Anubhav Sahu Moneycontrol Research

The airline sector witnessed a smart recovery in its credit and stock ratings a few years ago on the back of improving passenger load factor and a sharp decline in fuel prices. However, now the reversal of oil prices have put the operational performance of Indian carriers through a trial by fire. And it’s no surprise that the one weakest on the cost curve, Jet Airways, is worst hit.

Last quarterly result

If we look at the last quarterly result, operating expense, excluding one-time maintenance cost, was up 21 percent year-on-year (YoY). High expenses were mainly on account of fuel cost which rose 30 percent YoY and accounted for 32 percent of the operating expense. While the operating income was up 9 percent, higher passenger growth and resultant higher passenger load factor were offset by lower yields. The standalone result at the operating level was a loss of Rs 765 crore.

Declining yields because of intensified competition is a glaring concern. In the last two years, Jet Airways’ quarterly revenue yields have declined by around 13 percent. Spread between revenue per available seat kilometer (RASK) and cost per available seat kilometer (CASK) has sharply declined to negative territory.

Chart: Jet Airways Operating Profit and Spread

Source: Company, Moneycontrol Research

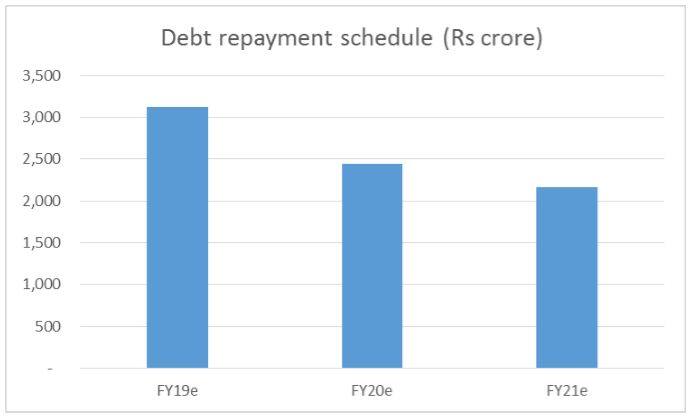

Strained credit profile and Repayment schedule

Post Q4FY18 result, ICRA downgraded the credit rating from BBB- (negative) to BB+ (negative) citing operating weakness, inability to pass through fuel prices and a weak balance sheet. Net debt stands at Rs. 8,149 crore (March FY18) with a heavy repayment schedule. Now, clearly, the company’s current operating performance doesn’t suggest enough cash flow accruals and hence the scenario of a refinancing of repayment is a good possibility.

Source: ICRA

Credit and liquidity improvement initiatives

Jet in the recent past has taken various steps to improve its cash flow situation for debt servicing and operational functioning. A strategic investment by Etihad Airways (operational synergies) has helped in reducing CASK (ex-fuel) by about 2 percent YoY. Further, the company has renegotiated maintenance contracts which can save $100 million annually (effective Jan’19). Additionally, as per media reports, the company has asked for a cut in pilot salaries of as much as 25 percent.

While the above steps may be the need of the hour, current industry dynamics suggest they may not be enough. Looking at pro forma quarterly numbers for next year, incorporating some of the strategic steps by Jet Airways, suggests operating profit may not be good enough and interest coverage may remain negative.

Table: Pro forma quarterly numbers vs. last quarterly number

Source: Company, Moneycontrol Research

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.