India Gold August Futures pared gains after hitting fresh record highs of Rs 48,333 per 10 gm on June 24 tracking positive trend seen in the international spot prices.

Experts are of the view that as long as yellow metal sustains above Rs 48,200, it is a buy on dips for a target of Rs 48,600 per 10 gm.

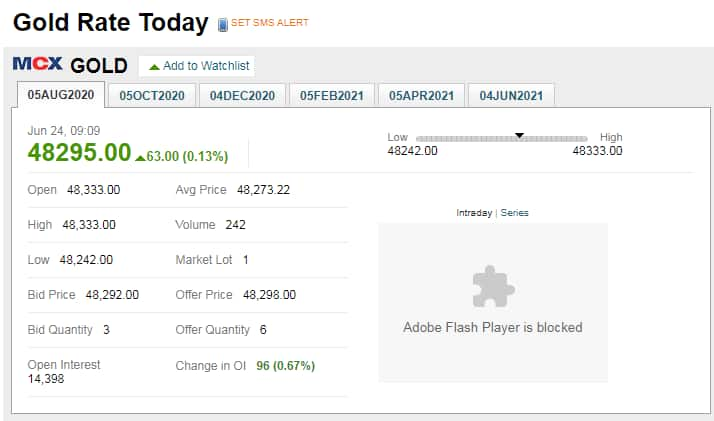

On Multi-Commodity Exchange (MCX), August gold contracts were trading higher by 0.10 percent at Rs 48,281 per 10 gram at 09:30 hours. July futures for silver were trading 0.28 percent lower at Rs 48,500 per kg.

Gold and silver extended gains on June 23 in the international market. Both precious metals gained around 1 percent. Gold settled at $1,782 per troy ounce and silver also settled at $18.06 per troy ounce.

Due to strength in rupee both the precious metals gained around 0.50 percent in the domestic market. Gold settled above 48200 and silver settled around 48800 levels.

“We expect both the precious metals remain volatile and could approach next resistance levels in the international market. Gold prices sustain above $1778 could extend the gains towards $1788-1800 per troy ounce, $1760 act as a major support for the day,” Manoj Jain, Director (Head - Commodity & Currency Research) at Prithvi Finmart Pvt Ltd told Moneycontrol.

“At MCX, Gold prices sustain above 48200 could extend the gains towards 48440-48600 levels, 47800 act as major support for the day,” he said.

International bullion prices have started with solid gains this Wednesday morning in Asian trade supported by expectations that global central banks will continue to provide more stimulus to the markets to cushion from the effects of a second wave in many nations.

Domestic bullion surged higher with gold hitting all time high’s tracking firm international prices. Domestically prices will start higher this Wednesday, tracking firm overseas prices.

Technically, LBMA GOLD Spot had give a sharp rise of 1% where its trading above $1770 levels with increased in volume activity indicating a positive trend to continue up to $1781-$1795 levels. Support is placed at $1755 levels.

MCX Gold August contract might give a gap up open above 48300 levels tracking overseas markets where it may continue its bullish momentum up to 48500-49100 levels. Support will be at 48200 level.

Expert: Ravindra Rao, VP- Head Commodity Research at Kotak Securities.COMEX gold trades higher near $1786/oz and has hit a session high of $1791.8/oz, the highest level since Oct.2012. Gold trades higher supported by weaker US dollar, increasing concerns about rising virus cases, uncertainty about US-China trade deal, hopes of additional stimulus measures and continuing ETF inflows.

Gold may continue to trade with a positive bias on increasing uncertainty relating to rising virus cases however the momentum could subside if the price doesn’t close above $1789-1790 a multiple resistance zone.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!