Several analysts warn that surging oil prices, combined with instability in West Asia, could impact foreign institutional investor (FII) flows to Indian markets. Rising crude prices could put pressure on fiscal and current account balances due to increased import costs.

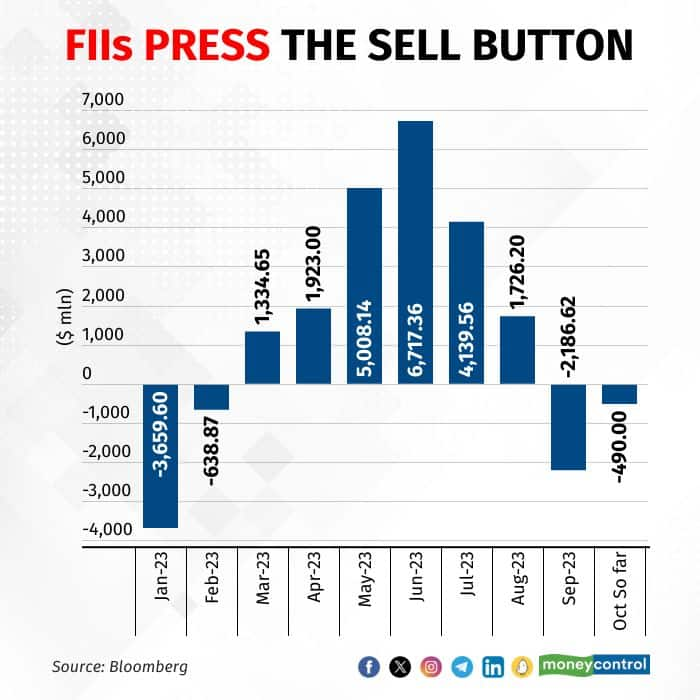

In September, FIIs sold around $2.19 billion in local equities, the highest level in six months, after investing around $17 billion since April. So far in October, they have sold around $500 million.

The US Fed might raise rates once more, analysts expect, which could strengthen the dollar. US 10-year yields are at their highest since 2007, at around 4.7 percent, due to the expectation of a prolonged high-interest rate policy.

Meanwhile, analysts believe the US is experiencing positive economic momentum, reducing the likelihood of a recession. The job market remains strong, with a steady 3.8 percent unemployment rate and the addition of 336,000 non-farm jobs in September. Q2 2023 annualised GDP growth has risen to 2.1 percent, and the service sector (September PMI at 50.1) indicates expansion. There is optimism that the Fed can achieve a "soft landing." US inflation has improved, with the core PCE index up only 0.1 percent, the smallest increase since November 2020. However, US retail sales in September 2023 showed a slight 0.6 percent month-on-month moderation.

Read: TCS revenue growth disappoints, margin ‘surprised positively’: Jefferies

Recently, brokerage Prabhudas Lilladher was cautious on Indian markets due to factors such as El Nino's impact on crops, inflation, low chances of an interest rate cut in India, expected US interest rate hikes, and political uncertainty ahead of the Lok Sabha elections. Now, it believes that more challenges have arisen with recent spikes in crude oil prices and geopolitical tensions related to the conflict in Israel. Additionally, the brokerage sees a split in the domestic economy, with strong demand for premium and luxury goods while basic goods struggle due to inflation. The market's future hinges on festive demand in the coming months, it added.

"We believe the gap between INR and USD treasury rates suggests that the gap between the two could reduce further, which can accelerate outflows. India is also heading for state and general elections over the next 6-8 months, which could increase political uncertainty and impact FII inflows,” Prabhudas Lilladher said in its latest note.

The brokerage says consumer goods consumption could face challenges from past rate hikes and uncertainties such as El Nino. Still, the festive season and election-related fiscal spending could help. However, the global merchandise trade slowdown might not boost the external sector. Lower input costs' advantage may fade due to recent commodity price increases, especially crude oil.

Read: Infosys Q2 preview: Tepid revenue likely amid weak spends, profit may grow 3% QoQ

Some analysts say that the FII flows can be very volatile and unpredictable and that it is not practical to make any forecasts in the short term.

“We track FII flows on a 12-month rolling basis and it gives us some sense of the trend ahead. On a 12-month rolling basis, FII flows turned positive only in May 2023 after a long gap after December 2021,” said Gaurav Dua, Senior VP & Head – Capital Market Strategy, Sharekhan by BNP Paribas. Normally, the 12-month rolling remains posted for 10-12 months after moving from the negative to the positive side, Dua added.

Meanwhile, despite these problems, some analysts believe that negative sentiments in the local equity market will be short-lived. Global financial services group Nomura recently upgraded India to overweight from Neutral, seeing market losses as buying opportunities. It argues that India’s potential for supply chain diversification away from China will attract investor flows.

Global brokerage CLSA also raised its India allocation to ‘20 percent overweight’ from ‘40 percent underweight’, hoping that the country's strong economic fundamentals will help sustain the momentum in the equity market.

Analysts further suggest that the outflows from FIIs are unlikely to destabilise the local market. Domestic institutional investors such as mutual funds, provident funds, and insurance companies have become stabilisers in the Indian stock market, countering FII-induced volatility. This trend is expected to continue due to low financialisation of savings in India, leading to more money flowing into mutual funds and pension funds, benefiting the stock markets.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!