India VIX has more than doubled so far in 2020 from reading above 11 to 25.20 recorded on March 2, but experts feel that market could well be nearing the bottom based on anecdotal data.

The recent outbreak of Coronavirus has increased panic in the global market. On average, developed and emerging equity markets have fallen 15 percent in just over a month. This has increased the panic, which is measured in terms of volatility.

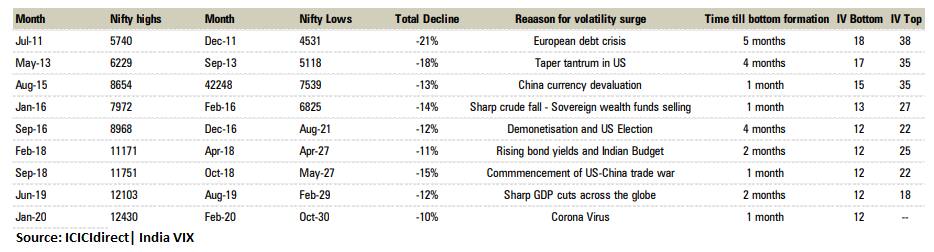

Volatility had made a top near 40 percent before 2015 on the occurrence of four major scenarios. This was the time when the lower levels of volatility used to be 15 percent.

Post-2015, as the markets have started trading at lower volatility levels of 10 percent, the sharp panic levels in volatility have seen top formation near 30 percent.

According to the ICICIdirect report, volatility has seen a surge from 10% to 25% already. It is expected to see a cool off from 30%, which should ideally form the market bottom.

The volatility indices have seen a sharp spike to multi-year highs in recent times. “Out of nine panic situations seen in the last 10 years, Nifty has bottomed out within a month or two in six instances after posting an average decline of 11-13%,” ICICIdirect said in a report.

In three out of nine times, the Nifty has seen bottom formation in four to five months after posting an average decline of 17%, the report added.

Currently, Nifty has already fallen 10 percent in the recent past. Hence, Nifty has an important level of investment at 10,800 and the worst-case scenario seems to be close to 10,400 levels.

It looks like money flow has shifted from risky assets to safe havens like bonds and gold, which have given positive returns.

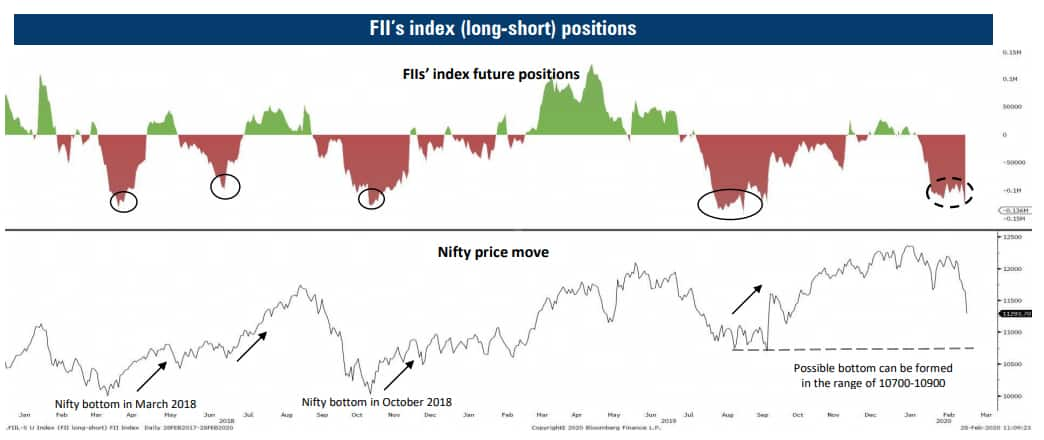

FIIs’ net short positions have reached beyond 1 lakh contracts:

Since 2015, whenever FIIs' short exposure has increased and net short positions has gone beyond 1 lakh contracts, Nifty has come closer to the bottom.

Currently, net short positions of FIIs have reached 1.5 lakh contracts and markets seem to be coming to the oversold zone, said the ICICIdirect note.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.