1745 shares have advanced, 1614 shares declined, and 133 shares are unchanged.

Among the sectors, buying was seen in oil & gas, power and metal names while financials, FMCG and IT indices ended in the red. The midcap index added half a percent.

September 06, 2022 / 15:17 IST

Tamilnad Mercantile Bank IPO updates

The maiden public issue of Tamilnad Mercantile Bank continued to see good participation on September 6, the second day of subscription. The offer received bids for 1.05 crore shares against IPO size of 87.12 lakh shares, getting subscribed 1.22 times.

Retail investors remained ahead in terms of subscription, booking their quota 2.94 times, while non-institutional investors bought 1.05 times of their reserved portion. Good response was also seen from qualified institutional investors with their portion getting subscribed 73 percent.

September 06, 2022 / 15:10 IST

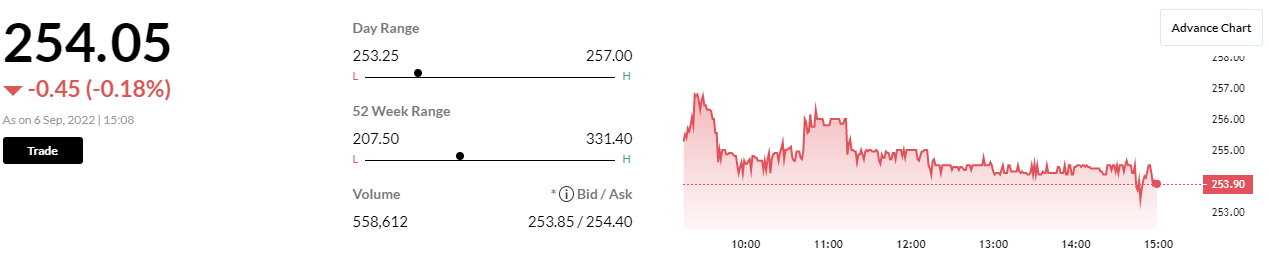

KNR Construction Large Trade | 14.3 lakh shares (0.4% equity) worth Rs 36.31 cr change hands at Rs 254 per share

September 06, 2022 / 15:05 IST

Vinod Nair, Head of Research, Geojit Financial Services on tyre stocks

The sector was trailing under pressure due to subdued demand in the auto sector and high input costs. However, situation is likely to improve going forward due to asteep fall in crude prices and easing of semi-conductor issue at OEM level.

Apollo Tyres holds 31% domestic market share in TBR tyres. To offset the margin pressure, the company took 8% price hike in Q1FY23 and a further 3-4% hike is expected in the ongoing quarter. As a result, the company registered an earnings growth of 68% QoQ. Cyclical upswing in CV industry, high radicalization levels, an uptick in PV space and network expansion to be major top-line drivers for the company in a medium to long-term basis. In addition, benign commodity prices along with operational efficiency will result in margin expansion in FY24.

September 06, 2022 / 15:01 IST

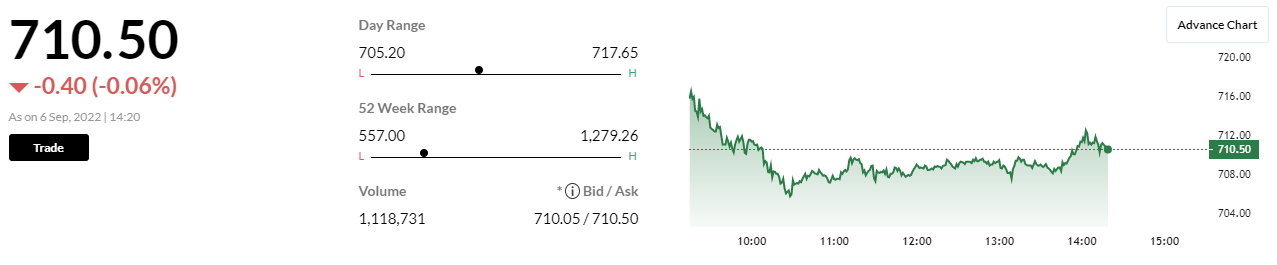

Market update at 3 PM: Sensex is down 40.57 points or 0.07% at 59205.41, and the Nifty shed 11.30 points or 0.06% at 17654.50.

September 06, 2022 / 14:49 IST

RITES bags order worth Rs 92.7 cr from Gujarat Metro Rail Corporation

September 06, 2022 / 14:42 IST

Tapan Patel, Senior Analyst (Commodities), HDFC Securities

:

Crude oil prices traded higher with benchmark NYMEX WTI crude oil prices were up by 1.27% near $87.97 per barrel on Tuesday. Crude Oil prices as OPEC+ members agreed to a small production cut of 100,000 barrels per day to bolster prices. The move was seen as a largely symbolic move to bolster prices after the market's recent slide. Oil prices are down substantially from 14-year highs hit earlier in the year, as concerns over slowing crude demand offset supply shocks from the Russia-Ukraine conflict.

We expect crude oil prices to trade sideways to up with resistance at $90 per barrel with support at $86 per barrel. MCX Crude oil September contract has important support at Rs 6950 and resistance at Rs 7180 per barrel.

September 06, 2022 / 14:34 IST

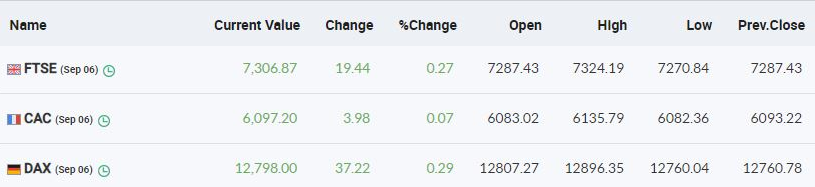

European Markets Updates

September 06, 2022 / 14:24 IST

IRCTC CMD Rajni Hasija gets tenure extension

In an exchange filing, IRCTC informed: Rajni Hasija, Director (T&M), IRCTC will continue to hold the additional charge of the post of the CMD, IRCTC, in addition to her own, for a further period of 6 months (w.e.f August 01, 2022) or till the regularly selected incumbent joins the post or until further orders, whichever is the earliest.

September 06, 2022 / 14:21 IST

Way2Wealth Research on Metro Brands

:

Metro Brands is one of the largest Indian footwear & accessories specialty retailers and are among the aspirational Indian brands in the footwear category. Due to operational excellence, the company can provide a great platform to brands with an online and offline presence and a pan-India distribution. Demand is back across categories and continues its growth momentum; formals are back as people return to the office. The company has already opened 20 stores in Q1FY23 and is on the runway to open about 200 stores by end of FY23.

We appreciate the competitive strengths of Metro brands, in terms of the product mix, pricing mix, distribution, third-party brands, etc. Considering all the above factors, Metro Brands is in a strong position to drive growth in the medium to longer term. At the current price of Rs 819, it is trading at ~67.6 times P/E to its EPS (TTM) of Rs 12.11. Strong margins, asset-light business model, operating efficiency, a high share of premium products, and the immense size of opportunity justify the premium valuations given to the stock. We recommend investors to buy the stock on dips.