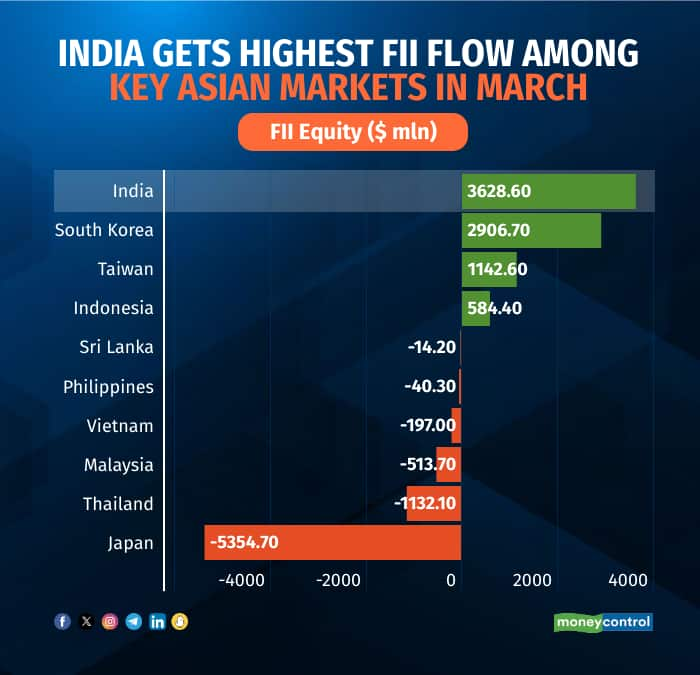

India has beaten rest of the Asian markets by attracting the highest foreign funds flow in March, defying geopolitical crises and concerns that the higher interest rate regime will continue for some more time.

Foreign Institutional Investors (FIIs) pumped $3.63 billion into Indian equities in their biggest buying binge since December 2023. Domestic institutions continued to be net buyers, investing around Rs 52,467 crore in the market to hit a four-year high.

Outside India, South Korea, Taiwan and Indonesia were the investment destinations for FIIs, while they chose to pull out money from markets in Japan, Malaysia, the Philippines, Thailand, Vietnam and Sri Lanka. South Korea received inflows of $2.91 billion, Taiwan $1.14 billion and Indonesia $585 million. The Japanese market recorded the biggest FII outflow of $5.35 billion, followed by Thailand and Malaysia at $1.13 billion and $514 million. In Vietnam, the outflow reached $197 million, and $40 million in the Philippines.

Deepak Jasani, head of retail research at HDFC Securities, attributed the net FII figures to purchases of stocks through block deals and index rebalancing in March. A steep correction in the market also threw up an opportunity to buy undervalued stocks, including small and mid-caps. For DIIs, cash reserves helped raise their equity holdings. With March being the year-end month, investors try to book fresh positions and clean up their books. This also fuelled the buying binge, according to him.

March witnessed significant block trades, including BAT Plc selling its stake in ITC for Rs 17,485 crore, Rakesh Gangwal divesting in Interglobe Aviation for over Rs 7,800 crore, Tata Sons selling off around 1 percent stake in Tata Consultancy Services for Rs 9,000 crore, and Singtel diluting its stake in Bharti Airtel for Rs 5,849 crore.

Gaurav Misra, Head - Equity at Mirae Asset Investment Managers, said Domestic institutions have been buyers and FIIs sellers in aggregate, except for MSCI-related rebalancing. Domestic mutual funds and possibly AIF have been sitting on cash which would have been deployed in stocks where they have bottom-up comfort. This is despite some cohorts of the market being at a premium.

So far in March, the benchmark Sensex and Nifty indices lost 0.1 percent each, while BSE MidCap and SmallCap declined 0.7 percent and 5.53 percent. The correction in the Indian markets were triggered by factors such as ED raids on a major market player, Sebi warning about market froth, concerns about liquidity stress tests by mutual funds, and fears of RBI intervention against stock market inflows.

Analysts said that despite the buying binge of the institutional investors, liquidity has dried up after recent actions by the RBI and enforcement agencies, impacting market operators and HNIs reliant on leverage. They added that NBFCs were reassessing lending against shares, reducing the overdraft facilities for HNIs. This forced liquidation of positions, triggering a cycle of falling prices and panic selling. However, analysts expect mutual fund SIP flows are expected to remain stable, and attractive valuations may draw in investors waiting on the sidelines. Stocks linked to dubious entities might take longer to recover, while fundamentally sound ones may rebound more swiftly, they added.

Brokerage Nuvama Research in its latest report suggests turning bullish after the recent correction in mid and small-cap stocks. They view the current phase as a correction within an ongoing bull market, reaching oversold conditions at key support levels, recommending long positions.

The broader market, previously overheated, has undergone a healthy decline, likely marking the end of the correction phase and the resumption of the bull market. Large caps have also experienced corrective phases without significant damage to the Nifty50. Strong global market tailwinds, upcoming earnings seasons, and general elections indicate favorable risk premiums for long positions in the market, it added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!