It was in the first quarter of FY21 that consumer tech startups like Zomato, Paytm, Nykaa and Policybazaar revealed that a public listing was around the corner. Over the next few months, these companies had blockbuster initial public offerings (IPOs), which encouraged other tech startup peers to follow suit.

The tide has since turned as expensive tech stocks are facing a tough time around the world. Be it analysts or investors, the ask from all quarters is profitability now.

However, the companies’ financials in the last quarter show that they would keep leaking cash on multiple fronts in the near future.

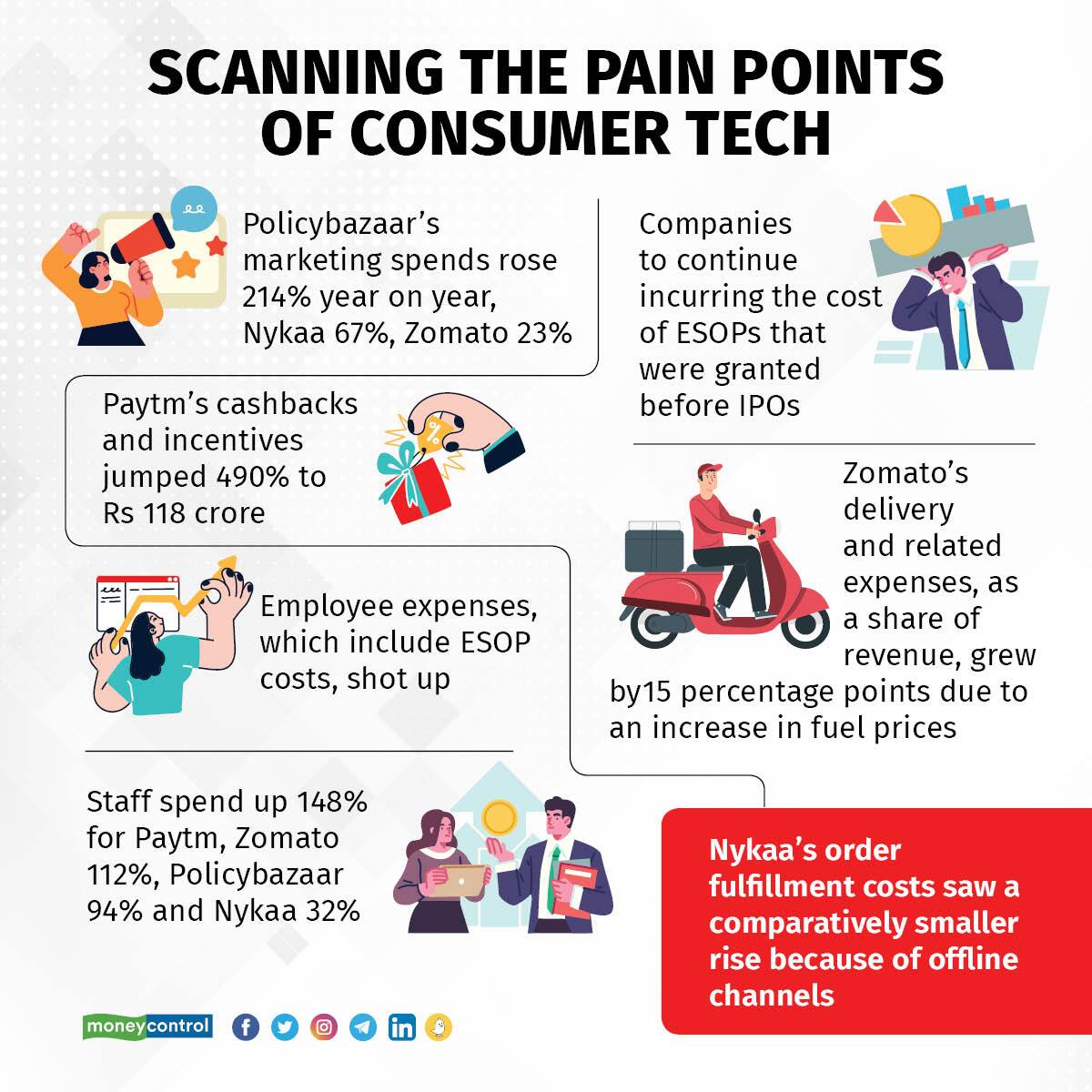

Take, for instance, marketing activities where consumer tech firms spent a lot more compared to the year-ago period. Nykaa saw the line item grow 67 percent to Rs 117 crore, Policybazaar’s marketing expenses jumped 214 percent to Rs 361 crore and Zomato’s rose 23 percent to Rs 270 crore, whereas Paytm’s promotional cashbacks and incentives rose 490 percent to Rs 118 crore.

“There is no denying that public listing of most of these companies was a great success partly driven by the narrative that was built as a precursor, their individual journeys till date and the investor sentiment around what these companies can become. In the last sixth months, macros have put challenges on short-term growth outlook. But they can’t suddenly dial down spends at the cost of growth,” said Ankur Bisen, a senior management consultant who works with consumer companies.

“It’s a tough environment for them as the country’s economic growth has slowed—and they are fighting hard to acquire and retain the same set of consumers repeatedly,” he added.

Experts also believe that the elevated levels of marketing and discounts are because of the waning of the pandemic’s impact.

“The spike in organic traffic that these platforms saw in the Covid era is not there anymore. If you leave out a couple of weeks in January when people had already blown their discretionary expenses at the end of the year, consumers have steadily been going for offline consumption,” said an analyst who did not want to be named.

“So, it has become that much harder to pull them back online. And it might get worse going forward,” he added.

ESOP pains will go on

Yet, the top concern on most investors’ minds right now is the ESOP cost on the balance sheet of these companies, barring Nykaa.

Employee benefits expenses, which include the cost incurred by the firms on account of stock options to employees, have ballooned in Q4. While Paytm’s employee spend shot up 148 percent to Rs 863 crore, Zomato’s jumped 112 percent to Rs 407 crore and Policybazaar’s rose 94 percent to Rs 374 crore. Nykaa, which has a comparatively sober ESOP programme, saw the number go up by 32 percent to Rs 91 crore.

With questions being asked about profitability, the loss-making tech companies have resorted to talking about a metric called ‘adjusted EBITDA’—which leaves out the cost of ESOPs from EBITDA (earnings before interest, tax, depreciation and amortisation—in the last couple of quarters. For example, Paytm has said that it will become profitable in ‘adjusted EBITDA’ terms by 2025 and Zomato’s letter to shareholders waxes eloquent about how this metric has been improving quarter on quarter.

But experts have cautioned about falling for such new-fangled yardsticks. “The market accepts adjusted metrics only when there’s an exceptional event—not for routine matters that apply uniformly to all companies. It’s a stop-gap arrangement but not a long-term solution,” said Siddarth Pai, managing partner at venture capital firm 3One4 Capital.

“Massive ESOP dilutions increase the supply of securities in the market and unless there’s a corresponding rise in demand, the market will self-correct the stock price,” he added

According to the analyst quoted earlier, these companies will continue incurring the cost of ESOPs that were granted before their IPOs over the next few years. However, he added that the costs will typically come down gradually every year due to a staggered vesting schedule.

Elephant in the room

The macroeconomic situation will determine the trajectory of these internet businesses in the next few quarters, say industry players.

A glimpse of this was already visible in Q4 as Zomato’s delivery and related expenses rose due to an increase in fuel prices—it was 45 percent of revenue in the March quarter of FY22, compared to 30 percent of revenue in the year-ago period.

For Nykaa, the other company in the group that delivers goods to the doorstep, this impact was muted but visible as fulfilment costs increased from 8.6 percent of revenue to 9.7 percent.

“Nykaa might have been hurt less than Zomato by the rise in fuel prices as a good amount of its sales are from offline channels,” said Bisen.

“Ultimately, none of these companies can break out of the limitations imposed by things like fuel prices, inflation and an economic slowdown. It would be a tall order from them to chase profitability while latching onto growth in a stagflationary environment,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.