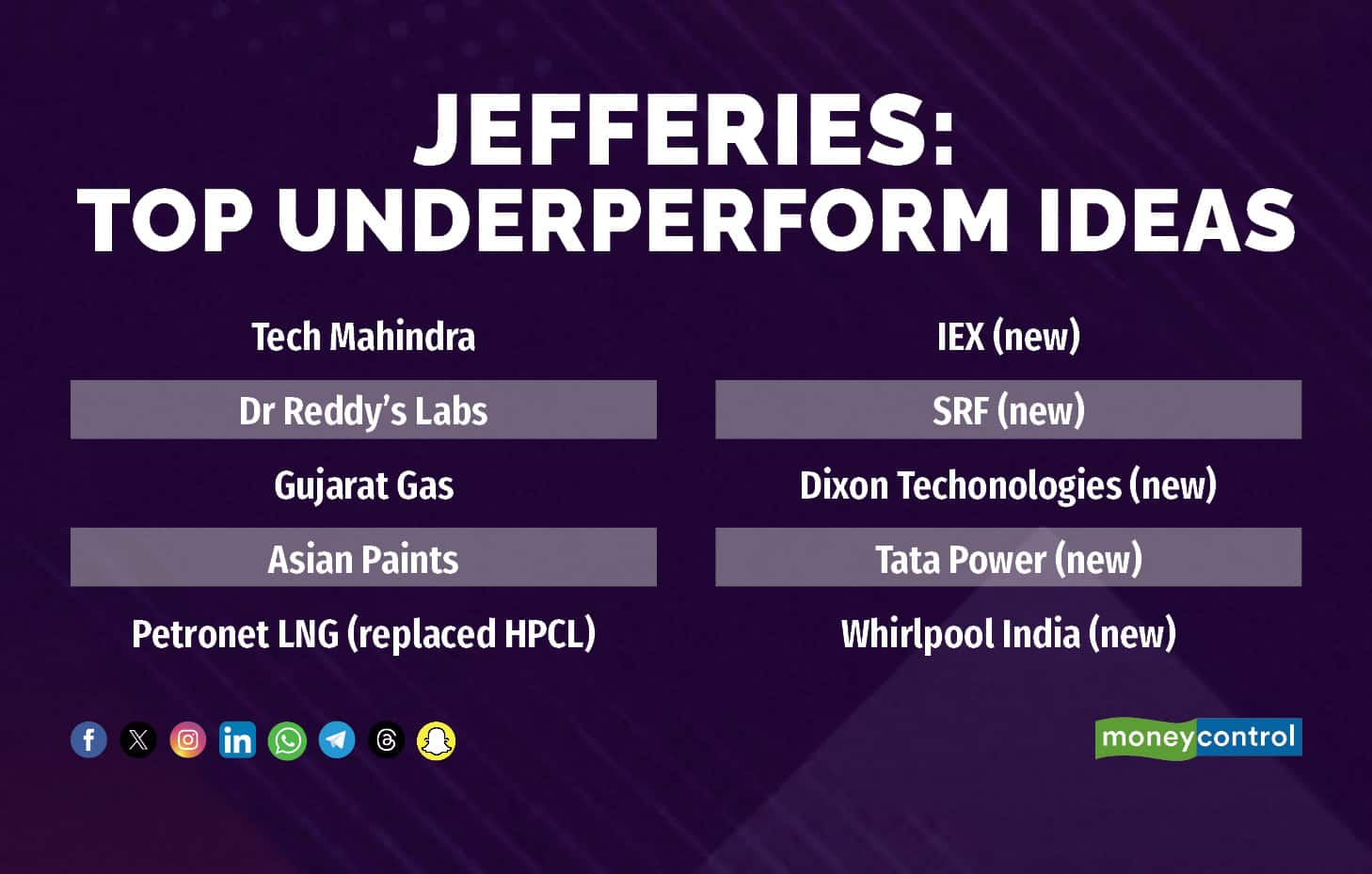

International brokerage Jefferies has updated its top investment ideas with 28 'buy' calls and 10 'underperform' calls, with the number of underperform calls doubling. This move is in-line with Jefferies' cautious view on markets near term.

Some new ideas in the 'buy' list are Cholamandalam Finance, ICICI Lombard, Coal India, Siemens India, ITC, HUL, Jubilant Foodwords, Sun Pharma, Zydus Life and Interglobe Aviation.

On the other hand, some key underperform ideas are Petronet LNG, which replaced Mankind Pharma, while SRF, Dixon Technologies, Tata Power, IEX and Whirlpool of India made fresh entries into the list.

TechM derives 36 percent of its revenues from Communication vertical, which is witnessing a slowdown in the current macro environment, with near-term recovery looking unlikely. Additionally, the brokerage said it remains concerned on execution delays and sustainable returns for Tata Power and prefers NTPC and JSW Energy to play the power upcycle in India.

IEX faces the near-term headwind of the competing exchange, noted the brokerage, which has launched operations and is gaining share. Medium-term, IGX should create material value, but IEX likely will eventually hold only 25 percent.

Key reasons for including Whirlpool in its underperform list, according to Jefferies, include deteriorating margin trajectory over past FY20-24 led by weak volume growth, subdued industry growth along with higher competitive intensity for refs and washing machines – which are key categories for the firm.

Also Read | CLSA reiterates 'outperform' call on Shriram Finance amid stable asset quality, margins

For Dr Reddy's, Jefferies said that IQVIA data for May/Jun 2024 indicate the pharma giant losing market share in its top 10 drugs which include gVascepa, gCiprodex and gSuboxone. US accounts for 53 percent of current revenue, and the 3 mentioned products have an annual revenue contribution of $417 million.

The Indian paint industry has enjoyed an oligopolistic structure providing significant pricing power, with Asian Paints enjoying a strong leadership. However, Grasim’s plan to invest Rs 10,000 crore in paint capex by FY25, well above the gross block of Asian Paints raises concerns.

SRF's specialty chemical portfolio derives ~88 percent revenues from intermediates and only 12 percent from Active Ingredients. Intermediates face stiff Chinese competition and price erosion, said Jefferies.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.