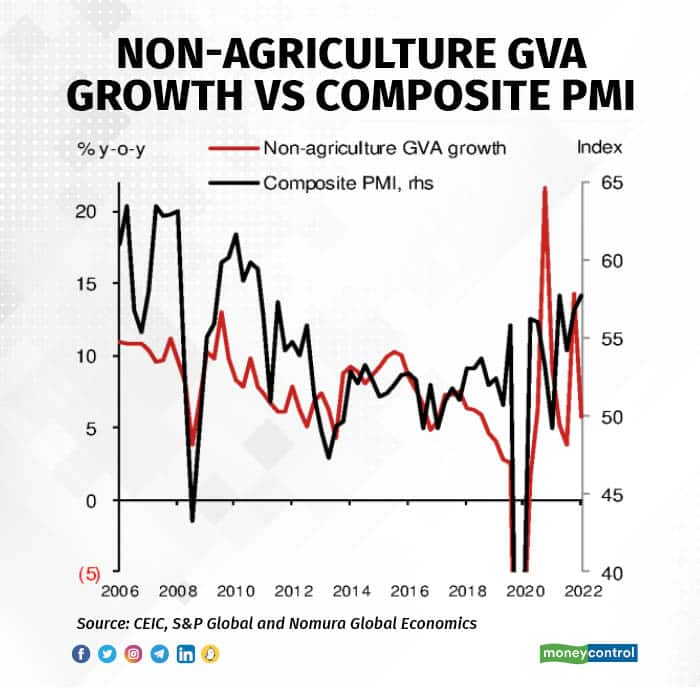

Strong numbers reported for Purchasing Managers’ Index (PMI) for December were cheered, but historically PMI readings have been poor indicators of economic growth, according to economists at Nomura.

They retained their below-consensus estimate for GDP growth at 4.5 percent year on year in CY23. The growth figure will moderate from 7.7 percent in CY22 because of spillovers from recession in developing markets (DM) and lagged effect of the domestic monetary-tightening policy.

Also read: The curious case of falling IIP and rising PMI

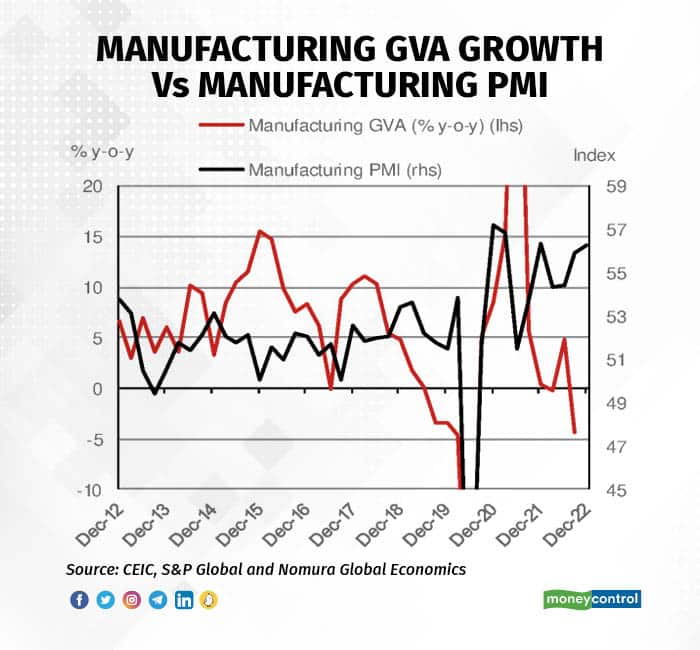

In their latest report, economists Aurodeep Nandi and Sonal Varma wrote, “we argue that PMIs are a poor indicator of GVA (gross value added) growth, and most of the post-pandemic trends have diverged from the PMI readings, especially in manufacturing”.

“Real economy data for November-December suggest that overall activity appears to have peaked around mid-2022, with consumption and the services sector lagging, while the industrial sector has fared relatively better,” they added.

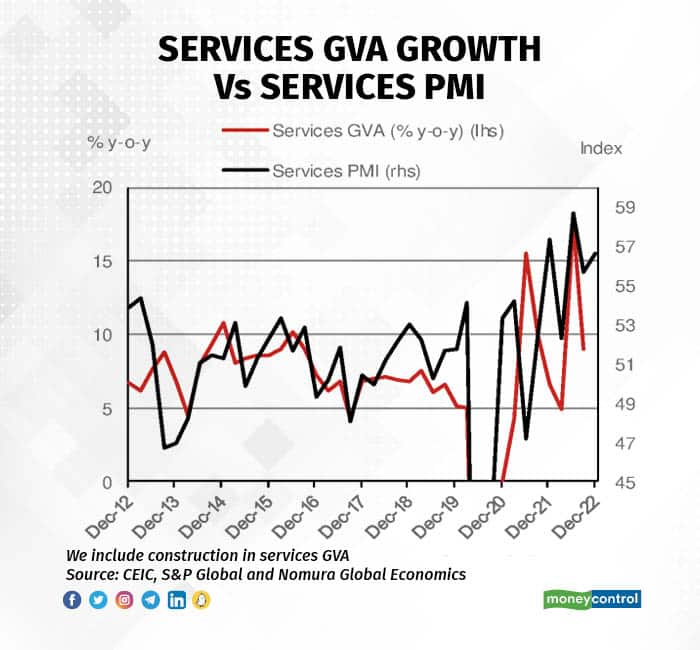

The services PMI was found to have a relatively higher correlation coefficient with services GVA growth…

..the manufacturing PMI was found to have a lower correlation with manufacturing GVA growth.

PMI was compared against Nomura’s index that tracks normalisation of economic activity to pre-pandemic level. The Nomura India Normalisation Index (NINI) filters out seasonal and base effects and pegs performance of high-frequency indicators to pre-pandemic levels (set at 100), for the industry and services sectors.

“We find that over the past two years, the manufacturing PMI has largely understated the inherent performance of industrial sector indicators. Based on early data for December, our analysis of real economy indicators shows that the industrial sector was ~8pp above its pre-pandemic level, while the manufacturing PMI was up only 5.3pp,” it stated.

“In the case of services, the two series (NINI and PMI) seem to have a stronger correlation. However, until Q1 2022, the PMI was overstating the extent of the services sector recovery, and since then it has been understating the extent of the recovery,” it added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.