While global markets have staged a smart rally over the past year, Indian markets have remained lacklustre. According to strategists and experts, one of the reasons behind the underperformance is India’s position as an ‘anti-artificial intelligence’ play.

“The focus of global tourist capital, the one that looks at short-term returns, has been on AI. And India does not really offer an AI trade,” said Ridham Desai, Managing Director at Morgan Stanley India, who spoke at CNBC-TV18’s Global Leadership Summit.

Neelkanth Mishra, the Head of Global Research at Axis Capital also chimed in. He said that the view among foreign investors is not just neutral on India, it’s actually negative. “They see India as an AI loser, while Taiwan and South Korea are AI winners because of companies like TSMC and Samsung that directly benefit from the AI boom. India, on the other hand, is not only absent from the AI opportunity, but investors believe Indian IT and GCCs could actually suffer because of it.”

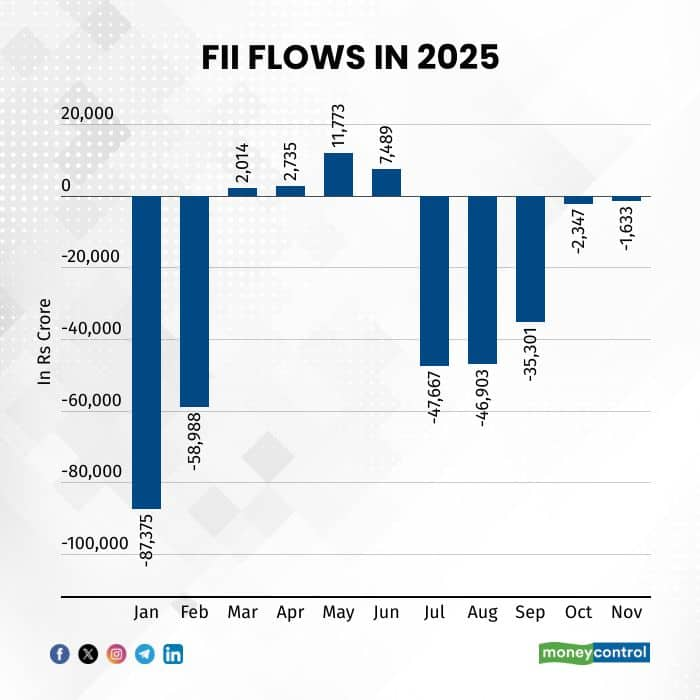

Therefore, as Dalal Street does not offer many AI or AI-related stock opportunities for investors, foreign investors have rotated their money out of India, into other emerging markets. So far this year, FIIs have sold off nearly Rs 2.5 lakh crore in the cash markets.

This, in turn, has weighed on the benchmark indices, which have given investors poor returns. Foreign institutional investors have already been steady sellers in Indian equities. Weak earnings growth has kept sentiment subdued despite government attempts to boost consumption.

In comparison, most emerging markets that have exposure to the AI theme have given investors stellar returns. Global AI plays have absorbed much of the capital moving out of India.

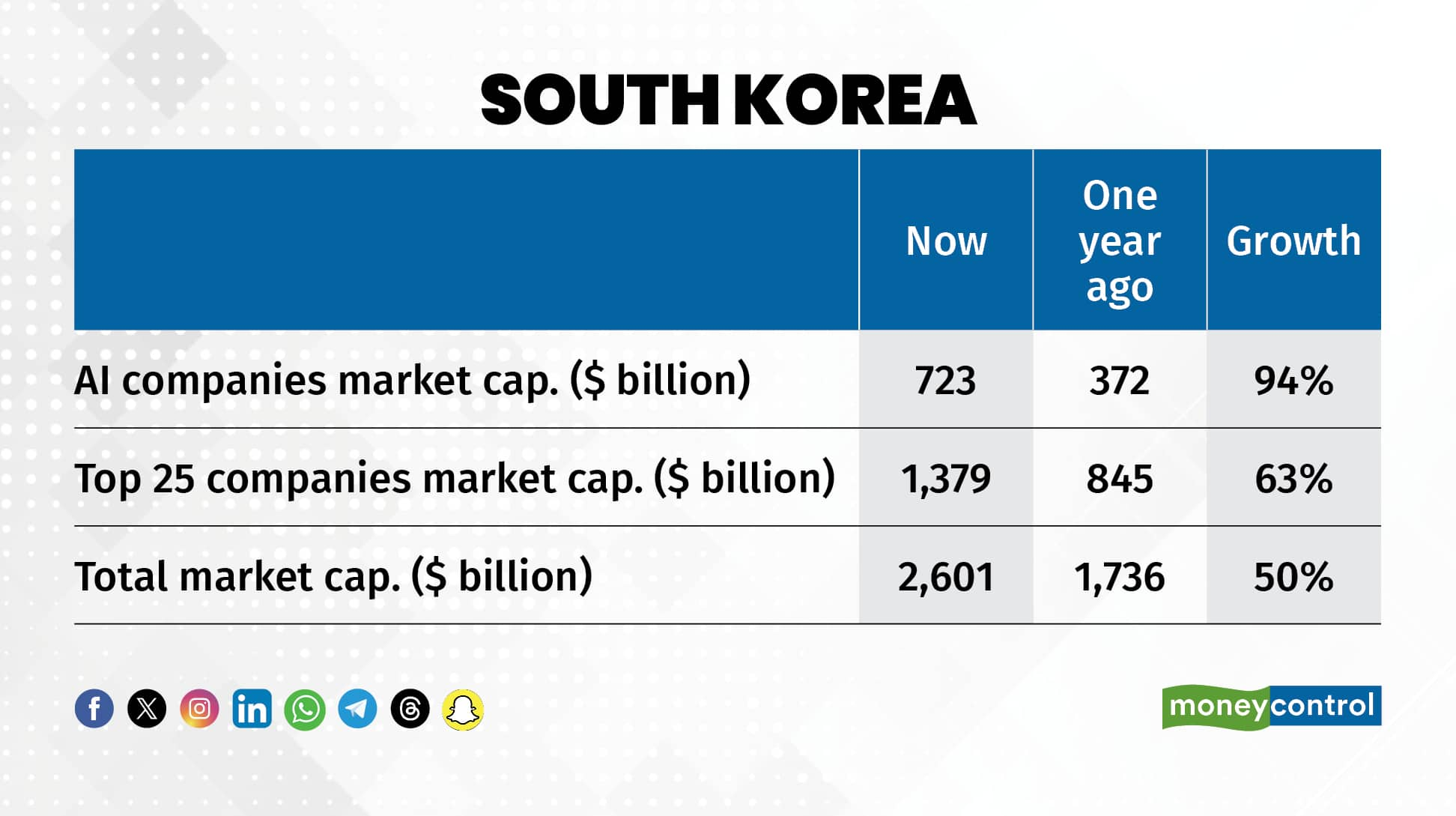

On the emerging markets front, there is a clear rotation towards tech-heavy markets like South Korea and Taiwan, as India’s valuations remain elevated and earnings momentum stays weak.

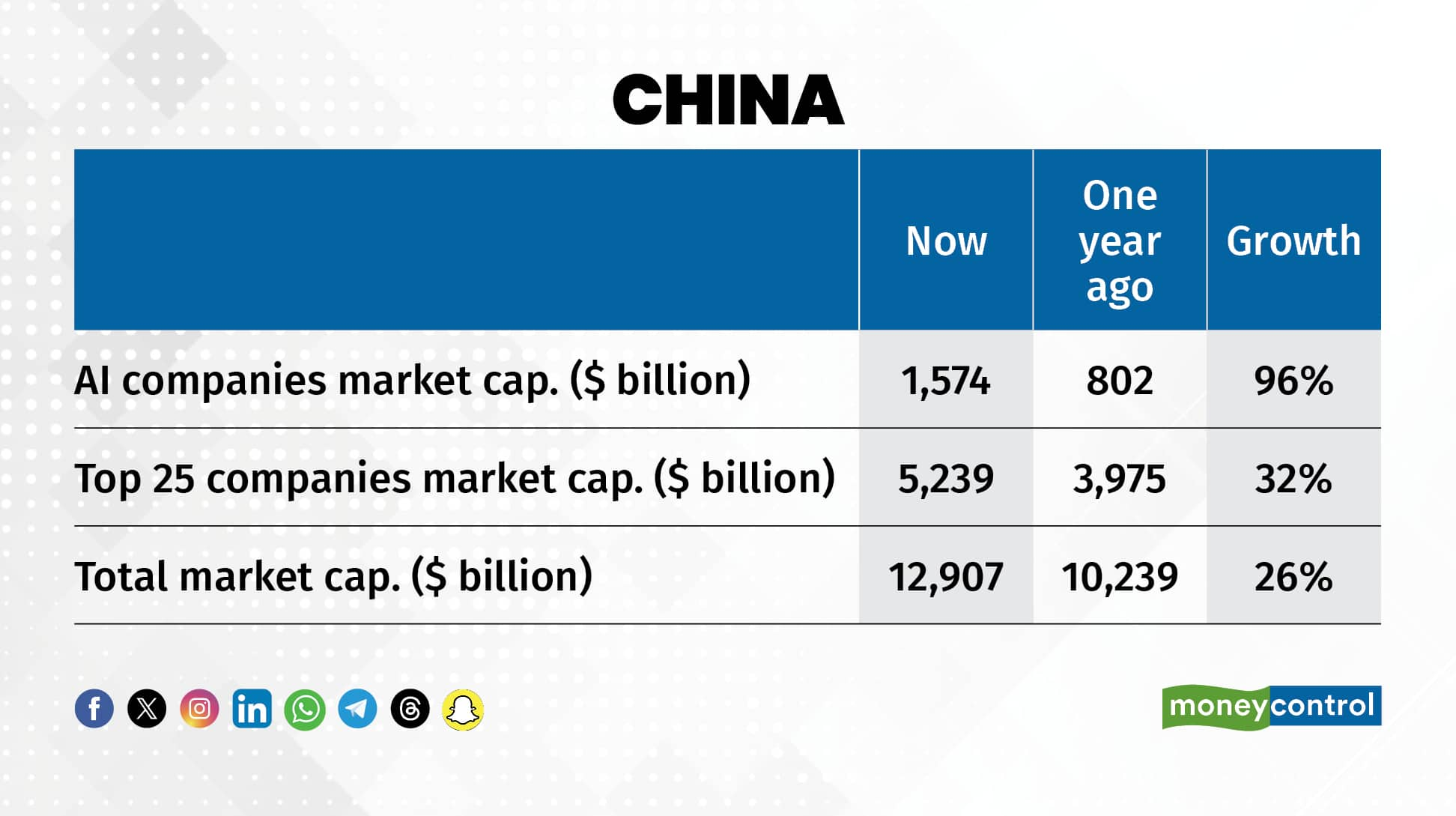

In the September quarter alone, FIIs bought fifteen billion dollars of Taiwanese equities, which is the highest quarterly inflow ever. Positioning in South Korea is now at its strongest in more than a decade, while foreign investors continue trimming their exposure to India. China leads with AI company valuations nearly doubling in a year, growing ninety six percent.

South Korea is close behind, with the market-cap of AI firms jumping ninety four percent in one year.

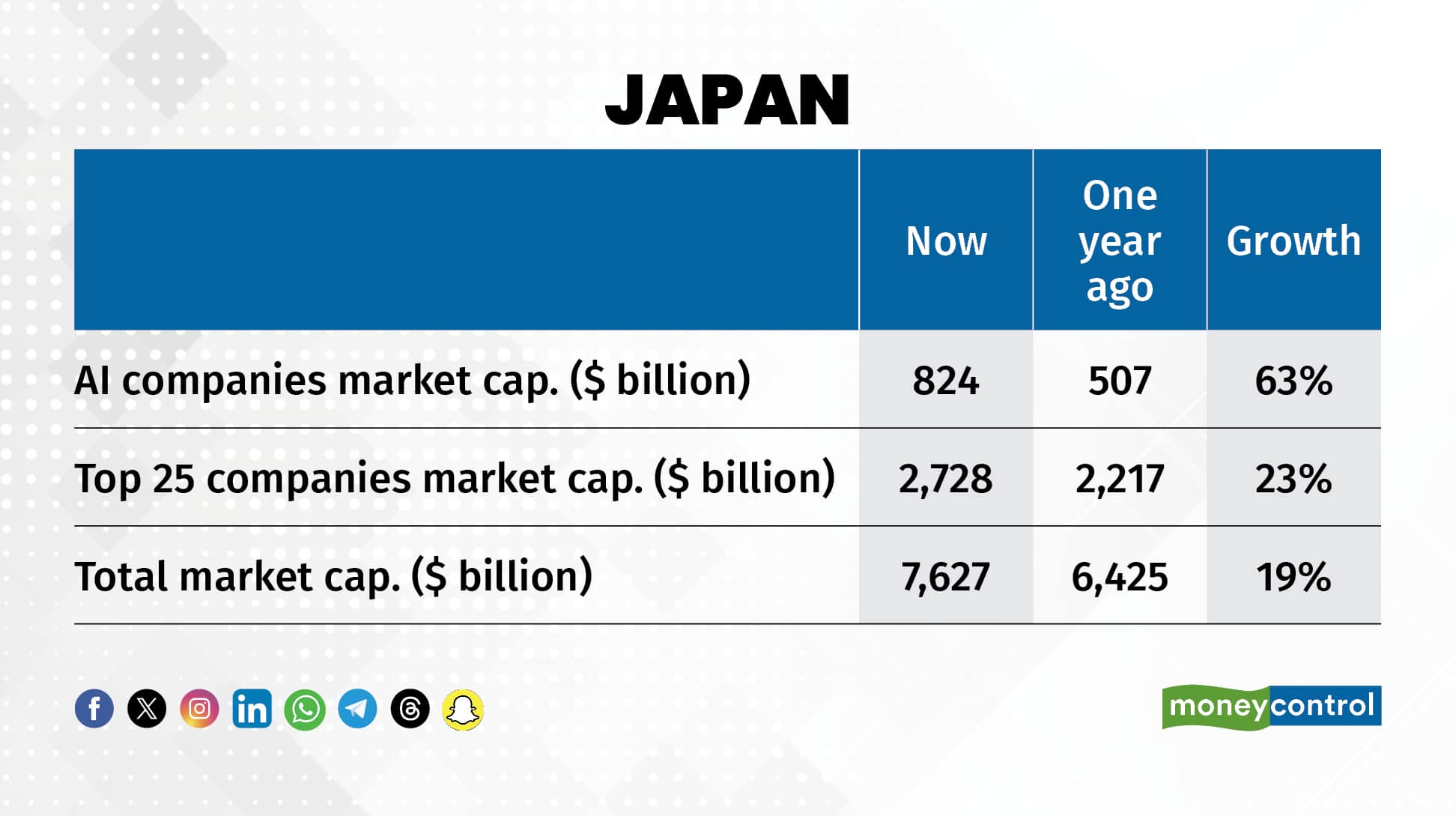

Japan and Taiwan are also seeing strong momentum, with AI market caps rising more than sixty percent and forty seven percent.

And in the US, the world’s biggest AI market, valuations continue to surge, with AI companies adding over forty percent in the past year. Across regions, the AI trade is powering some of the strongest equity gains.

However, there is still hope for India. As domestic earnings see an improvement, with the government’s repeated attempts to boost consumption, FY27 may be a better year for equities.

Not just that, experts have noted that the AI rally could be losing steam. The Nasdaq slipped three percent last week, indicating the first real pause, while the Bloomberg AI index slipped 4 percent last week.

"If this trend persists without high volatility, that would make the US market healthy, preempting a bubble formation and its eventual burst. Investors have to watch how this trend plays out," said VK Vijayakumar, Chief Investment Strategist, Geojit Investments.

He added that FIIs, particularly the hedge funds, who have been consistently selling in India and taking money out for playing the AI trade, are now likely to pause and slowly reverse the AI trade in favour for non-AI trade in countries like India.

And the timing aligns well. Earnings growth in India is improving and is expected to accelerate, which will provide fundamental support for a potential rally going forward.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.