April 07, 2020 / 07:19 IST

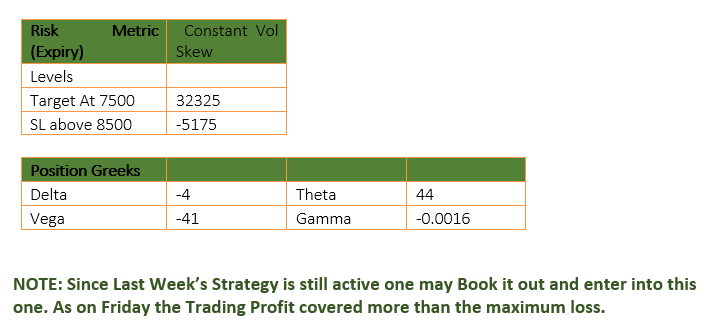

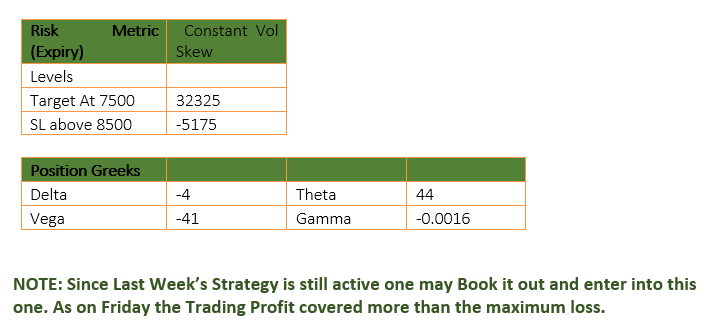

Shubham Agarwal After a sombre start to April, the Nifty50 tried to stage a comeback in the next session but got pulled deeper into the trenches amid uncertainty regarding the impact of COVID-19. The index settled with a loss of 6 percent for the week ended April 3. The carnage was worse in Bank Nifty as it dropped a whopping 13 percent in the week gone by. The diversity of impact in the returns is a little more painful when associated with the open interest (OI) activity in futures. The reaction of traders in the futures segment was quite predictable as far as Bank Nifty is concerned which added over 13 percent in OI. On the other hand, despite the fact that it’s the first week of April expiry, Nifty lost interest in futures especially later in the week, which was out of ordinary. Aggregate futures attracted fresh directional interest in the first week augmenting itself by around 5 percent. What was more interesting to see was at least initiation of a bit of positivity. As the participants soak the bitterness of the impact of the global pandemic, there were pockets in the now called essential sectors viz. FMCG and Pharma as it attracted fresh long interest. Apart from that about 30 percent of the stocks witnessed unwinding divided equally between Long Unwinding and Short Covering. And finally, over 50 percent of the stocks added shorts. Slicing it down further, FMCG added longs led by HUL, UBL, Dabur and Colgate Palmolive. Falling crude oil prices sparked the Oil PSUs with long additions in BPCL and HPCL. Pharma was one sector that added almost secular longs. The only sector to witness the unusual unwinding this week was Cement led by the unwinding of interest in ACC and Grasim. India VIX has dropped by 15 points this week to the level of 55. Even though these are super elevated levels, it is better than the week before. The increment in implied volatility has also taken a toll on liquidity, which could start getting restored if the implied volatility cools off. Composition wise too, a lot of interest is now seen in the farther strikes, which because of the fatter premiums looks fairly attractive. This is visible in Nifty as low as 6,100 strikes have also added a significant amount of interest. However, considering the unpredictability of the pandemic it makes sense to keep the trades limited and protected. Hence, Modified Butterfly on monthly series options is advised. Modified Put Butterfly is a 4-legged strategy where 1 lot of Put close to current underlying level is bought against that 2 lots of lower strike Puts are sold and 1 more lot of Put is bought but closer to the Put sold strike. This keeps the lower but constant profits in case of a downward breakout. This is a risk-averse and a universal strategy.

Story continues below Advertisement

(The author is CEO & Head of Research at Quantsapp Private Limited.)Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!