IndusInd Bank is likely to report 17 percent year-on-year (YoY) rise in net interest income (NII) in the October-December quarter (Q3FY23-24) led by strong credit growth, said analysts. Profit, too, is seen to be growing by 16.5 percent YoY, aided by healthy income and margin improvement. The private sector lender will report Q3 results on January 18.

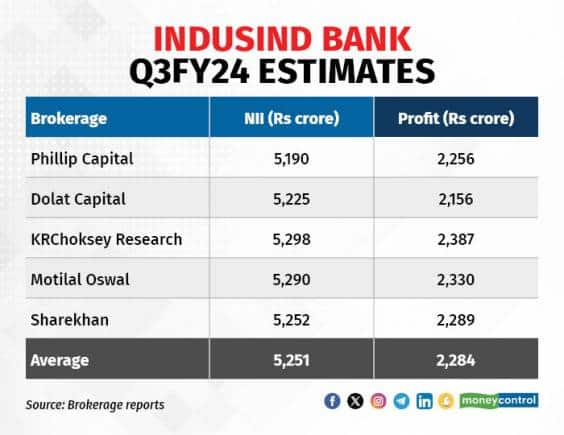

According to an average estimate of five brokerages, IndusInd Bank's NII is projected to grow to Rs 5,251 crore in Q3FY23-24 compared to Rs 4,495 crore in Q3FY22-23. Profit-after-tax (PAT) may rise to Rs 2,284 crore against Rs 1,959 crore in the corresponding period last year.

A gradual moderation in the cost of funds, or borrowing costs, is expected to keep net interest margins (NIMs) of the private sector lender stable at 4.28 percent in Q3FY23-24 versus 4.27 percent in the year prior, said analysts.

ALSO READ: Buy IndusInd Bank; target of Rs 1900: Motilal Oswal

Regarding asset-quality, the gross non-performing assets (GNPA) is predicted to improve to 1.9 percent from 2.1 percent in the year-ago period, as per analysts at Motilal Oswal Financial Services. The net NPA, on the other hand, is expected to remain steady at 0.6 percent in the December-ended quarter.

Some of the key factors investors should watch out for post the Q3 results are: the outlook on retail deposit mobilisation, the margin trajectory, and the management's growth outlook.

IndusInd Bank's Q3 business update

The private sector lender's net advances grew 20 percent YoY to Rs 3.2 lakh crore in Q3FY23-24, per an exchange filing. Total deposits, meanwhile, jumped 13 percent on-year to Rs 3.7 lakh crore in Q3FY23-24, from Rs 3.25 lakh crore in the year-ago period.

Retail deposits and deposits from small business customers amounted to Rs 1.65 lakh crore as of December 31, 2023. The bank’s CASA ratio (the ratio of deposits in current and savings accounts, to total deposits) stood at 38.5 percent as of December 31, 2023, versus 42 percent in the year-ago period.

ALSO READ: Banking Central | Indian banks finally wake up to problem of mis-selling

Stock performance and valuation

In the October-December period, the stock of IndusInd Bank surged over 11 percent to outperform the Bank Nifty index, which gained only four percent. Moreover, the bank’s shares were up over 36 percent in a the year as against a 13 percent jump in the Bank Nifty index, according to the data.

Valuation-wise, IndusInd Bank's price-to-earnings (PE) ratio is 14 based on FY23-24E and 12.4 based on FY24-25E, said analysts at Sharekhan. The brokerage firm shared a 'buy' rating on the counter, with a target price of Rs 1,850 per share (as against last close of Rs 1,688).

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!