Diversified FMCG-to-cigarettes conglomerate ITC will report its earnings for the first quarter of the current fiscal year on August 1, 2025. The FMCG player is likely to report the highest revenue among all its listed peers.

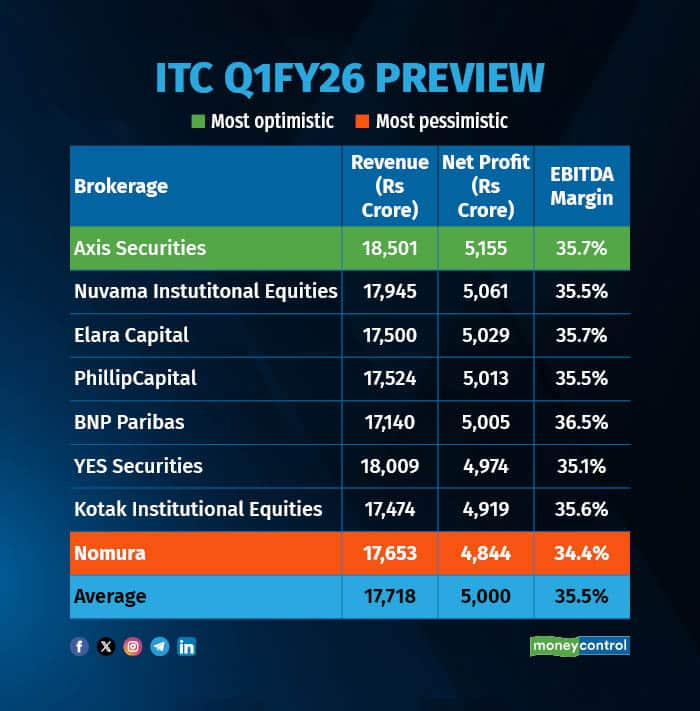

According to a Moneycontrol poll of eight brokerages, ITC is likely to report revenue of Rs 17,718 crore, rising 4.2 percent year-on-year compared to Rs 17,000 crore in the April to June quarter of FY25.

Net profit is likely to come in at Rs 5,000 crore in Q1FY26 as against Rs 4,921 crore in the year-ago period, a growth of one percent.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock. The most optimistic estimate sees ITC’s net profit growing 4.8 percent year-on-year, while the most negative projection sees a fall of 1.6 percent in net profit for the quarter.

What factors are impacting the earnings?

Cigarettes

For the quarter ended June, cigarette volumes are likely to rise in the range of 3 to 5 percent, according to most brokerages. According to BNP Paribas, the cigarette business’ net revenue may grow 7.5 percent YoY, while volume growth contributing three percent and the rest led by pricing and mix.

"Higher leaf tobacco prices to continue to pressure cigarettes EBIT margins, leading to 4 percent cigarette EBIT growth," according to Japan-based brokerage Nomura.

Segments performance:

In the FMCG segment, Kotak Insituttional Equities believes that revenue is expected to grow by around 5 percent year-on-year, compared to 4 percent and 3.7 percent in the third and fourth quarters of FY25, respectively.

The agri business is likely to see a stronger performance with a 10 percent year-on-year growth. In contrast, the paperboards segment is expected to post a muted 6 percent year-on-year growth amid challenging operating conditions, including weak domestic and export demand, lower net realizations, and an influx of cheaper Chinese supplies.

EBIT margin for the paperboards business is estimated at around 10 percent, slightly above the 9.6 percent and 9.2 percent recorded in the previous two quarters.

Margins

"We expect a 5 percent YoY growth in cigarette EBIT, though margins may contract 40 bps due to rising leaf tobacco prices. In the FMCG business, we expect a 16 percent decline in EBIT, with a 170 bps margin contraction as price hikes lag RM inflation," said Motilal Oswal.

What to look out for in the quarterly show?

Analysts will closely monitor demand in metro areas compared to the rural outlook, along with the competitive intensity.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.