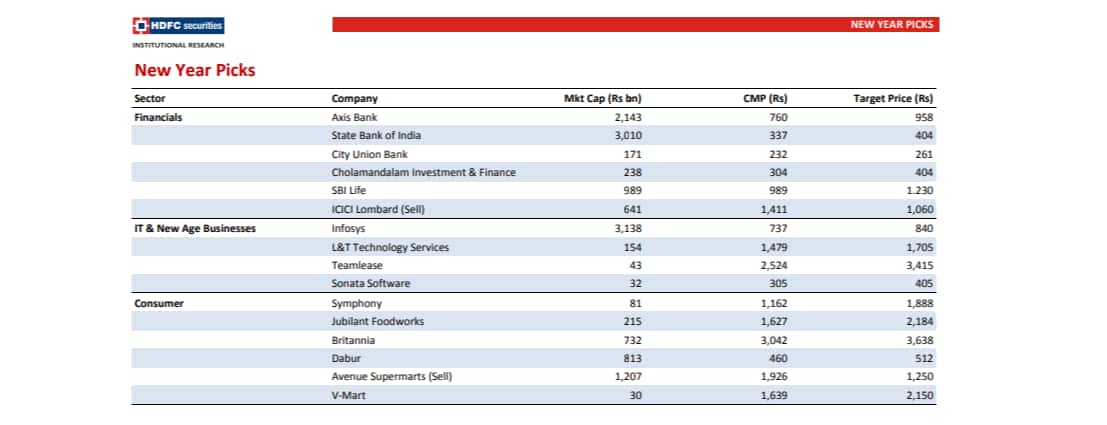

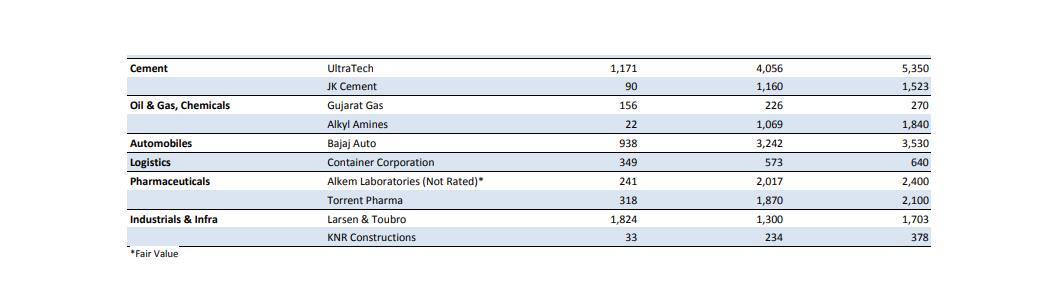

FinancialsThe healing cycle is set to play out further at stressed lenders, despite a slowing economy. Our picks here include the rapidly healing Axis Bank and SBI.We also like steady compounders such as Cholamandalam Inv & Finance and City Union Bank. In the non-lending pack, SBI Life is set for sustainable growth. ICICI Lombard is a great business but looks overpriced given the de-tariffing risk in TP.Consumer companiesConsumer companies are sitting on very high valuations, even as sentiment—as seen in volume growth—has struggled considerably of late.New-age businesses like QSR face long growth runways and, justifiably, command high valuations. Durables/appliances players with niche strengths are similar.The category expansion play at Britannia is not fully priced in even after the run-up over the last few years. Dabur’s focus and rising distribution penetration drive our optimism, while Jubilant’s multi-year growth story is yet to play out.Among retailers, we see structural risks playing out for the stratospherically valued D-Mart, while V-Mart offers an interesting growth proposition, driven by a strategic focus on value retailing.TechnologyTech companies with all their enticing talent, free cash flows (FCFs) and payout yields are going for under 15x FY22E EPS (top 5-Avg). We feel that value is emerging at Infosys.Staffing leader Teamlease is relatively affordable now, while the growth/valuation bargains at L&T Tech and Sonata seem sensible at the current market price.CementCement may not enjoy the twin benefits of higher pricing and softer coal prices for another year. Our preferred stocks include market leaders such as UltraTech and the fast-growing and—now—reasonably profitable JK Cement.AutomobilesAutomobiles are battling a severe cyclical downturn and face longer-term challenges, as the threat of electric vehicles (EVs) looms large. Sales volumes are down 19/38/14% for PVs/MHCVs/2Ws in 1HFY20.Here, we like Bajaj Auto’s global sales footprint, while Container Corp can capture freight from truckers in the congested Delhi-Mumbai route as the dedicated freight corridor takes off.Oil companiesOil companies will find it a hard task to recover from a value-destructive regulatory environment. The unfettered-by-regulation city gas distributors thus make sense.Gujarat Gas will—as its product mix tilts towards CNG— tread the path of Indraprastha Gas. The exceptionally talented and prudent Alkyl Amines is our speciality chemicals pick.IndustrialsIndustrial never really recovered from the slowdown in the corporate capex after the fairy-tale pre-GFC years. Barring L&T, infra stocks have gone through a ride to heaven and back. KNR Constructions is the other consistent performer in this space.PharmaPharma may well emerge in 2020 from its multi-year slump. But, we are betting on the more domestic-focused Alkem Laboratories and Torrent Pharma that also have interesting US pipeline and look set to improve capital efficiency and cash flows in the foreseeable future.(The author is Head- Institutional Research, HDFC Securities)Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

FinancialsThe healing cycle is set to play out further at stressed lenders, despite a slowing economy. Our picks here include the rapidly healing Axis Bank and SBI.We also like steady compounders such as Cholamandalam Inv & Finance and City Union Bank. In the non-lending pack, SBI Life is set for sustainable growth. ICICI Lombard is a great business but looks overpriced given the de-tariffing risk in TP.Consumer companiesConsumer companies are sitting on very high valuations, even as sentiment—as seen in volume growth—has struggled considerably of late.New-age businesses like QSR face long growth runways and, justifiably, command high valuations. Durables/appliances players with niche strengths are similar.The category expansion play at Britannia is not fully priced in even after the run-up over the last few years. Dabur’s focus and rising distribution penetration drive our optimism, while Jubilant’s multi-year growth story is yet to play out.Among retailers, we see structural risks playing out for the stratospherically valued D-Mart, while V-Mart offers an interesting growth proposition, driven by a strategic focus on value retailing.TechnologyTech companies with all their enticing talent, free cash flows (FCFs) and payout yields are going for under 15x FY22E EPS (top 5-Avg). We feel that value is emerging at Infosys.Staffing leader Teamlease is relatively affordable now, while the growth/valuation bargains at L&T Tech and Sonata seem sensible at the current market price.CementCement may not enjoy the twin benefits of higher pricing and softer coal prices for another year. Our preferred stocks include market leaders such as UltraTech and the fast-growing and—now—reasonably profitable JK Cement.AutomobilesAutomobiles are battling a severe cyclical downturn and face longer-term challenges, as the threat of electric vehicles (EVs) looms large. Sales volumes are down 19/38/14% for PVs/MHCVs/2Ws in 1HFY20.Here, we like Bajaj Auto’s global sales footprint, while Container Corp can capture freight from truckers in the congested Delhi-Mumbai route as the dedicated freight corridor takes off.Oil companiesOil companies will find it a hard task to recover from a value-destructive regulatory environment. The unfettered-by-regulation city gas distributors thus make sense.Gujarat Gas will—as its product mix tilts towards CNG— tread the path of Indraprastha Gas. The exceptionally talented and prudent Alkyl Amines is our speciality chemicals pick.IndustrialsIndustrial never really recovered from the slowdown in the corporate capex after the fairy-tale pre-GFC years. Barring L&T, infra stocks have gone through a ride to heaven and back. KNR Constructions is the other consistent performer in this space.PharmaPharma may well emerge in 2020 from its multi-year slump. But, we are betting on the more domestic-focused Alkem Laboratories and Torrent Pharma that also have interesting US pipeline and look set to improve capital efficiency and cash flows in the foreseeable future.(The author is Head- Institutional Research, HDFC Securities)Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.