IT major Infosys is likely to see a marginal decline in revenue on a sequential basis to Rs 37,694 crore in the July-September quarter of fiscal year 2023-24 (Q2FY24) amid weak discretionary spends and slower deal ramp-ups, said analysts. However, easing margin pressures from a weaker rupee may help the company to register 3.5 percent quarter-on-quarter (QoQ) net profit growth in Q2FY24.

Analysts believe that continued rationalisation of discretionary programmes, along with extended timelines for execution of existing ones is leading to the leakage of revenues and weak trends.

On a year-on-year (YoY) basis, Infosys’ revenue is forecast to grow 3 percent, whereas net profit is estimated to grow at 2.2 percent, per the average estimate of five brokerages.

Besides that, the Bengaluru-headquartered company’s earnings before interest and tax (Ebit) margin is likely to decline 20 basis points (bps) YoY to 21.3 percent in Q2FY24 from 21.5 percent in Q2FY23. However, sequentially, it is expected to expand 50 bps from 20.8 percent in Q1FY24, owing to a weaker rupee and the absence of any wage hikes.

That apart, the company’s profit-after-tax (PAT) is projected to grow 2.2 percent YoY and 3.5 percent QoQ to Rs 6,156 crore in the quarter ended September, said analysts.

Infosys is expected to reiterate its FY24 growth guidance of 1-3.5 percent YoY in constant currency (CC) terms and margin guidance of 20-22 percent.

On the bourses, shares of Infosys surged 7.5 percent during the July-September period,against a 2 percent rise in the Sensex benchmark.

ALSO READ: TCS Earnings Preview Q2FY24: Moderate growth to continue despite major deal wins

Key monitorables: Investors will watch out for the management’s commentary on the ramp-up timelines of mega deals, margin levers, especially noting that back-ended growth guidance is based on typically margin-dilutive large and mega-deals, a discretionary spending environment, especially in impacted verticals, the reasons for senior leadership exits and replacements, and the effective date for a wage revision.

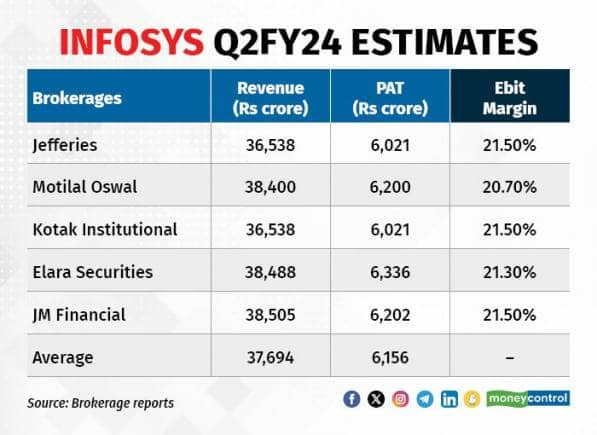

Here’s what top brokerages estimate for Infosys’ Q2FY24 numbers:

Jefferies

The global brokerage firm forecasts revenue growth to remain soft at 1 percent QoQ in constant currency (CC) terms to $4,555 million—in line with the previous quarter, owing to continued weakness in discretionary spends while deal ramp-ups help absorb some impact of the revenue leakage. In rupee terms, revenue is pegged at Rs 36,538 crore in Q2FY24, up 1.6 percent QoQ and 5.5 percent YoY.

The IT major’s margin, meanwhile, is expected to expand 20 bps QoQ driven by higher utilisation and cost efficiencies. Analysts expect the company to retain its FY24 growth guidance of 1-3.5 percent YoY in CC terms and margin guidance of 20-22 percent.

Motilal Oswal

Analysts see muted revenue growth of 0.8 percent in CC terms for Infosys due to the demand slowdown and lack of a meaningful contribution from recently signed mega deals. Though deal total contract values (TCVs) look attractive amid mega wins in recent days, the analysts said they would closely monitor the ramp-ups of these wins.

The operating margin, however, is expected to remain stable due to weak topline growth, which entails no wage hikes this quarter. The brokerage firm shared a ‘buy’ call on the counter, with a target price of Rs 1,680 per share.

ALSO READ: Will the IT sector turn the corner in Q2? Here’s what analysts are saying

Kotak Institutional Equities

The brokerage firm projected Infosys adjusted PAT to grow 4.5 percent QoQ to Rs 6,215 crore in Q2FY24 from Rs 6,021 crore in Q1FY24. The company’s Ebitda, however, is expected to decline marginally, by 0.6 percent QoQ to Rs 9,005 crore in the September-ended quarter. As a result, the Ebit margin is likely to see a drop of 22 bps QoQ to 23.5 percent.

On the deal TCV front, analysts foresee large announcements of $5-5.6 billion, retaining the revenue growth guidance of 1-3.5 percent in CC terms.

Elara Securities

Analysts see deal momentum in the September-ended quarter being led by the banking, financial services and insurance (BFSI) and communications segments, given the Danske Bank deal worth $454 million in the former and Liberty Global’s 1.5-billion-euro megadeal in the latter. That apart, analysts observed that the IT services company may clock a 50 bps margin expansion on a sequential basis to 21.3 percent in Q2 amid the absence of wage hikes.

JM Financial Institutional Securities

The brokerage firm expects revenue to grow in 1 percent QoQ in CC terms with 20 bps cross-currency tailwinds translating into 0.8 percent QoQ revenue growth in dollar terms. A weaker rupee, coupled with operational efficiencies, is expected to improve Infosys’ Ebit margins by 24 bps QoQ. On the other hand, the company’s net profits are expected to surge 4.3 percent QoQ to Rs 6,202 crore in Q2FY24.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!