Indian alcoholic beverage (alcobev) companies are doubling down on premium spirits with new launches as young and aspirational drinkers drive double-digit growth in this category.

Analysts said alcobev companies are focusing on driving growth through innovation and the introduction of products in the premium-to-luxury segment in the coming quarters.

“The launch of new premium products has been a growth driver for alcobev companies as there is more adoption in the 18+ category users who want to try new products,” said Ajay Thakur, an analyst at Anand Rathi Institutional Equities.

Radico Khaitan recently introduced the 1999 Spirit of Victory Whisky, priced at Rs 5,000 per bottle, alongside the successful Rampur Single Malt. United Spirits introduced the McDowell's No. 1 premium smooth variant, positioned above the core McDowell's No. 1 Luxury offering, in Assam as part of its efforts to introduce products regionally, too.

“Companies focusing on brand innovation are poised to achieve stronger growth compared to their competitors, thereby gaining a competitive edge,” said Karan Taurani, vice president at Elara Capital.

Over the past two years, Radico Khaitan has seen impressive growth in its Prestige & Above (P&A) Category. Magic Moments vodka reached a milestone of 5 million cases, while Morpheus brandy surpassed 1 million cases. The 1965 Premium rum and 8PM Premium Black whisky have achieved milestones of 1 million and 3 million cases, respectively.

In the alcohol industry, a "case" typically refers to 12 bottles of 750 ml each, although the number of bottles could vary by company.

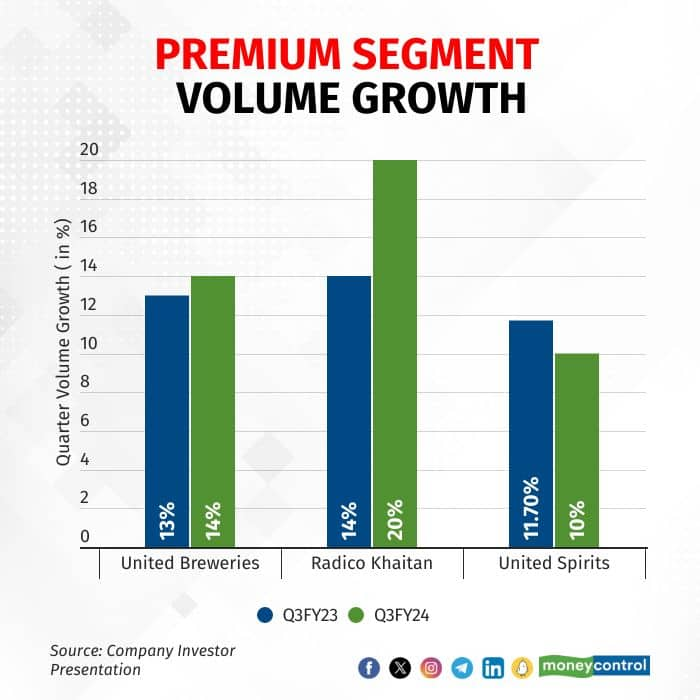

Analysts noted the premium category is growing in the range of 12-15 percent. For Radico Khaitan, this category now accounts for half of its sales volumes.

“For three years or five years, at this point of time, we were in our volume terms around 35 percent P&A. Now, we stand 50 percent almost in volume, so it is a consistent growth in our existing flagship brands and then new brands,” Dilip Banthiya, CFO of Radico Khaitan, said on an earnings call.

The industry's luxury category, particularly upper-premium products, has been expanding at over 20 percent. However, the mass category has been growing at 2-5 percent.

“This stark contrast in growth rates can be attributed to the negative impact of broader inflationary trends on the mass category, whereas the prestige and luxury segments continue to exhibit robust growth.” said Taurani.

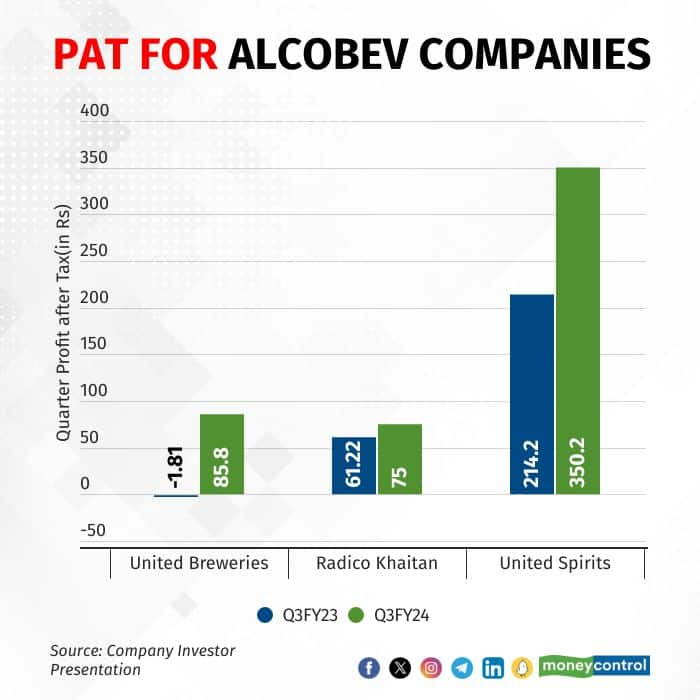

United Spirits’ P&A segment clocked growth of 10 percent year-on-year and overall net sales value growth of 7.5 percent year-on-year.

“The premium and luxury end is continuing to spend, continuing to experiment, continuing to do repertoire drinking, especially experimenting with white spirits, drinking out-of-home, whereas middle-India or the value-oriented consumer is actually cutting down on the number of occasions to manage their wallets,” said Hina Nagarajan, MD and CEO of United Spirits.

United Breweries reported strong double-digit growth in some of its key premium brands like Ultra Max, the management said on a post-earnings call. Taurani noted that in terms of growth, user adoption is the highest for beer and whisky in the premium segment.

For the alcobev industry, the cooling of prices of major commodities such as glass and barley suggests that most companies will likely improve growth over the previous quarters. Glass is used for packaging alcoholic beverages. Barley provides fermentable sugars in beer and whisky production.

However, prices of Extra Neutral Alcohol (ENA), the primary raw material, have yet to stabilise. ENA is generally imported and makes up almost 40 percent of the total costs of liquor companies.

“ENA remains volatile and may continue to weigh down on margins,” said Thakur of Anand Rathi.

Taurani noted that the growth rates might slow because elections are coming up. Additionally, states such as Telangana, Haryana, Assam, Maharashtra, Rajasthan, Delhi, Karnataka, and Uttar Pradesh have increased alcohol prices.

“This will result in alcoholic beverages like beer and spirits to become more expensive for consumers, resulting in a slight decrease in consumption trends,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!