The quality of copper in Chile, the top producer of the metal, is dropping and this could increase inflationary pressure, according to the CIO of a macro-investing fund.

In a tweet titled “Copper's Declining Ore Problem”, Foundation Capital's Brandon Beylo explained how the falling copper-ore grades could create higher inflationary cycles.

Also watch: What does US economic data mean for commodities?

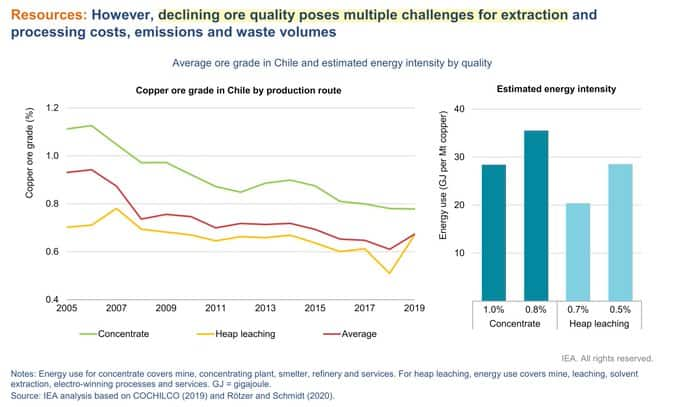

He said in Chile, the ore grades had declined from around 0.90 percent to about 0.60 percent.

This, according to him, means more mining, more extraction, more fuel demand, more energy output, more water demand and higher labour costs.

Copper ore grades have declined from ~0.90% to ~0.60%.

Copper ore grades have declined from ~0.90% to ~0.60%.

Copper prices have been falling since January 2023 and global investors have been shorting the metal on gloomy macro indicators, including weak economic data from China and the worry of slowing growth in the US.

But the data shared by Beylo shows that the trend may not sustain.

The metal has applications across sectors, including housing, power generation and mobility, and is often used as an indicator to track the health of the world economy.

Ä Reuters report said, “Investment funds have turned net short of the London Metal Exchange (LME) copper contract for the first time since June 2020, mirroring the bearish positioning already established on the CME's contract.”

As LME three-month copper fell to a year-to-date low of $7,867 per tonne, Goldman Sachs toned down its bullish stance on the metal and said that "we were wrong on price expectations".

The investment bank has cut its price forecasts but still expects copper to hit $10,000 per tonne in 12 months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.